Uncertainty over the future of Ukraine continues to cause investors agita.

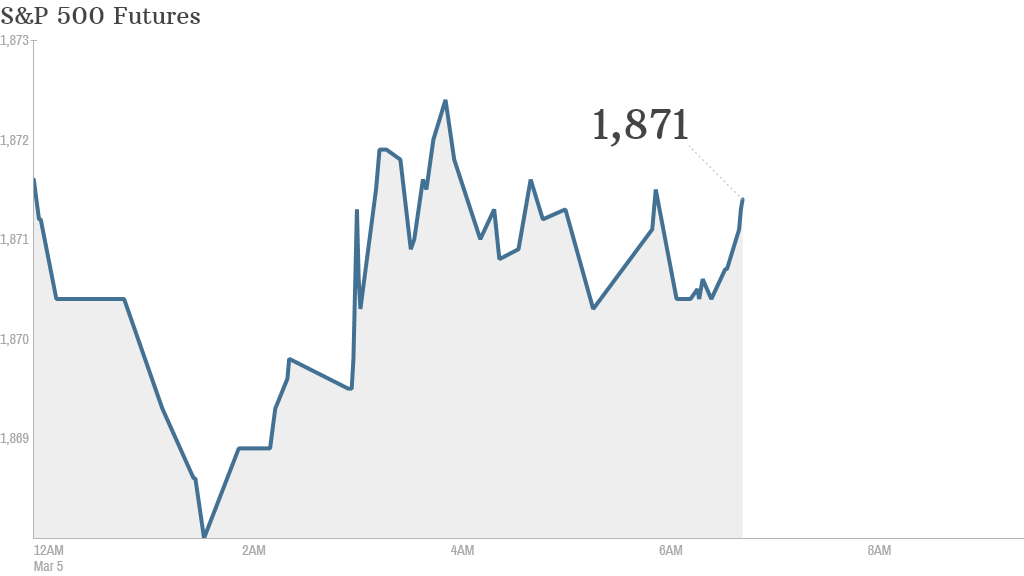

U.S. stock futures barely budged ahead of the opeing bell Wednesday. The tense situation between Russia and Ukraine has left investors and traders uncertain about how to proceed after two days of extreme market volatility.

An announcement from the EU offering an aid package to Ukraine worth € 11 billion did little to lift that anxiety. EU officials have also said they are considering sanctions, and Russia threatening to hit back if that happens.

Investors hit the sell button Monday as they worried Russia was preparing for a possible war with Ukraine.

U.S. stocks rebounded Tuesday as those worries ebbed. The S&P 500 rose to an all-time high. The Dow Jones industrial average made its biggest one-day gain of the year, rising 228 points, and the Nasdaq shot up by nearly 1.8%.

Related: Fear & Greed Index, back to greed

Some market experts think Tuesday's push higher was irrational.

"If there was ever a day the equity market exhibited a detachment from reality, it was [Tuesday]," said Mike O'Rourke, chief market strategist at JonesTrading.

The high-stakes standoff between Ukraine and Russia continues Wednesday, with both sides insisting they don't want war, but publicly offering little evidence of their willingness to budge.

Related: Ukraine won't kill the bull market

Back in the U.S., investors will have a slew of economic data to parse through.

In economic news, ADP will report U.S. employment numbers at 8:15 a.m. ET. The ISM's monthly reading of non-manufacturing jobs will be released at 10 a.m. The latest report on crude inventories will come out at 10:30 a.m. The Ukraine-Russia conflict has also raised worries about the flow of oil.

In the afternoon, the Federal Reserve's beige book report about the health of regional economies will be released.

On the corporate front, PetSmart (PETM) and homebuilder Hovnanian (HOV) will report earnings before the opening bell.

Shares of Smith & Wesson (SWHC) surged 12% in premarket trading after the gunmaker reported sales jumped 7%., with handgun sales up 30%.

European markets slid in midday trading. In Asia, Chinese markets moved lower as the country launched its annual parliamentary meetings in Beijing. The Shanghai Composite index declined by 0.9% and the Hang Seng in Hong Kong edged down by 0.3%. Meanwhile, the Nikkei in Japan climbed by 1.2%.