Investors seem relieved the contentious Crimean referendum is over, though geopolitical tensions remain high as Western nations prepare sanctions to punish Russia for meddling in Ukraine.

Initial results show Crimeans who voted in a Sunday referendum overwhelmingly supported the idea of breaking from Ukraine to join Russia. The results were expected -- and the West maintained the referendum was illegal. Moscow strongly backed the vote.

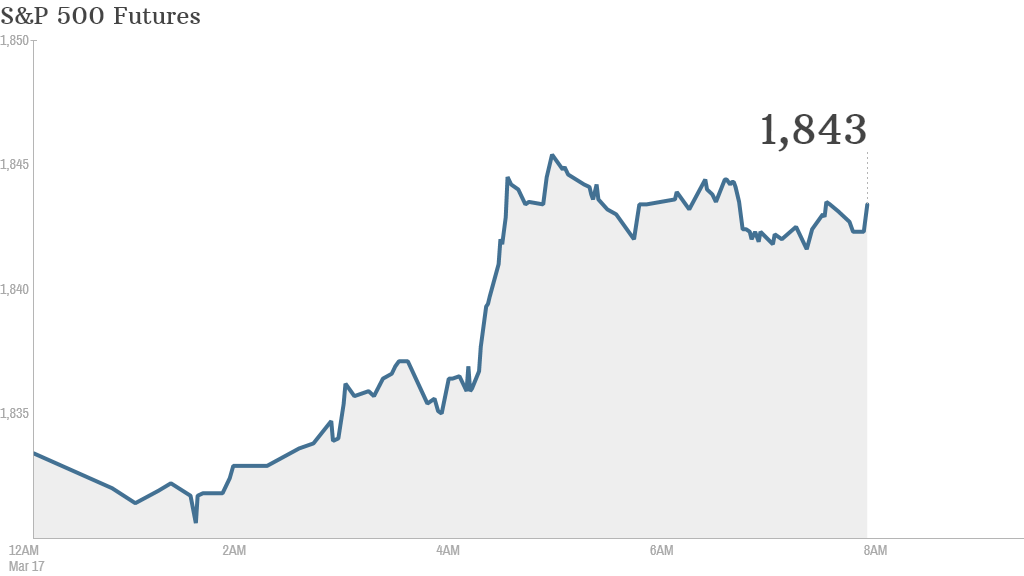

U.S. stock futures were gaining ground Monday, after markets fell last week.

"The referendum outcome was widely expected and so did not yield a sustained response from investors," explained Ilya Spivak, a currency analyst at DailyFX. "Monitoring follow-on theatrics will be important in gauging further market moving potential."

Related: All eyes on Ukraine and the Fed

EU officials were meeting to agree sanctions on Russia that could be revealed as early as Monday, risking an escalating trade war that would hit the global economy.

Russian markets, which have been slammed so far this year by the rising tensions with the West over Ukraine, also showed signs of stabilizing.

Related: Fear & Greed Index backslides into fear

There's little U.S. economic or corporate news set for Monday.

But Yahoo (YHOO) shares jumped in premarket trading. Yahoo has a stake in Chinese Internet giant Alibaba, which said this weekend that it plans to go public in the U.S.

Shares in Target (PBCFX) slid slightly in extended trading Friday after the company warned that its ongoing investigation regarding last year's data breach could turn up "additional information that was accessed or stolen."

U.S. stocks closed lower Friday. The Dow, the S&P 500 and the Nasdaq were all down about 2% last week. The Dow Jones industrial average has fallen for five days straight.

The main European markets were all rising in morning trading.

Asian markets ended with mixed results. The biggest mover was the Shanghai Composite, which jumped by 1%.

The Chinese currency was in focus Monday after China's central bank said over the weekend it would further loosen its hold over yuan trading. The move marks another step in the government's push to open up its economy and markets.