Markets were in a cautious mood Tuesday as concerns over U.S. monetary and fiscal policies hang over investors.

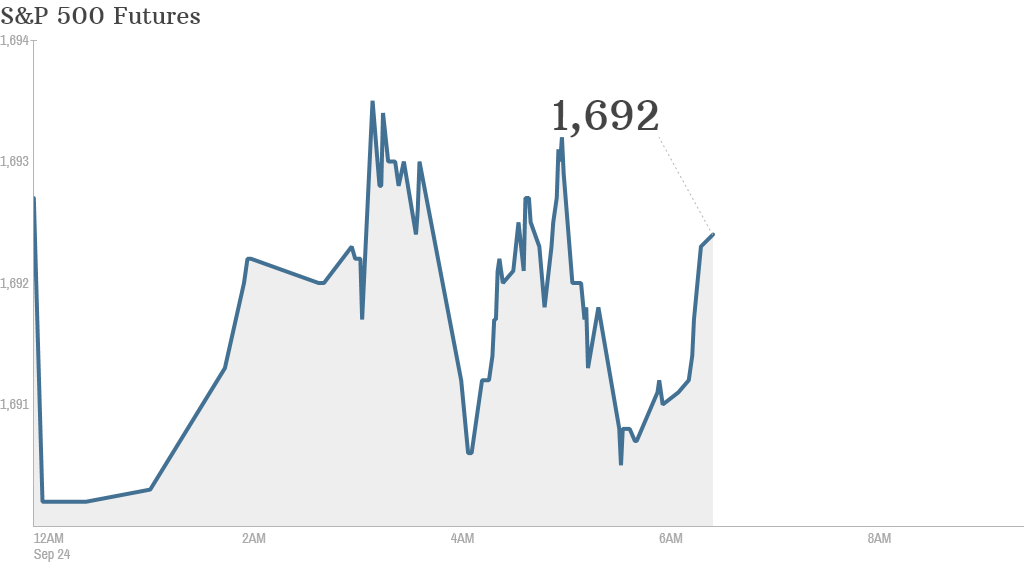

U.S. stock futures were mostly lower, with investors considering the possibility that the September rally has stalled.

Investors are again worried about the possibility of a U.S. government shutdown and its impact on the economy. They're also wary about the Federal Reserve's next monetary policy move, since Fed members have been sending mixed messages about when the central bank will start to pump less money into markets.

On the corporate front, software maker Applied Materials (AMAT) announced a $29 billion merger with Tokyo Electron Limited "to create a global innovator in semiconductor and display manufacturing technology." Applied Materials' stock rose in premarket trading.

The stock price for Red Hat (RHT), a business software maker, plunged 8% in premarket trading. Investors showed their disappointment the day after the company reported quarterly earnings, with an increase in profit that fell short of forecasts.

Related: 'Made in America' revival gains pace

Homebuilder Lennar (LEN) reported a boost in quarterly earnings and revenue compared to the year-earlier quarter, with a significant increase in new-home orders.

KB Home (KBH) is also scheduled to report quarterly results before the opening bell Tuesday. Carnival (CCL) is also reporting ahead of the open.

Investors will also gain insight into the strength of the housing market at 9 a.m. ET, when S&P releases the Case-Shiller 20-city home price index.

The Conference Board will release its monthly consumer confidence index at 10 a.m. ET.

Related: Fear & Greed Index, back to neutral

U.S. stocks fell slightly Monday, in their third consecutive day of declines. The Dow Jones industrial average, S&P 500 and Nasdaq declined modestly.

Meanwhile, BlackBerry (BBRY) announced that its largest shareholder, Fairfax Financial, was leading a group to acquire the troubled company for $9 a share. Blackberry shares edged higher in premarket trading but were still just below the $9 mark.

European markets were in positive territory in morning trading, led by the CAC 40 in Paris, with a gain of 0.4%. Frankfurt's Dax index edged up by 0.1%. The latest German business sentiment data shows confidence continued to improve in September.

Asian markets ended the day with some small losses.