AIG chief gets OK for $10.5 million pay package

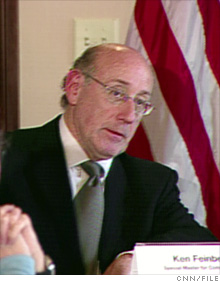

Kenneth Feinberg gives formal OK for Benmosche's salary, making AIG the first company to receive the pay czar's compensation approval.

|

| Kenneth Feinberg approved AIG CEO Robert Benmosche's $10.5 million salary. |

NEW YORK (CNNMoney.com) -- AIG Chief Executive Robert Benmosche's $10.5 million annual pay package has been formally approved by Obama administration pay czar Kenneth Feinberg.

According to a letter to Treasury's compensation committee dated Oct. 2, Feinberg said Benmosche's package, $4 million of which is in stock options, is comparable to that of other CEOs.

Benmosche, who took over the bailed out insurer's reins in August, will take home $3 million in cash. His "stock salary" will come in equally divisible, bimonthly payments of common shares. Under the terms of his pay deal, he can't sell those shares until August 2014.

The new AIG CEO will also be eligible for $3.5 million in annual performance bonuses. The bonus will be prorated for 2009. AIG can recover his bonus if he deceives shareholders.

The approval was widely expected, because Feinberg gave a preliminary thumbs-up to the package when it was announced on Aug. 18. For formal approval, AIG had to submit a review of Benmosche's compensation package from his last job, when he was the CEO of MetLife (MET, Fortune 500). AIG also was asked to compare Benmosche's pay plan to those of other CEOs at similar companies.

In his letter to Treasury, Feinberg said he maintains the right to reduce (but not to increase) Benmosche's bonus based on the CEO's or the company's performance.

Feinberg oversees the executive compensation packages of seven bailed-out companies, including AIG, Chrysler, Chrysler Financial, Citigroup (C, Fortune 500), Bank of America (BAC, Fortune 500), General Motors and GMAC. The companies submitted proposed employment contracts for their 25 highest-paid employees on Aug 14, and compensation proposals for the next 75 most compensated employees are due by Oct. 13.

AIG was the first of the seven companies to receive any kind of formal approval. The pay czar is expected to rule on all of the pay plans by the end of the month. That information is due to be made public by Treasury sometime after, although any announcement may not include details of pay packages for individual employees.

Shares of AIG (AIG, Fortune 500) rose 6% by midday Tuesday. ![]()