Gustav sends oil higher

Crude rises slightly in 'muted response' during a special electronic trading session. Hurricane bears down on region that controls 25% of U.S. crude production.

NEW YORK (CNNMoney.com) -- In a special Sunday afternoon trading session, oil prices spiked more than $3 before pulling back as the world oil market signaled its preliminary response to the looming threat of Hurricane Gustav.

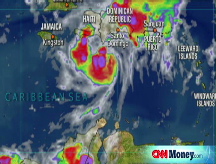

Gustav, a Category 4 storm when it raked through Cuba on Saturday, was downgraded on Sunday but expected to strengthen again as it gets closer to the U.S. coast. Forecasters predict it will touch land on Monday.

U.S. crude traded $1.24 higher to $116.70 a barrel. That's less than some analysts predicted after the New York Mercantile Exchange opened electronic trading three and a half hours earlier than normal. The early open was designed to give traders more time to react to the news of the hurricane.

"This is a very, very muted response," said Peter Beutel, an oil analyst with Cameron Hanover. "The fact that it's trading this low shows how powerful the dollar is and how bearish this market has become; had this happened in early July, oil would have been up $10 now."

Electronic trading on Sunday normally begins at 6 p.m. ET, coinciding with early trading in Asia. Monday's session will continue as scheduled: Floor trading will be closed for Labor Day but investors will be able to trade electronically throughout the day.

Though prices rose on Sunday, the market's early reaction was much less frantic than it was in August 2005, when the impact of Hurricane Katrina sent oil prices up about $3, spiking just below $70 to a then-record $69.81 a barrel. With oil trading at nearly twice that amount today, a similar market reaction would have sent oil up about $5 to $121 a barrel.

Gustav threatens oil imports and production facilities. The 5.6 million barrels of imported oil that enter the Gulf every day have been suspended, according to the U.S. Department of Energy. Those imports account for 56% of all oil imports, the agency said.

And the Gulf is the site of about 25% of U.S. oil production, or 1.3 million barrels a day. Offshore platforms and pipelines buried in the sea bed are vulnerable to extreme storms such as hurricanes.

As of Sunday evening, 96% of oil production in the Gulf has been halted, according to the Energy Department.

Oil companies such as Shell (RDSA) and BP (BP) said they were completing evacuations of their drilling personnel and many have completely shut down and secured their drilling platforms, the Associated Press reported.

"We're not trading as high as some may have thought partly because the storm has weakened a bit and partly because it looks like [the industry] is prepared for this," said Alaron Trading senior market analyst Phil Flynn.

Immediately after Sunday's early open, crude quickly spiked to $118.60, but that jump did not eclipse the high reached on Friday, when some forecasters said the storm would reach Category 5 status.

This is the first time that NYMEX has extended trading for an emergency, and analysts applauded the move.

"In times of emergency, it is very important to have the markets opened," said Esa Ramasamy, director of market reporting for energy analysis group Platts. "People need to protect their positions if they're exposed to market changes."

Oil prices also rose after NYMEX declared a force majeure on its natural gas contracts for August and September delivery. That means that gas sold under those futures contracts may be delivered late since the hurricane has impeded shipments.

The Energy Department said there are 22 natural gas plants along the Gulf of Mexico processing 13.2 billion cubic feet per day. Many of the plants have shut down due to Gustav.

Three years ago, Hurricanes Katrina and Rita devastated oil facilities before battering the Louisiana coast. The storms, which reached Category 5 strength before making landfall, destroyed 113 offshore oil and natural gas platforms and damaged 457 pipelines in 2005. Since then, the oil industry has improved its safety measures, and believes it is better prepared for large storms entering the Gulf.

So far, about 15% of total U.S. refining capacity has already been shut down, according to Ramasamy. The Associated Press reported that Exxon Mobil (XOM, Fortune 500) and Valero (VLO, Fortune 500) have shut down refineries. Shell conformed it has shut down one refinery and is slowing production at others. Other smaller refiners have shut down locations in Louisiana, and AP reported that ConocoPhillips (COP, Fortune 500) is reducing its refining production in the region.

"That 15% looks small, but bear in mind that the U.S. is a huge country," said Ramasamy. "That's about 2.4 million barrels that have been lost, which would normally go as far as the Atlantic coast states and the Midwest. By Tuesday, places as far as Chicago will feel the impact of this."

There are only 150 refineries in the United States, about a third of which are located in the Gulf Coast region. But other refiners may not be able to pick up the slack from the shuttered Louisiana producers.

"Most refiners are already operating at full capacity, so the others won't be able to meet much of the shortfall," said Ramasamy.

As a result, if the storm does make a direct hit on Gulf facilities, the Energy Department said Thursday it was prepared to release supplies from the government's 700 million barrel Strategic Petroleum Reserve to cushion the blow. After Katrina and Rita, the government opened up the SPR for just the fourth time in history, shipping off just 11 million barrels to refiners.

In a preliminary report Sunday, the department said existing supplies of oil may be enough to avoid major problems in the market.

"[A]bsent significant physical damage to the region's energy systems, the record level of supply existent in the SPR today, coupled with the inventories held both offshore and onshore by the petroleum sector, should ensure these disruptions are localized and temporary," the department wrote.

However, gas prices have already started to rise as workers on offshore oil rigs abandoned ship and residents fled their homes. The national average price of gasoline rose for a third day straight to $3.687, motorist group AAA reported on Sunday.

The price increase was most dramatic in Louisiana, where prices rose a bit more than 2 cents a gallon. Texas saw prices rise almost 2 cents. Mississippi's price increase was close behind, rising 1.6 cents a gallon. Gas rose by 1.4 cents a gallon in the coastal cities of Biloxi, Gulfport and Pascagoula. ![]()