Like every other regional bank, East West Bancorp was hammered by the financial crisis. But unlike many competitors, East West owned up early to its problem loans. The Pasadena-based commercial bank raised $200 million and set aside $140 million in loan-loss provisions during the first half of 2008 -- before the bottom fell out of the credit markets.

That paid off, allowing East West to acquire the assets of two failed rivals from the FDIC at fire-sale prices. The FDIC even agreed to cover more than 80% of losses on the acquired loans and real estate. "I don't think the FDIC would have looked as favorably on the transactions if East West didn't already have its own portfolio in order," says George Henning, manager of the Pacific Advisors Small Cap Fund, which counts East West as a top-five holding.

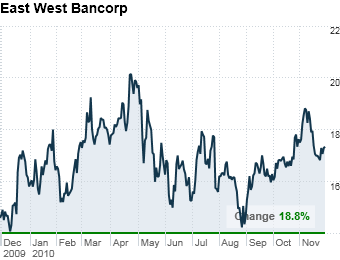

The bank's results are heading in the right direction. East West recorded third-quarter profits of 27¢ a share vs. a 91¢ loss in the third quarter of '09. Analysts expect next year's earnings to climb 51%, above the 11% growth projected for East West's peer group. The bank is better capitalized than its competitors, according to a Sterne Agee report, and its percentage of nonperforming loans is lower -- 3.1% vs. 5.1%. Despite all this, East West's stock trades at 12.9 times projected 2011 earnings, a significant discount to the 19 P/E of its peers.

It's not just the numbers that look good. East West's demographics are attractive too. With the two FDIC transactions, East West is now believed to be the largest Chinese-American-focused bank in the country. (In addition to its 131 branches in the U.S., the bank also has three branches in China.) According to a recent Ariel/Hewitt study, Asian Americans boast a savings rate 19% higher than the national average. The median household income among Asian Americans is $65,469, vs. $49,777 for the entire U.S., and the number of Asian-owned businesses in the U.S. is growing at twice the national rate.

That helps explain why East West boasts a return on equity four times higher than the median regional bank, and why its shares seem likely to appreciate.

NEXT: Royal Caribbean