Search News

NEW YORK (CNNMoney) -- Customers are dumping their banks in droves ahead of the nationwide "Move Your Money" and "Bank Transfer Day" movements this Saturday.

Given the recent spotlight on attempts -- and ultimate failures -- by some of the nation's biggest banks to tack on new debit card fees, thousands of disgruntled consumers have already either left or pledged to leave their current bank for a community bank or credit union, which are known for having fewer and/or lower bank account fees.

At least 650,000 consumers have already joined credit unions since Sept. 29, the day Bank of America (BAC, Fortune 500) announced plans to impose its controversial $5 debit card fee, according to a nationwide survey of credit unions by the Credit Union National Association.

That's more than a year's worth of members in a single month -- with credit unions adding 600,000 members in all of 2010.

The new memberships in October amount to $4.5 billion in new savings accounts, CUNA said.

And while Bank of America and other banks have since backpedaled on imposing the fees, consumers are making it clear they are still fed up. More than four in every five credit unions said new customers cited days like "Bank Transfer Day" and new fees imposed by their banks as reasons for opening accounts.

"We must flee all those banks now!!! They will be adding hidden fees shortly! Drop the credit cards and go to credit unions to avoid this pitfall," one CNNMoney reader wrote.

Meanwhile, the Independent Community Bankers of America said a poll of its 5,000 members conducted on Oct. 17 found that nearly 60% of community banks are gaining customers who are sick and tired of the big financial institutions. The association's community bank locator has seen more than 5,000 inquiries in the last few weeks -- an increase of nearly 500%.

By the end of this weekend, accounts at these credit unions and community banks could grow by tens of thousands more.

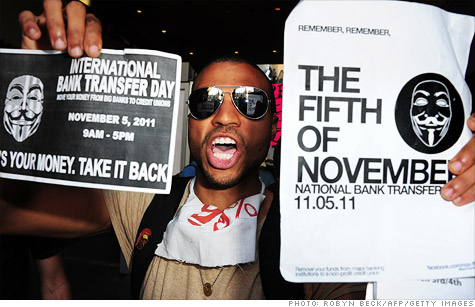

"Move Your Money Day" and "Bank Transfer Day" are backed by consumer groups like MoveOn.org and the Progressive Change Campaign Committee (PCCC), which are urging customers to switch banks by this Saturday -- and turning to social media outlets like Facebook to do their convincing.

"Bank Transfer Day," was started by a Facebook user who had heard about Bank of America's $5 fee and posted an event on Facebook. So far, 75,061 Facebook users have said they will be attending, while 16,007 will "maybe" attend.

The PCCC said it has already received pledges from about 52,500 people to take their money out of major financial institutions by Saturday as part of the Move Your Money "banxodus," with just under 22,000 consumers planning to remove their money from Bank of America specifically. About 6,900 customers told the PCCC they have already moved their money.

"They take your deposits and use them to buy politicians to de-regulate, give them immunity, interest-free loans and bailouts. Then they turn around and charge you fees to make them even richer," said one "Move Your Money" flyer posted on a Facebook page dedicated to the initiative (which has 43,679 "likes"). "Take your money to a credit union or a community bank that will use your money in your community and not to pervert the rule of law and fill their own pockets."

Occupy Wall Street has formed a separate united front, called "Dump Your Bank Day," which will take place on Tuesday, November 8.

Even though Bank of America and other banks canceled plans to introduce the new debit card fee -- thanks to the mass uproar -- the momentum is still going strong. Plus, experts in the banking industry predict more fees -- and higher existing fees -- will be popping up soon.

"The big banks will not be charging me a dime in additional fees. I moved my accounts to a great credit union last week," a CNNMoney reader wrote. "Next week I get to tell Wells Fargo, to put it nicely, to take a hike." ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: