Diamonds aren't foreverA new Hollywood movie is raising tough questions about Africa's bloody diamond trade. Fortune's Vivienne Walt reports from the pits.(Fortune Magazine) -- Sahr Amara is stooped low, knee-deep in a muddy river, in the fifth hour of his workday. As he has each day for the past week, the 18-year-old will earn a stipend of only 7 cents, enough to buy himself a bowl of porridge to see him through the day. Yet he returns every morning to dig in the wilting heat on the edge of Koidu, a town in eastern Sierra Leone, hunting for the one thing he says could transform his life: a diamond. Since he is the oldest of six children - three others have died of diseases - much of his family's future rests on his prospects.

"If I find a big diamond, I can afford to go to school, I can learn, and then I can help my family and even my village," he says. So far the plan has proved elusive; he has found no gems during his first week of work. "It's not easy," he says. "I think it depends on God." Whether or not divine intervention leads Amara to a big find, his tale is anchored in a much more earthly economy: the $60-billion-a-year diamond industry, which has built its growth on dreams of love rather than of raw survival. Koidu, whose diamonds have been mined since the 1930s, is thousands of miles away - and a galaxy removed - from the glittering displays in jewelry stores in New York, Tokyo and London. It is set in a country where the average man earns $220 a year and dies at 39. In the dwellings along Koidu's dirt tracks, residents eat dinner by candlelight not because it is romantic but because there is no electricity in town, just as there are no telephone lines and little indoor plumbing. In short, it is hard to imagine a starker contrast between Amara's world and that of the people who might one day wear whatever diamond he finds, and they live in deep ignorance of each other. When asked what diamonds are used for, Amara draws a blank. "I only know they are valuable," he says. Hollywood weighs in But after 130 years of diamond mining in Africa, that ignorance is unraveling fast as the two worlds collide over the image of diamonds. The conflict, which has rocked the industry in recent years, may reach fever pitch this month with the release of the movie "Blood Diamond." Set in wartime Sierra Leone during the late 1990s, the film depicts a South African diamond smuggler, played by Leonardo DiCaprio, trying to recover a rare pink stone from a local fisherman whom rebels have forced to dig in the diamond pits. The story line - a mixture of villainy and heroism - is classic Hollywood. But its roots are fact: In the 1990s rebels in Sierra Leone and Liberia financed their carnage from diamonds plucked out of the rivers and traded for arms. During a decade of war about 50,000 people were killed, and thousands had their hands hacked off by rebels. Months before it opened, the movie had garnered media attention, aided by a marketing blitz by Warner Bros. (owned by Time Warner (Charts), parent of Fortune's publisher) and a $15 million counterattack by the World Diamond Council, an organization founded by more than 50 producers and dealers to end illegal diamond trading. "We have been engaged in a massive educational campaign," says Eli Izakhoff, chairman and CEO of the council, which is heavily financed by De Beers, the company that sources about 40 percent of the world's diamonds, all of them from Africa. "This movie gives the industry a great story to tell." The council's message: More than 99 percent of diamonds are now from conflict-free sources, and millions of Africans have schooling and health care thanks to diamond revenues. The movie is indeed a period piece: The civil wars in Sierra Leone and Liberia ended a few years ago. But the war over perceptions is just warming up. Many in the industry fear that as the end credits roll, moviegoers might glance down at their diamond rings and wonder under what circumstances the gems were dug. Unlike oil prospecting or coal mining - essentials for modern life - those questions could roil an industry whose lifeblood is ephemeral. Controversy affects value "Diamonds are essentially worth nothing," says Mordechai Rapaport, whose Rapaport Group price list is the industry standard. It's all about what they signify, he explains: In the case of a wedding ring, it's the guy, not the one-carat diamond. By that logic, he adds, "when a guy gives a woman a diamond and someone was killed for it, it is not worth anything." Diamond producers and dealers did not need Hollywood to reach that conclusion. As war raged in the past decade, they realized that so-called blood diamonds carried a risk to their business that was far out of proportion to the tiny number of stones. Even during the bloodiest years no more than 15 percent of the world's diamonds were controlled by rebels in Sierra Leone, Liberia, Angola and the Democratic Republic of Congo. The vast majority of diamonds, then and now, come from deep-level mines run by well-ordered international corporations, including Koidu Holdings, Sierra Leone's newest such operation, which opened in 2003 and exports $2.5 million in diamonds a month. And although UN investigators recently found that rebels in the Ivory Coast had smuggled millions of dollars' worth of diamonds onto the world market through Ghana, blood diamonds account for only 0.2 percent of today's global supply. But the industry's problem is far trickier than percentages. Consumers cannot be sure which diamonds are blood diamonds. And therein lies the potential for a boycott, especially since synthetic diamonds now look close to the real thing. "Diamonds are a luxury, so we depend completely on the consumer's faith," says Rory More O'Ferrall, director of external affairs for De Beers. "Anything that affects the integrity of that we need to address." Tackling the problem took an unlikely alliance: Industry executives joined forces in 2003 with governments and the UN to end the trade of conflict diamonds. The resulting Kimberley Process Certification Scheme is a rare experiment by a major industry to monitor its own abuses. The 71 member countries agree to trade only among themselves. They inspect one another's facilities, then issue certificates declaring their diamonds conflict-free. In theory, rigorous paperwork tries to trace all diamonds from mines to consumers. Transgressors are ousted: The Republic of Congo was banned in 2004, and Venezuela was threatened with suspension last month after reporting zero diamond exports for 2005. But the system is hardly flawless, even in the U.S. In September the U.S. Government Accountability Office found that Customs and Treasury officials were only haphazardly enforcing the system, leaving companies to monitor themselves. Last year about 300,000 more carats were exported from than imported to the U.S. - which produces no commercial diamonds itself. Representatives from all 71 countries met last month in Botswana to try to tighten loopholes and squeeze out nonmembers. "There are fewer and fewer countries left that nonmembers can trade with," says Sue Saarnio, the U.S. State Department's representative to the November conference. The underground diamond trade A far grimmer assessment of the Kimberley Process can be found in the back alleys of Koidu. As the clammy heat eases off in the late afternoon, dozens of men converge on the neighborhood dubbed by the locals "Open Yei," Creole for "keep your eyes open," a reference to its thriving unlicensed diamond trading. The action is the area's major entertainment, drawing a crowd of curious men and children. In a dirt clearing between the small wooden storefronts, Abdollai Koroma runs his business from a chair under a shade tree, clutching a yellow calculator and a jeweler's loupe in a weathered pouch. During just one hour eight men arrive with their wares wrapped in scraps of paper stuffed in their pockets. Koroma takes each stone and swirls it in his mouth before examining it briefly under the loupe. "This is 1.20 carats," he says after spitting out a glittering stone the size of a shirt button. Koroma, who started trading diamonds at age 17, taps on his calculator, peels off a wad of banknotes, and makes his biggest purchase of the day: 200,000 leones, about $66. The previous day the neighborhood trade was equally brisk, as men gathered to sell diamonds to Komba Fillefaboa, a 47-year-old trader who began digging when he was 12. Fillefaboa says he buys dozens of stones on an average afternoon. "We buy piece by piece and then gather them into a parcel to sell to dealers," he says. Once the parcel of diamonds is sold to a licensed dealer, illegally mined diamonds are easily mixed in. Fillefaboa says he has no problem finding buyers, despite Sierra Leone's strict licensing laws, which ban illegal diamond dealing. Licenses are regarded as too costly and laws too cumbersome. "We are all illegal here," boasts the neighborhood's chief, Sahr Sam. "If the monitors come, we scatter." Smuggling In reality, government monitors rarely come to Open Yei. There are only 200 for the entire country, sharing ten motorcycles donated by the U.S. Agency for International Development. "At every level people say to us, 'If you harass us, we will just smuggle the diamonds,'" says Dan Joe Hadji, a senior monitoring officer in Koidu. "So we allow people to move around and hope and pray that they find religion" -by obeying the law. Diamond producers and dealers frequently tout Sierra Leone as a Kimberley Process success story, since its official exports soared from near zero in 1999 to about $142 million last year, suggesting that smuggling has plummeted. Not necessarily so: The official statistics cannot be proved, says Jan Ketelaar, mine manager of Koidu Holdings and a former diamond advisor to Sierra Leone's President. Worse, this year's exports are likely to drop about 10 percent, suggesting that bigger diamonds are being smuggled illegally, says a Western ambassador in Freetown who sits on a high-level diamond committee of diplomats and aid organizations but asked not to be identified. Director of Mines Alimany Wurie admits smuggling is widespread - perhaps as much as one-third of all Sierra Leone's diamonds. Enforcement is nearly impossible. The frontier with Liberia, whose diamonds are banned from world trade, is just 30 miles from Koidu and riddled with old smuggling routes. Only three of the 36 border crossings into Guinea are guarded, says Hadji, and even those are left unmanned for a few days each month when border officials walk to town to collect their pay. Yet the rampant smuggling, though illegal, does not kill. And with peace restored in West Africa, it is tempting to think of blood diamonds as little more than a dramatic movie plot. Those who have witnessed Africa's bloodletting up close say it's a mistake to relegate the issue to history, because history could repeat itself. In any future conflict in the region, diamonds would be one of the surest ways with which to buy weapons. "Diamonds were very much the fuel for the war but not the root cause, and those root causes are still very much with us," says the Western ambassador. "Corruption, unemployment, poverty - I could well imagine another blood-diamond scenario here." Fair trade Faced with that stark possibility, diamond companies have begun trying to tackle the crippling poverty at the bottom of the industry, where, according to Global Witness, a British organization that has done extensive research on blood diamonds, about one million Africans earn pennies a day in the backbreaking and increasingly fruitless search for alluvial stones. Flying low over Koidu in a twin-propeller plane shows how daunting that task is. Hundreds of men can be seen bent low in the rivers around Koidu. "They are working in absolutely horrific conditions in the hopes of striking it rich, but the majority never do," says Susie Sanders, a Global Witness researcher. Little of the region's innate mineral wealth has filtered down to residents. "A billion dollars' worth of diamonds have come out of Sierra Leone in the last several years, and there is no electricity or water wells," says Rapaport, who toured the villages around Koidu last summer with his father, Martin, chairman of the Rapaport Group. Shaken by the chasm between the diggers and the diamond buyers, the Rapaports are trying to start a Fair Trade association of producers along the lines of Starbucks (Charts), which buys coffee beans for a premium price from some growers, then sells them for more money to socially conscious coffee drinkers. Rapaport is predicting that the current controversy over diamonds will jolt consumers into asking retailers probing questions about the gems' origins. If so, they are unlikely to find much information: Two years ago a survey of 40 major American retailers by Amnesty International and Global Witness found that almost none had policies in place against blood diamonds. Rapaport believes consumers would happily pay a little extra to ensure they are buying African diamonds mined for decent wages under humane conditions. "Our idea," he says, "is that Tiffany (Charts) is going to wake up one morning and see that Cartier is selling fair-trade jewelry and say, 'Oh, my God, we need to do that.' They will change not from an ethical point of view but from greed." In Koidu a U.S.-funded program trains diggers in how to grade and value the diamonds they find as a way of avoiding being fleeced by local traders. Last year De Beers and two activist organizations founded the Diamond Development Initiative, an international organization to train diggers in safety and economic issues, and ultimately to try to persuade many to grow crops instead. De Beers has begun a similar pilot training project in Tanzania, which it says it will replicate elsewhere in Africa if it is successful. But for 18-year-old Sahr Amara all those projects seem abstract. His parents grow crops in a village about 20 miles from Koidu and cannot afford to buy his schoolbooks or pay his yearly tuition of 35,000 leones ($11.66). "I would like to find a diamond so I can go back to school," Amara says. "If I stay digging at this site for a long time and find nothing, maybe I will leave and try to find a job somewhere." That would leave Africa's 999,999 other diamond diggers still searching for a dream. ______________________ |

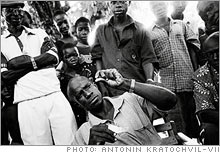

|