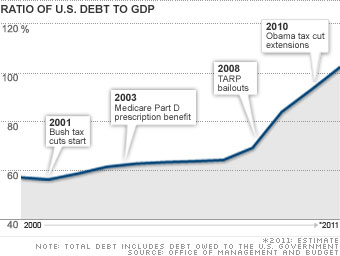

There is plenty of blame to go around for the nation's current budget troubles. Democrats and Republicans alike pushed major legislation that increased government spending, without corresponding increases in revenue.

Of course, there was also the deep recession, which started in 2007 and caused tax revenue to plummet.

Today, the national debt stands at more than $14 trillion, and Washington is gearing up for a brawl over the debt ceiling, which will have to be raised sometime in the next month or so. Both sides agree the debt must be addressed, though there's little agreement on how to get there. Stay tuned!

More galleries

Last updated April 27 2011: 5:01 AM ET