Markets have drifted lower this week in the absence of major economic or corporate news, but stocks could tiptoe higher Thursday.

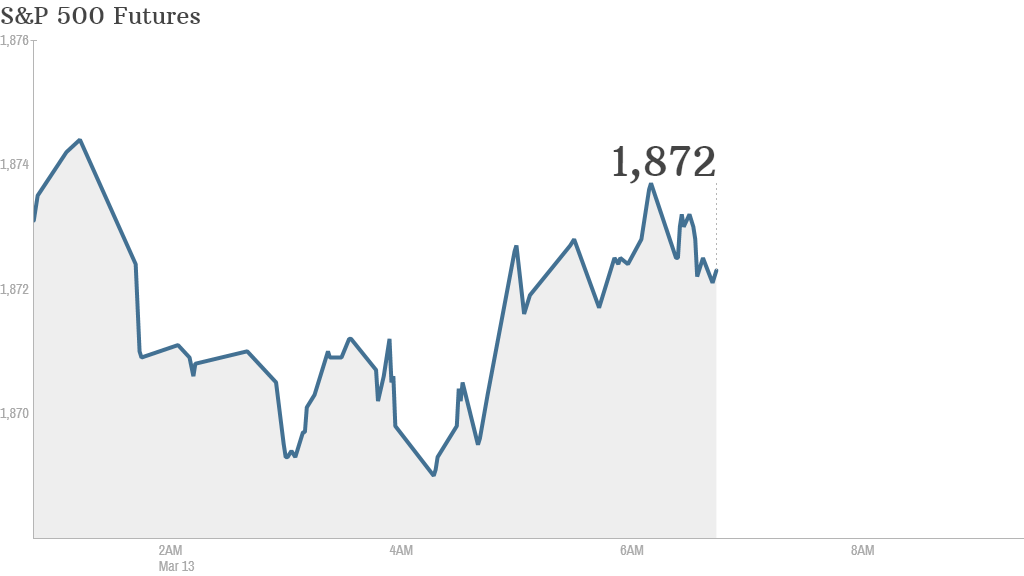

U.S. stock futures were pointing up and greed is still driving investors, according to CNNMoney's Fear & Greed index.

But some are becoming more cautious and are buying into gold -- a perceived safe-haven asset.

Gold prices have risen by nearly 8% over the past month amid market volatility, geopolitical uncertainty and concerns about a slowdown in China. Gold prices were rising by $2.50 an ounce early Thursday.

"The tone is one of an environment of rising caution, but no real fear," said Mike O'Rourke, chief market strategist at JonesTrading.

Related: Fear & Greed Index gets greedy

Looking ahead to the economic news of the day, the U.S. government will publish weekly jobless claims numbers and February retail sales, both at 8:30 a.m. ET.

On the corporate side, Plug Power (PLUG) will report earnings before the open. It's a highly speculative stock that's enjoyed a massive run as of late and was continuing to climb in premarket trading.

Aeropostale (ARO) will report results after the close.

U.S. stocks were little changed Wednesday. The Dow fell 12 points in its third consecutive day of declines while the S&P 500 and Nasdaq edged higher.

Both European and Asian stock markets were showing mixed results Thursday.

Worries about a slowdown in China -- the world's second largest economy -- spooked international investors Wednesday.

Economic data out Thursday did little to reassure investors, raising further questions about China's growth rate.

"For China, the question is whether the [government] authorities are in control of the slowdown, or if it starts controlling them," said Simon Smith, chief economist at FxPro.