Stock rally: Rest or recharge

Signs that the battered labor market is starting to heal lifted stocks last week. But with Wall Street at 14-month highs, the advance could be set to stall out.

NEW YORK (CNNMoney.com) -- Wall Street has finally gotten the piece of economic news it has been waiting for: the battered labor market may be starting to heal. But with major stock gauges at their highest levels in more than a year, recovery bets could already be baked into the cake.

The week ahead brings a modest array of economic reports. Highlights include readings on retail sales, consumer sentiment and the trade gap. President Obama and Federal Reserve Chairman Ben Bernanke are among the speakers on tap. But none of these events are likely to change the markets' direction much.

Through the end of 2009 and the first quarter of 2010, stocks are bound to stick to a narrow range, as investors hold onto gains off March lows and seek the next catalyst, said Jamie Cox, managing partner at Harris Financial Group.

"The broad averages are probably going to go sideways and for a while," Cox said. "It's not going to be as hard or as easy as it's been in the last 24 months, where everything rose, everything fell, then everything rose again. The next few months are going to be stock by stock."

Jobs report lifts spirits: Employers cut 11,000 jobs from their payrolls last month, the Labor Department reported Friday. It was the smallest number of job losses since the start of the recession in December 2007. The unemployment rate, generated by a separate survey, fell to 10% from a 26-year high of 10.2% in October.

Job losses from the previous two months were revised lower too, indicating that a slow but steady pattern of lessening job cuts is emerging. But the drop in the unemployment rate is also points to the millions of people who have been out of work so long that they've given up looking for a job.

"It's going to be years until we get back to where we were in 2007, but this report is a clear sign that the labor market is improving," said Phil Orlando, chief equity market strategist at Federated Investors.

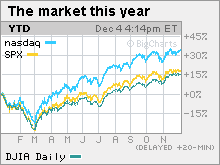

Bets that the recession was ending -- combined with substantial fiscal and monetary stimulus -- drove stocks higher over the last 9 months. The Dow (INDU) has risen 59% as of Friday's close since bottoming at a 12-year low on March 9.

Following the release of Friday's jobs report, the blue-chip average and the S&P 500 (SPX) both hit 14-month highs, touching levels not seen since just after the collapse of Lehman Brothers last year. The Nasdaq (COMP) is also near 14-month levels.

While the gains off the lows have been tremendous, most investors have still not recovered the bulk of what they lost in the slow market crash of 2008 through early 2009. The wish to recover more of what was lost -- and the need to put to work the trillions still sitting in cash or other low-yielding holdings -- should give stocks a continued upward bias, the analysts said.

But at the very least it's likely to be much more slow going than it was for most of this year, even with signs of the labor market starting to recover.

"It's going to be a slow slog for the labor market, but I think stocks can continue to grind higher from here," said Orlando.

On the docket

Monday: Fed Chairman Ben Bernanke speaks about the economic outlook and Fed policy at the Economic Club of Washington in the early afternoon.

Fed Vice-Chairman William Dudley speaks in the late afternoon.

A report on October consumer credit is also due in the afternoon, but it's not usually a market mover.

Tuesday: President Obama speaks about the economy at the Brookings Institution in Washington.

Intel (INTC, Fortune 500), Microsoft (MSFT, Fortune 500) and Netflix (NFLX) are among the companies due to attend Barclays Technology conference in San Francisco.

JPMorgan Chase (JPM, Fortune 500), MasterCard (MA, Fortune 500) and Regions Financial (RF, Fortune 500) are among the companies due to attend the Goldman Sachs U.S. Financial Services conference in New York.

After the close, chipmaker Texas Instruments (TXN, Fortune 500) issues its mid-quarter update.

Wednesday: RealtyTrac releases its November foreclosure report.

The Commerce Department is expected to report in the morning that wholesale inventories for October fell 0.6% after falling 0.9% in the previous month.

The government's weekly crude oil inventories report is also due in the morning.

CNNMoney.com parent Time Warner (TWX, Fortune 500) completes its spinoff of AOL.

Thursday: The October trade balance from the Commerce Department is due before the markets open. The trade gap is expected to have widened to $37.1 billion from $36.5 billion in September.

The flow of funds report from the Federal Reserve is due around noon. The report is likely to show that household net worth continued to fall in the second quarter, along with home values.

The Labor Department's weekly jobless claims report is due out in the morning. The Treasury budget is due in the afternoon.

Treasury Secretary Timothy Geithner testifies before the Congressional Oversight Committee.

Federal Reserve Governor Elizabeth A. Duke speaks in Chicago on Mortgage Foreclosure policy.

Friday: The November retail sales report from the Commerce Department is due in the morning. Sales are expected to have risen 0.5% after rising 1.4% in the previous month. Sales excluding autos are expected to have risen 0.5% in November after rising 0.2% in the previous month.

The University of Michigan's preliminary consumer sentiment index for December is due just after the start of trading. Sentiment is expected to have improved to 68.5 from 67.4 in late November.

Reports on October business inventories and November import and export prices are also due. ![]()