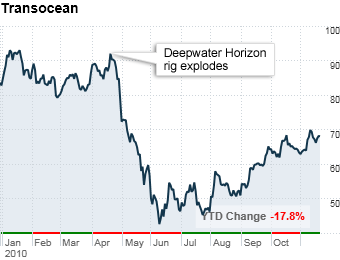

Transocean, the owner of the ill-fated Deepwater Horizon rig leased by BP, took a big hit after the Macondo oil well blew out in April, as investors worried about how much the drilling company might have to pay out for the extensive damage along the Gulf Coast.

But Transocean's stock has bounced back from its year lows and analysts are optimistic. According to a recent SEC filing, the contract between BP and Transocean "indemnifies" Transocean from any liabilities related to the incident, noted Gabelli & Co. analyst Andrea Sharkey.

And President Obama's moratorium on deepwater oil drilling was lifted last month, which has also helped boost Transocean's shares. Though permits to begin drilling again will be slow in coming, Transocean has started to purchase drilling equipment and analysts expect the company to post improved income and revenue figures in 2011.

"Companies across the drilling industry are investing in higher quality equipment and better technology, and we're seeing a lot more optimism in general from drillers," Sharkey said.

Thanks to the brighter outlook, Barclay's Capital recently raised the price target for the stock to $77, up 13% from its current level.

There is still one dark cloud looming over the industry.

The magnitude of the BP disaster will likely result in increased regulation throughout the oil drilling business, which could strain profits. The Bureau of Ocean Energy Management Regulation and Enforcement has already issued a number of safety measures, and analysts expect the government agency to introduce additional rules.

An interesting side note: Billionaire oil investor T. Boone Pickens sold his stake in Transocean -- more than 200,000 shares -- according to third-quarter regulatory filing. At the same time, his firm, BP Capital Management, picked up nearly 500,000 shares of BP, valued at about $19.8 million.

NEXT: Hewlett Packard: Snap it up