Concerns about the Chinese economy hit global stocks Wednesday and could make for a weak start on U.S. markets.

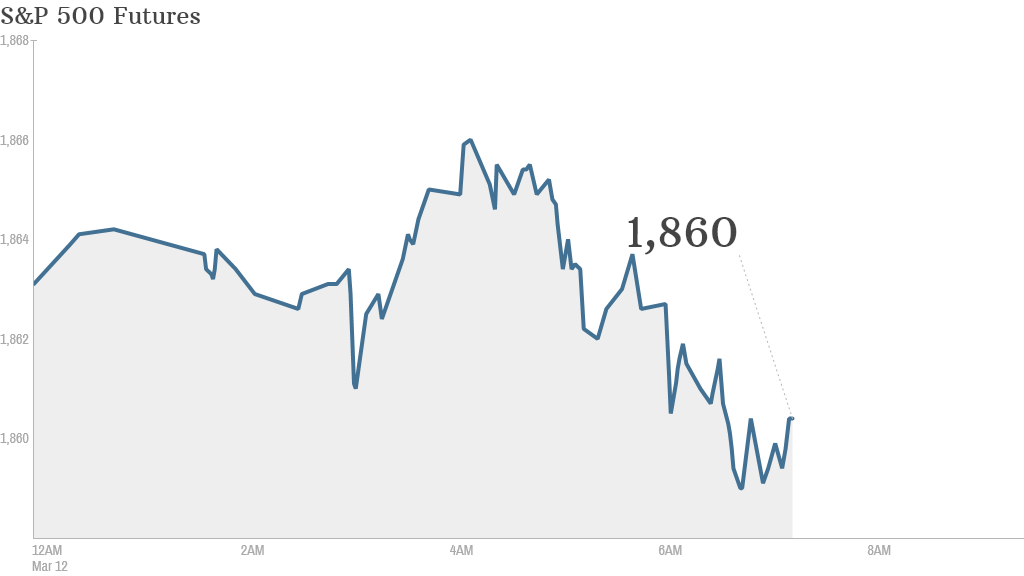

U.S. stock futures were modestly lower ahead of a quiet day in terms of U.S. economic and corporate news.

Big swings in some commodities reflected the nervousness about the pace of growth in the world's second biggest economy. Gold prices pushed higher while copper prices fell to their lowest level in at least a year.

"It was the accumulation of negative China-related headlines or it was the sharp drop in copper in both London and Shanghai that spooked markets," wrote Deutsche Bank analyst Jim Reid in a market report.

China concerns have been edging to the forefront of investors' minds since February data showed exports tumbled 18% compared to last year.

That followed news that the country had experienced its first-ever corporate debt default. Some analysts believe more defaults could be in the pipeline.

In recent weeks, the Chinese central bank has also loosened its grip on the currency, allowing it to fluctuate more than usual, shaking confidence in what has been seen as a safe one-way bet.

Related: Fear & Greed Index, still greedy

Nearly all Asian stock markets closed in the red Wednesday, with Japan's Nikkei taking a 2.6% hit. The Hang Seng in Hong Kong dropped by 1.7% and the Shanghai Composite also posted a small decline.

European markets were also taking note, with all the major indexes pushing down in morning trading. The CAC 40 index in Paris dropped 1.6%.

Treasury Secretary Jack Lew is set to testify before the Senate budget committee at 10 a.m. ET about the President's 2015 Budget.

Plug Power (PLUG) and rival fuel cell stocks Ballard Power System (BLDP) and FuelCell Energy (FCEL) were all down dramatically in premarket trading. The companies are considered highly speculative and have enjoyed a massive run as of late.

U.S. stocks closed slightly lower Tuesday.