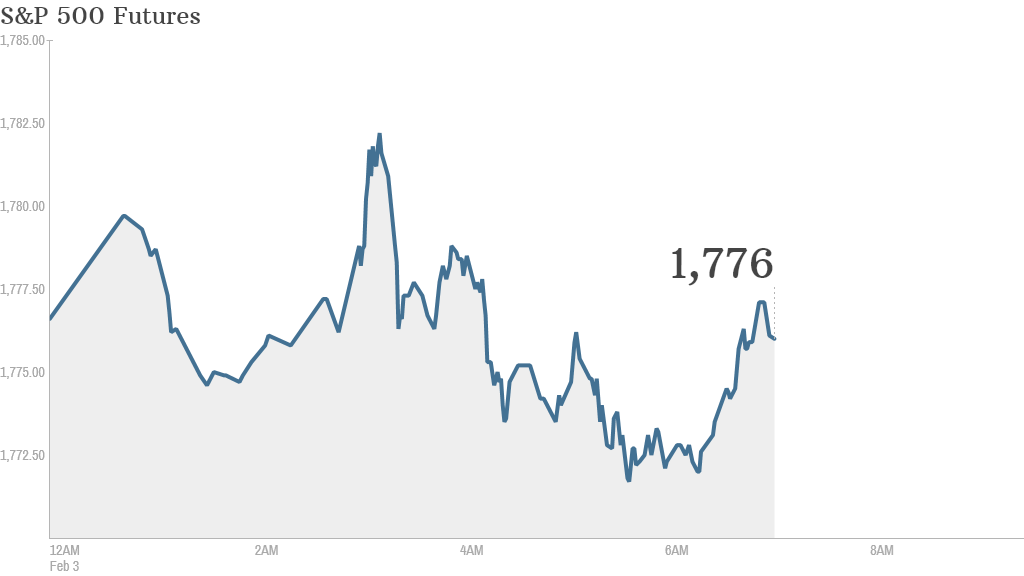

U.S. markets were barely moving early Monday morning following a difficult January when the Dow Jones Industrial Average declined by just over 5%.

Looking ahead to data due Monday, the U.S. Census Bureau will release its monthly report on construction spending at 10 a.m. ET. At the same time, the Institute for Supply Management will publish its monthly manufacturing index.

In corporate news, Herbalife (HLF) shares were higher after the company said fourth quarter earnings would top forecasts; the company also raised the amount of its planned share repurchase by $500 million.

Automakers are due to report January sales during the day Monday.

Restaurant operator Yum! Brands (YUM) is set to release quarterly results after the closing bell.

U.S. stocks fell Friday, ending a month of losses. The S&P 500 slipped more than 3% in January, while the Nasdaq shed nearly 2%.

Related: Can stocks shake off January jitters?

European markets were weaker in morning trading as investors ignored reports of stronger manufacturing activity in the eurozone in January.

Many Asian markets were closed for the lunar new year but those trading moved lower, with the Nikkei in Japan declining by 2%. Traders in Asia were cautious after the release of weak official Chinese manufacturing data.

"Despite the weakness being widely expected [in the Chinese numbers], traders were taking no chances and continued to dump emerging market assets," said Ishaq Siddiqi, a market strategist at ETX Capital in London.

Many emerging markets have suffered over the past few weeks as investors have moved money out of riskier markets in favor of relative safe havens.