Search News

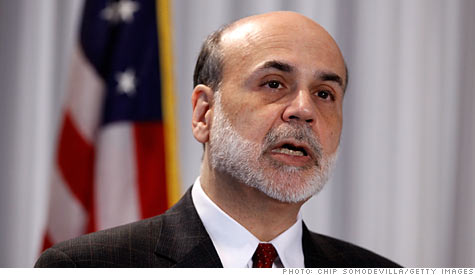

Federal Reserve Chairman Ben Bernanke spoke about the small business credit crunch and the urgent need to help Main Street businesses.

Federal Reserve Chairman Ben Bernanke spoke about the small business credit crunch and the urgent need to help Main Street businesses.

CNNMoney.com (NEW YORK) -- In the last two years, $40 billion worth of loans to small businesses have evaporated, and correcting the problem should be "front and center among our current policy challenges," Ben Bernanke, chairman of the Federal Reserve, said in a speech Monday.

Loans to small businesses dropped from more than $710 billion in the second quarter of 2008 to less than $670 billion in the first quarter of 2010, according to bank financial reports submitted to the Federal Financial Institutions Examination Council.

Bernanke, who was speaking at the day-long forum "Addressing the Financial Needs of Small Businesses" at the Federal Reserve, said that there are several factors behind the contraction in small businesses lending.

He cited weaker demand from Main Street businesses worried about taking on more debt during tough times, "deterioration in the financial condition of small businesses during the economic downturn," and a lack of supply of available credit.

"Clearly, though, to support the recovery, we need to find ways to ensure that creditworthy borrowers have access to needed loans," Bernanke said.

Monday's forum is the finale of a series of more than 40 roundtable meetings around the country between small businesses, lenders, bank regulators, trade associations and government officials that aimed to determine how best to help Main Street businesses that can't get the credit they need.

Throughout the dozens of forums, a couple issues came up repeatedly. In particular, banks noted they are stuck between a rock and a hard place. On the one hand, banks are being told to increase their small businesses lending, while on the other hand bank regulators are telling banks to tighten lending standards.

"We take this issue very seriously," said Bernanke. "Our message is clear: Consistent with maintaining appropriately prudent standards, lenders should do all they can to meet the needs of creditworthy borrowers. Doing so is good for the borrower, good for the lender, and good for our economy."

For small business owners, the collapse in the real estate market has also created another roadblock to obtaining a loan, since many depend on the value of their real estate as collateral for loans. Additionally, many manufacturers also rely on the value of their equipment as collateral for loans -- and those values have fallen off sometimes more than real estate.

"As one business owner at the Detroit meeting I attended put it, 'If you thought housing had declined in value, take a look at what equipment is worth,'" said Bernanke. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |