3 stocks that beat the recession

Blue chips McDonald's, Campbell Soup, and PG&E have battled thedownturn and are trading near recent highs. Should you buy or sell?

Recommendation: Sell

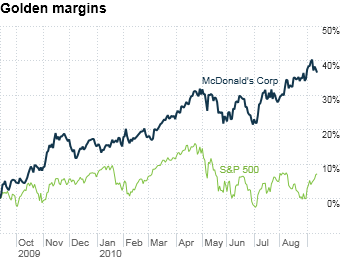

No restaurant has played the recession better than McDonald's. It entered the downturn with a host of ideas to boost profitability, including healthier menus and high-margin drinks like the McCafe Frappe. Now the stock is starting to look frothy. After restructurings, operating margins are at all-time highs, according to Morningstar analyst R.J. Hottovy. That suggests there isn't much fat left to cut, and the stock is up 36% in the past year. With a strengthening U.S. dollar, which reduces revenues from abroad, and the prospect of lower inflation (and thus lower price increases), McDonald's may struggle to maintain recent same-store sales increases. Hottovy calculates the fair value of McDonald's stock, which has been trading around $74, to be $66: "They still have interesting things in the pipeline--McCafe, smoothies. But there's a lot built into the share price now." Let McDonald's cool off before buying.

NEXT: Campbell Soup