Markets were muted Tuesday morning, with investors still trying to guess what the Federal Reserve has in store for later this week.

The Fed's final monetary policy meeting of 2013 wraps up Wednesday, and investors are eager to find out when the central bank might begin to cut back its massive stimulus program. Some think the so-called taper may come sooner than expected.

Deutsche Bank chief economist Peter Hooper is predicting that the Fed will immediately announce plans to cut back its monthly bond buying by anywhere from $5 billion to $15 billion.

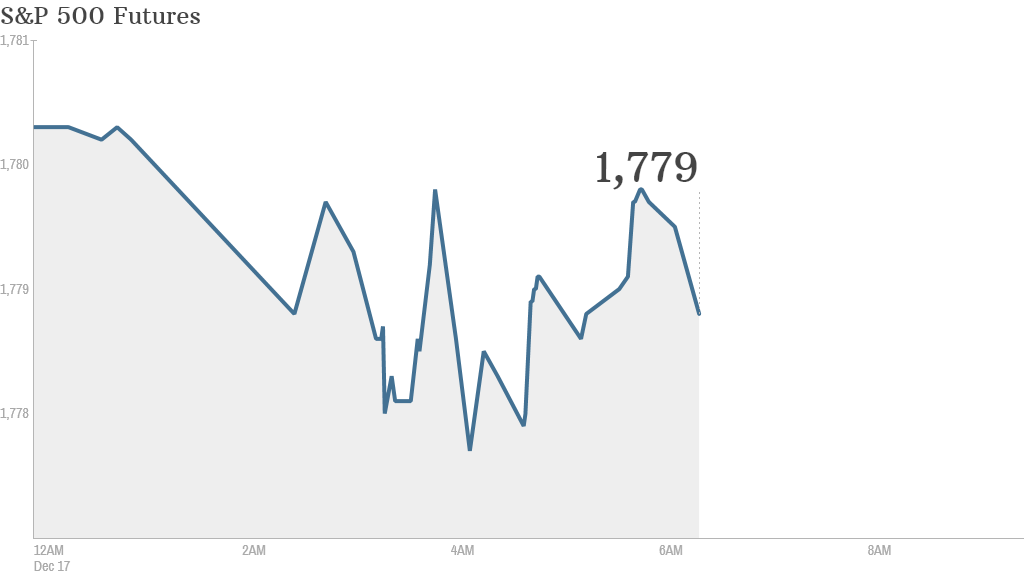

U.S. stock futures were narrowly mixed ahead of Tuesday's opening bell.

Investors are also waiting for the U.S. Department of Labor to release its monthly Consumer Price Index at 8:30 a.m. ET.

In corporate news, shares of Herbalife (HLF) surged more than 10% in after-hours trading Monday after PricewaterhouseCoopers' re-audits of the company's financial results came back clean. Herbalife has been battling accusations of financial wrongdoing from investors such as Bill Ackman, who has repeatedly called it a pyramid scheme.

GlaxoSmithKline (GLAXF) said it was scrapping bonuses for sales staff that are based on sales to doctors, and will stop paying health care professionals to attend conferences.

Shares of Boeing (BA) jumped after the aerospace giant announced a 50% dividend increase and $10 billion stock buyback program.

Related: Fear & Greed Index gripped by fear

On Monday, the Dow jumped about 130 points, or almost 1%, while the S&P 500 and Nasdaq also rose sharply.

It seems investors were feeling bullish ahead of the Fed announcement, though one market strategist noted there may have been a technical trigger for the move.

"There was some speculation that the drop in the 50-day moving average may have triggered some computerized buying," said Mike O'Rourke, chief market strategist at JonesTrading.

Related: Inside Hong Kong's biggest Bitcoin mine

European markets declined in morning trading. France's CAC 40 index fell nearly 1%.

Asian markets ended the day with mixed results. The Nikkei in Japan popped up by 0.8%, while markets in China edged lower.