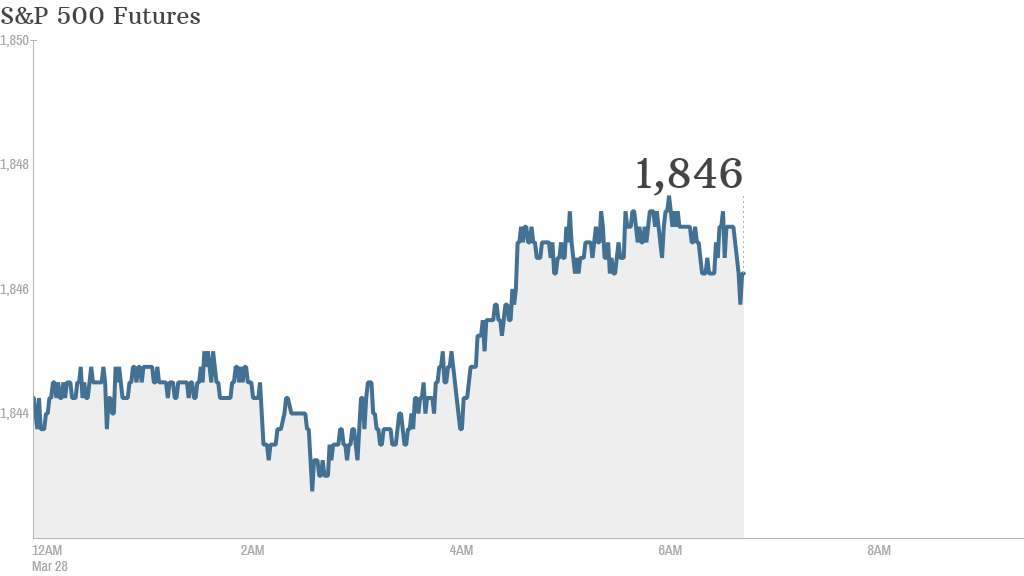

Stock markets looked as if they had found some inspiration before the open on Friday, a positive sign for investors as the end of the first quarter draws near.

U.S. stock futures were all higher ahead of the opening bell.

"There seems to be increasing hope that the European Central Bank next week will take action because deflation risks continue to increase in the eurozone," said Peter Cardillo, chief market economist at Rockwell Global Capital.

He also said that investors are looking forward to some economic reports scheduled for release Friday that are expected to be "market friendly."

The U.S. government will publish personal income and spending data for February at 8:30 a.m. ET.

Related: Russia looks to Asia for trade cushion

In corporate news, Finish Line (FINL) will report earnings before the opening bell.

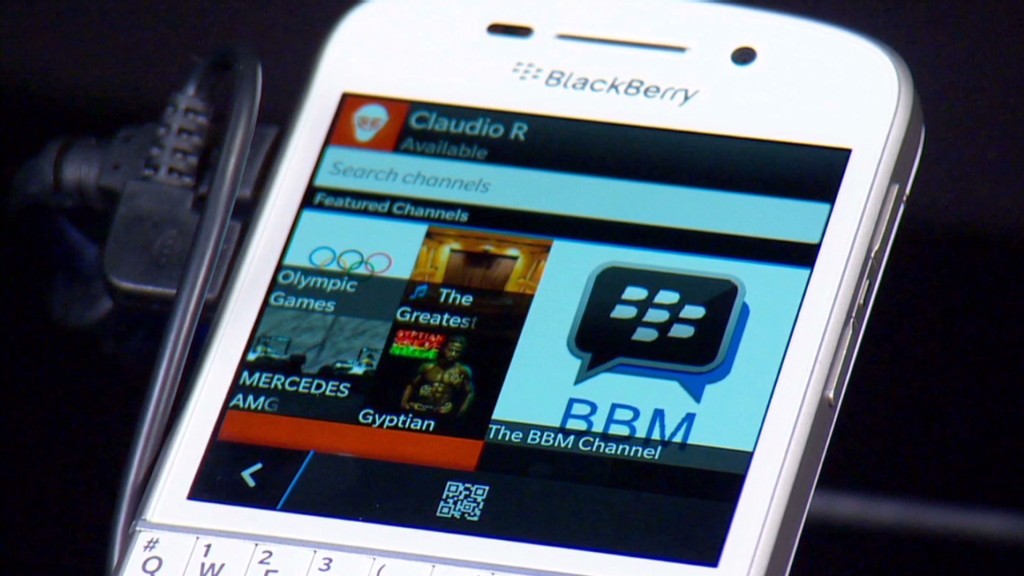

Blackberry reported a quarterly loss that was significantly lower than a year earlier, despite a hefty decline in revenue.

Shares in Blackberry (BBRY) have recovered by roughly 22% since the start of the year on hopes the company's CEO can revive the struggling smartphone maker. However, shares have declined over the past few days as investors worry about the company's turnaround plans and Societe Generale (SCGLF) downgraded the stock to "sell".

The first three months of 2014 have been bumpy and it's possible all the major indexes could end the quarter in the red. The Dow Jones industrial average has declined by 1.9% since the start of the year. The Nasdaq is off by 0.6% and the S&P 500 is essentially flat over the same period.

Related: Fear & Greed Index continues backslide into fear

U.S. stocks ended lower Thursday, for the second consecutive down day. The Dow was little changed, while the S&P 500 and Nasdaq ended in the red. Banks, especially Citigroup (C), were among the biggest losers for the day. But Citigroup edged up slightly in premarket trading.

European markets were up in midday trading. The Dax in Germany advanced by 0.9%.

Most Asian markets closed out the trading day with gains, though the Shanghai Composite dipped by 0.2%.