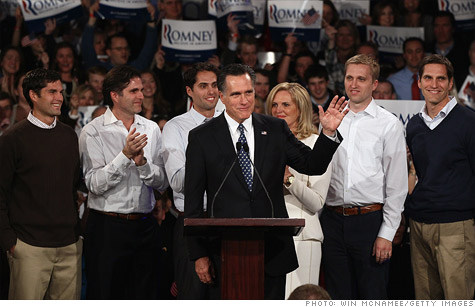

NEW YORK (CNNMoney) -- Mitt Romney's five sons -- Matt, Tagg, Craig, Ben and Josh -- are sitting pretty with a trust fund worth $100 million.

Getting there took investments that produced great growth, according to the Romney campaign. It also took smart tax strategies.

Romney and his wife Ann have been giving to the boys since 1995, and, according to a spokesperson for the Romney campaign, all of their contributions have been below gift-tax contribution limits.

The limit for a couple in 1995 was $20,000 and has since grown to $26,000. In addition, there's a "lifetime gift-tax exclusion" for all the boys that totaled $1.2 million back in 1995 and has since grown to $10 million.

Add it all up, and the Romneys could have gifted $1.3 million in 1995, and a total of $10.6 million through 2011. All tax free.

To get to $100 million, the account would have needed a 26% average annual compound rate of return, said Jonathan Bergman, chief investment officer at Palisades Hudson Asset Management. Stocks over that same time have gained about 10%.

The Romney campaign noted that winning investments, such as Apple (AAPL, Fortune 500), saw similar gains since the mid-90s. And the trust's 2010 tax return showed it has invested in the tech giant, as well as other winning investments like Goldman Sachs (GS, Fortune 500), Target (TGT, Fortune 500) and Oracle (ORCL, Fortune 500).

Plus, there are probably many investments we don't know about. "Romney probably invested the trust in the same kinds of things he invested in himself, like startups and private equities -- investments with high growth," said Tim Gagnon, assistant academic specialist of Accounting at Northeastern University.

But even that can't account for all the gains.

While many of the key details are missing because the family hasn't released gift-tax returns or disclosed the contributions to the trust, there were likely a few other strategies at play, tax experts said.

"You've got people who are paid $1 million a year to work 3,000 hours just to figure out ways to transfer money from older generations to younger generations, and Romney has the money to hire the best of the best," said Bergman.

As the co-founder of private equity firm Bain Capital, which he left in 1999, Romney has received compensation in the form of "carried interest", the share of investment profits that is paid to private equity fund managers. And if Romney transferred this interest to make payments to his kids' trust, he could have received big valuation discounts of up to 40% or more. So if Romney transferred interests in Bain Capital with a net asset value of, say, $14,000, he could have reported the fair market value as only $10,000, below the gift-tax exemption in 1995.

The Romneys could also have loaned money to the trust. While interest on the loans will vary, if the trust uses the loan proceeds to make high-growth investments, it can have more than enough money to pay back the loan.

Another way he could have added money to the trust would have been through a charitable lead trust, which would make a fixed payment to a charity for a specific period of time. Once that term ends, any remaining interest gained while in the trust can flow into the trust for his kids gift-tax-free.

The Romneys could have also set up a Grantor Retained Annuity Trust. When these trusts expire, the beneficiary receives the interest earned on the assets tax-free. They could have transferred a portion of the appreciation of assets into his kids' trust with little or no gift tax.

In the end, it was likely a combination of having a top-tier tax planner who knew exactly how to work the tax code for Romney's benefit that boosted the trust from a couple million dollars to $100 million in 17 years.

"This is an example of someone who has been very sophisticated and effective in working within the tax code to accomplish his goals," said Darell Krasnoff, managing director at Bel Air Investment Advisors. "But it's not just smart planning. Unless you had a very dramatic rate of return to begin with, you would never get this kind of growth."

As for paying income taxes on that great growth, Romney is footing the bill. According to his tax forms, the trust is set up as an "intentionally defective grantor trust," which means the senior generation pays income tax on the trust each year, but they don't pay the estate tax. That means the sons won't have to pay a dime on the trust's earnings until the assets are distributed or the Romneys pass away.

"Say he was paying a million dollars in income tax on behalf of the trust -- that's like another million dollar gift to the trust because it's money the trust doesn't have to pay," said Bergman. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: