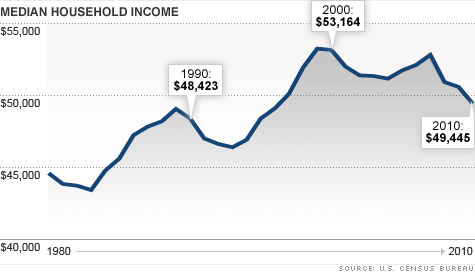

Middle-class income fell 7% in the last decade, adjusted for inflation.

NEW YORK (CNNMoney) -- It's official. The first decade of the 21st century will go down in the history books as a step back for the American middle class.

Last week, the government made gloomy headlines when it released the latest census report showing the poverty rate rose to a 17-year high. A whopping 46.2 million people (or 15.1% of the U.S. population) live in poverty and 49.9 million live without health insurance.

But the data also gave the first glimpse of what happened to middle-class incomes in the first decade of the millennium. While the earnings of middle-income Americans have barely budged since the mid 1970s, the new data showed that from 2000 to 2010, they actually regressed.

For American households in the middle of the pay scale, income fell to $49,445 last year, when adjusted for inflation, a level not seen since 1996.

And over the 10-year period, their income is down 7%.

"Economists talk about the lost decade in Japan. Well, with these 2010 data, we can confirm the lost decade for the American middle class," said Jared Bernstein, senior fellow at the Center on Budget and Policy Priorities.

Sure, it's fair to say Americans at all levels of income, from rich to poor, were hit hard in the decade that started with the dot-com boom and bust, and ended with the Great Recession.

But according to the census data, those losses disproportionately hit the lowest 60% of Americans, while the richest 40% actually gained wealth, relative to the entire U.S. economy.

Much of that trend can be explained by massive losses in the housing sector, the period of high unemployment that ensued, and rising prices that flew in the face of the American family's heightened financial struggles.

Unlike the richest Americans, middle class families have most of their wealth tied up in the equity of their homes, which took a beating in the recession. And high unemployment has left many people with little or no other income at all.

At the same time that Americans had less cash to spend, they were also being hit with rising prices for some crucial items. Even accounting for inflation, it still costs more to buy a home, fill your gas tank, go to the doctor and put food on the table than it did only 10 years ago.

And not only is it more expensive to live a middle-class life, it costs more to get there too. The price of a college education -- still considered the ticket to higher wages and a better lifestyle -- has surged over the last decade, even in spite of the recession.

Facing these burdens, the American Dream is undergoing stark changes, with fewer people choosing to buy homes and more young people postponing their own independent lives. The census data showed about 14.2% of all young people ages 25 to 34 are still living in their parents' homes this year, compared to about 11.8% before the recession began in 2007.

And that poses a challenge for the economy going forward. After all, what will the middle class and the American Dream look like another decade from now, if the younger generations still can't get their feet off the ground? ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |