Tuesday's shaping up to be a good day.

Here are the five things you need to know before the opening bell rings in New York:

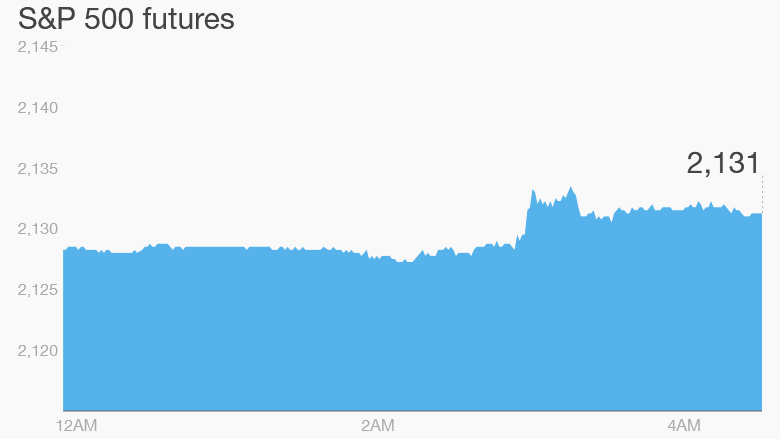

1. Stocks surging: U.S. stock futures are rising, giving investors hope that the Dow Jones industrial average and S&P 500 could smash new records.

Both indexes hit fresh closing highs Monday. The Nasdaq also rose by 0.6%.

2. International overview: There's a lot going on in Europe right now. European stock markets are rallying in early trading, with both the CAC 40 in France and the DAX in Germany shooting up by about 2%.

European government bonds are also firming, and the euro has fallen by just over 1% versus the U.S. dollar.

Investors are reacting to comments from a senior official at the European Central Bank, who was reported to have said the ECB would step up its bond-buying in May and June before liquidity tails off over the summer. The asset buying is part of the ECB's stimulus program to kill off eurozone deflation and boost the economy.

Asian markets mostly ended with positive results. The Shanghai Composite led the pack with a gain of 3.1%.

3. Stock market movers -- Urban Outfitters: Shares in Urban Outfitters (URBN) fell sharply in extended trading after the retailer posted quarterly earnings that missed Wall Street's expectations. Shares in the company dropped by about 15%.

4. Earnings: Get ready for a slew of retail earnings.

Walmart (WMT), Home Depot (HD), Dick's Sporting Goods (DKS) and TJX (TJX) are all reporting ahead of the open.

Meanwhile, Wall Street newbie Etsy (ETSY) is expected to report after the close. Shares in the company surged by nearly 90% immediately after the company went public in April, but they have since fallen back by roughly 30%.

5. Economics: The U.S. government will post monthly data on housing starts and building permits at 8:30 a.m. ET.

And across the pond, U.K. inflation data shows consumer prices fell in April by 0.1%, making this the first time the nation has experienced deflation since official records began in 1996. However, many officials expect this to be a one-off blip, not the start of a deflationary spiral.