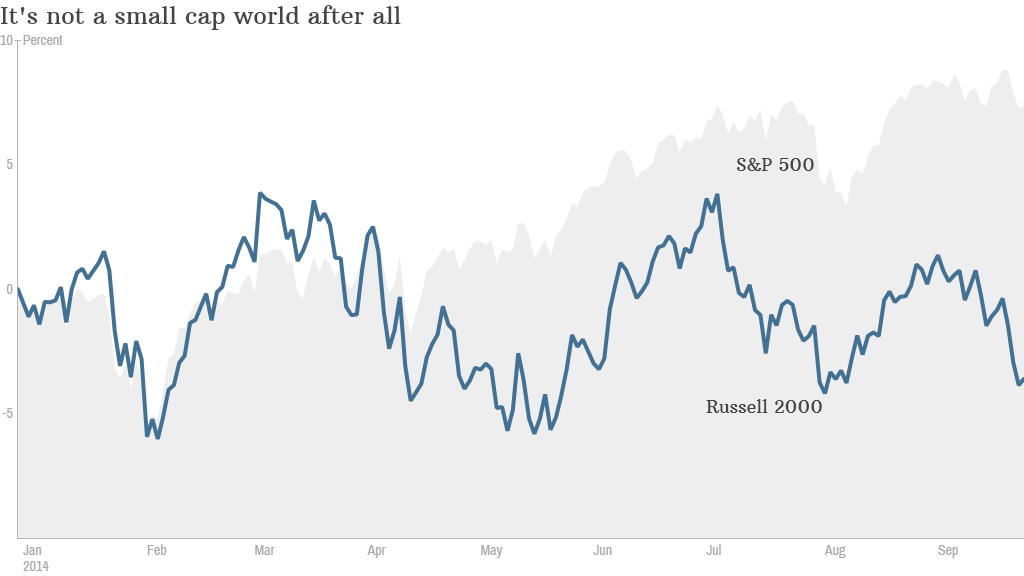

September is living up to its reputation as the worst month for the stock market.

CNNMoney's Fear & Greed Index is once again showing signs of Extreme Fear, and after two straight sell-offs to start the week, the S&P 500 and Nasdaq are in the red for the month (the Dow is just above breakeven).

The market bounced back Wednesday though, and the three major indexes remain up for the year. Shares of smaller companies, however, are really taking it on the chin.

The Russell 2000 index of small cap stocks is down 4% in September. That sell-off has wiped out the index's gains for all of 2014.

In a more ominous sign, the Russell 2000 hit something known by traders as a "death cross" on Monday.

That's a technical term used to describe when the 50-day moving average falls below the 200-day moving average for an index. In plain English, a death cross means momentum is going in the wrong direction.

Related: What will make stocks go even higher?

So should you be concerned? Death is not the happiest of words. But it's not time to panic if you are buying and holding quality companies for the long haul.

"The death cross is a big scary sounding name that will get some headlines. And it could be a major warning sign," said Ryan Detrick, strategist for See It Market, a research firm. "But smaller stocks have lagged for a while. Will they eventually pull down the overall market? It hasn't happened yet."

Detrick said the Russell 2000 death cross shows that investors are more interested in shares of "boring blue chips." Just look at some of the market's big leaders this year.

Massive companies like Apple (AAPL), Johnson & Johnson (JNJ), Merck (MRK), Disney (DIS), Microsoft (MSFT) and Wells Fargo (WFC) are beating the broader market. They're all stable companies that pay dividends.

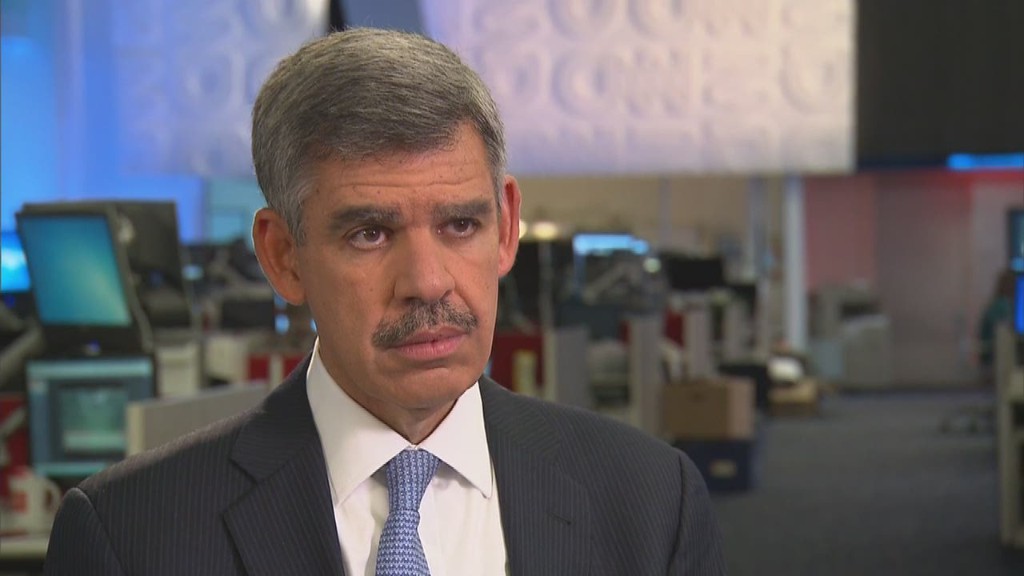

Richard Ross, the global technical strategist for brokerage firm Auerbach Grayson, agreed that the death cross is probably not the beginning of a bear market.

Related: Fear factor: Investors are scared again

He notes that investors have been worried about a variety of things lately -- emerging markets, Europe and geopolitical risks to name a few. While the market has been more volatile this year than last, the trend has still been up.

"We've been looking for canaries in the coal mine all year," Ross said. "The weakness for small caps is not a great thing, but the death cross is not the most bearish thing out there. It's not necessarily a great market timing tool."

To that end, the Russell 2000 last hit a death cross in 2011, around the time that the credit rating of the United States was downgraded by Standard & Poor's.

Those were nervous times indeed. Stocks went into a correction -- a drop of more than 10% from a recent peak -- as a result. But it didn't kill the bull market that's been going on since March 2009.

And speaking of a correction, we're long overdue for one. So while the market choppiness this month is a bit unnerving, it might be healthy over the long run.

Markets turn for the worse when companies start doing poorly. Plain and simple. There is no evidence of fundamentals deteriorating yet, especially for industry giants.

"Stocks may be volatile for the next few weeks, but over the next three to six months, it may not be so bad," Detrick said. "It may just be time for larger stocks to lead. Earnings are still going higher."