Search News

NEW YORK (CNNMoney) -- When it comes to taxes, do the rich pay their fair share?

The answer, of course, is subjective since "fair" is not an absolute concept and tax data, depending how it's sliced, can tell different stories.

Those who say the rich pay their fair share point to the fact that the top 1% of taxpayers end up paying almost as much in federal income tax (and some years even more) as the bottom 95% combined.

Still, it's unlikely that even the most anti-tax, pro-wealth advocates would find this particularly fair: A very small number of millionaires end up owing no federal income tax at all.

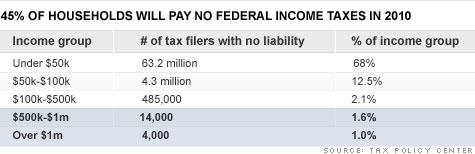

They're in good company, of course. Nearly half of all U.S. households, or 69 million, are estimated to have owed no federal income taxes for 2010. The vast majority of them, however, are low income.

But 18,000 were households taking in more than $500,000 -- and of those, 4,000 made more than $1 million.

How can it be that those with big income streams owed zip to Uncle Sam?

Janice Johnson and Jay Safier, members of the New York State Society of Certified Public Accountants, and Roberton Williams, a senior fellow at the Tax Policy Center, explained the likely reasons.

Such tax filers probably have big portfolios and big investment losses from the 2008 financial crisis. They are also more likely to be retired or self-employed, and may be charitably inclined.

What's common to all is that they likely qualify for the many tax breaks in the code that disproportionately benefit high-income households.

"A lot of these are people who probably made it very big on Wall Street years ago and who turned around and put it all in tax-exempt bonds," Johnson said.

Many of her clients are in their 50s or older, and "they're very leery of equity markets."

Williams offered a hypothetical example: A retired person with $10 million invested in municipal bonds paying 5% interest, or $500,000 a year.

"Because there is no limit on how much tax-exempt interest you can earn without having to pay taxes, she pays nothing to the federal government," he said.

Or it's possible that some of these tax filers have a large portfolio, and booked a lot of taxable gains in the recent run-up in stocks. But they were able to fully offset those gains with the many capital losses they realized during the financial crisis, which made even the most experienced investor want to take their marbles and go home.

Another possibility: A tax filer has a yen for foreign investments. Say he owns a dividend-paying foreign stock such as BP, Johnson said. The British government will withhold tax on the dividends that BP pays. To avoid being taxed twice on the dividend, the investor may be able to claim a foreign tax credit on her U.S. income tax return for the amount withheld.

"As long as the foreign tax exceeds her U.S. tax liability [on that dividend], she will pay nothing on her federal tax return" Williams said.

Johnson is also seeing a lot of people today who have left their jobs to start a business or become a consultant. Their self-employed paycheck -- not including income from their investments -- is far lower than their paychecks when they worked for The Man. And the tax owed on their new salary is more than offset by their mortgage interest and real estate tax deductions.

Safier noted there is another way such high-income households might substantially reduce their federal tax bite: giving to charity in a big way.

He noted two strategies. The first involves selling property to a charity below market value. That lets the seller treat a portion of the sale as a charitable contribution.

The second involves donating highly appreciated stocks to a charity. The tax filer can deduct the fair market value of the donated shares as a contribution without having to pay any capital gains.

At a time of record deficits, it's not unreasonable to say the rich should pay more, when the law allows even 1% of millionaires to owe nothing in federal income tax.

But keep in mind that boosting taxes on the rich by itself won't come close to solving the country's fiscal problems for a number of reasons. Most notably, there simply aren't enough of them. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: