An ex-ball player slides into stocksAfter his mutual funds tanked, Lenny Dykstra leaned on some heavy hitters to transform him from an ex-major leaguer to a minor-league stock picker.(Fortune Magazine) -- On the afternoon of Nov. 6, 2006, Lenny Dykstra tips the bellman at the St. Regis Hotel in New York City a double sawbuck for a bottle of water. He tips the doorman a double sawbuck for opening the door to his limo. The 43-year-old retired baseball player tips the limo driver a C-note for taking him three blocks to Ram Capital Resources, where he'll be trading some options. He sets up his three computers in the Ram conference room while he eats a toasted cheese sandwich. He looks like an unmade bed, like a clean-shaven version of Jeff Bridges's character, the Dude, in "The Big Lebowski."

He's short, with a big belly, hunched over, his loose-fitting pants falling off his butt and bagging at his ankles. These days the former New York Mets star lives in Thousand Oaks, Calif., where he owns a chain of Castrol Quick Lube centers and is trying to launch an investment fund for Major Leaguers. It's 3:40 p.m., and he has only 20 minutes until the closing bell. The Dude - he calls people "dude," and they call him that too - sees that Abbott Laboratories (Charts) today announced plans to acquire Kos Pharmaceuticals for $3.7 billion, $78 a share. Kos is a company that specializes in drugs that boost good cholesterol, or HDL. The Dude is a heavy investor in a lesser-known company, Lipid Sciences (Charts), that also is developing HDL-enhancing medicines. "I'm in the top five shareholders, dude." LIPD is trading below $2 on this day, and he is not happy. It is the only stock he owns. [A few weeks later, he would reveal in an SEC filing that he owns 7 percent of the stock.] "Someone is dumping Lipid stock," he says. "Who's this dumping 170,000 shares? It's brutal. Why aren't they loading up on Lipid? I'm gonna find this mofo." The market closes. The Dude packs up his computers. "I made 12 grand today," he says. A sample trade: He bought long-term options on Caterpillar (Charts) Inc. for $165,000 yesterday and sold them today for $171,000. That's his thing - making money off small moves in carefully targeted options. "It's like in baseball. The bottom line is, find an edge, find trades that are not crowded, not a lot of action on them, and connect the dots. It's all about work." 'GTC, dude' In a previous life the Dude helped the New York Mets win the World Series in '86 and led the Phillies to a World Series in '93. After that season he became the seventh-highest-paid player in the game, at $25 million for four years, not bad for a leadoff batter and singles hitter. In 1998, after a raft of injuries, he retired from his more than satisfactory 12-season career. He was known as Nails because he played the game and lived his life outside it as if he were as hard as nails. He smoked, gambled, chewed tobacco and slid into second base with his spikes high. He once said, "I was the most hated player in the National League for five years," and he may have been. "When I was a kid," he says of his childhood in Santa Ana, Calif., where he once was detained in a stadium jail for sneaking into the Angels clubhouse to meet his idol, Rod Carew, "I only had one friend, because I needed someone to have a catch with me." The link between his career in pro baseball and his new one as an investor and day trader is an ability to spot patterns. "You know the most important count in baseball?" he asks rhetorically as we stroll back to his hotel. "One-and-one. If it goes to two-one, a hitter hits .300. If it goes to one-and-two, he hits .100." To Nails, bad traders and bad batters are alike in that they swing for the fences when they should stay focused on merely getting on base. His trading philosophy is not that different from how he hit Hall of Famer Steve Carlton. "The game, whether it's baseball or stocks, is about getting into a predictable situation, a 2-0 count, when the odds are in your favor. At 2-0, the guy's gonna throw a fastball into my love zone, where I can turn and burn. I got one rule in stocks. When I make a $1,000 gain, I sell. GTC, dude. Good-till-cancel order. Buy it at $10, sell it at $11." Dykstra - who now makes semiregular appearances on CNBC and Fox's Bulls & Bears - did not morph from ballplayer to stock picker overnight. When he retired, he had $20 million invested in real estate and an additional $1 million in mutual funds - Fidelity, Goldman Sachs, Putnam. They grew to as much as $1.7 million but dropped to $400,000 in the correction of 2002. He went to the investment adviser who had put him into the funds and said, "What happened to my blue chips? You're fired. Give me my money." He took the remaining $400,000 and stuck it into a savings account for a year. "I learned that mutual fund brokers are just traders in cheap suits," he says with typical hyperbole. "I swore that would never happen to me again. I had always been in control in baseball. This was the first time I wasn't in control." Early mentors The Dude decided he would master the stock market. Instead of hitting the batting cages, he trolled Web sites, including Agora Financial, Porter Stansberry & Associates and Dr. Steve Sjuggerud's Dow Theory forecasts. He also tried to leverage his on-field celebrity into access to financiers who could show him how real money is made. He called the CEOs of big companies. Because he is Lenny Dykstra, some of them, including Ken Thompson, chairman, president and CEO of Wachovia, called back. "I even wrote a letter to Warren Buffett, that's how naive I was," he remembers. "I wrote, 'Mr. Buffett, I'm Lenny Dykstra, a baseball player. Could you teach me how to invest?' He handwrote back on his own stationery, 'Lenny, I'm a fan. I'd love to help you, but I can't. Best of luck.' It was so cool." [When contacted by Fortune, Mr. Buffett could not recall the letter.] The first investor who eventually came to his aid was a far cry from Buffett - rather, a neighbor in his gated community in Thousand Oaks, where Dykstra and his wife, Terri, live with two of his three kids. Larry Connors, founder of TradingMarkets.com, had a young daughter who wanted to be a softball star. "I told him I'd trade baseball tips for his daughter for stock tips from him," says the Dude. "That's how I got started." Connors confirms the tale and adds, "I just taught him how to buy good, strong companies as cheaply as possible. Lenny's street-smart. He picks up things quickly." Another early mentor was Wachovia's Paul Hollins, Dykstra's current stockbroker and the brother of Phillies teammate Dave Hollins. "People underestimate him as the Dude. That's his edge. He does his work. He always asks questions. He tries to get the odds in his favor. Sometimes he has more information than me," says Hollins. He helped Dykstra formulate a trading strategy that uses "deep-in-the-money calls" - options to buy a stock at well below its current price. Richard Suttmeier, chief market strategist for Joseph Stevens & Co., worked with Dykstra on refining this strategy by teaching him when to get in and out of the market. "I taught him to be selective in entry and exit levels on the stocks underlying his options strategies - what price levels should hold on a stock's weakness, and how high the stock can bounce on strength," says Suttmeier, who uses technical analysis and is a frequent contributor to TheStreet.com. Armed with this newfound knowledge, Dykstra dusted off his $400,000 in savings and started trading for himself. Since then, he claims he's turned $400,000 into $5 million. The reason he likes deep-in-the-money calls, he says, is the downside protection they provide. He thinks they are particularly effective when a company with solid fundamentals is being punished for bad news. "All I need is one uptick. I can lose only if there's an accounting scandal I can't control," he says. To illustrate how it works, he sent me trade executions where he bought 100 calls of Anadarko Petroleum (Charts) on Nov. 7, when it was trading at $47.28, with a December $40 strike price. He paid $7.40 a share in order to control 10,000 shares, putting up a total of $74,000. On Nov. 9, when Anadarko bounced to $48.90 a share, Lenny sold his options and made roughly $5,000. By 2005 the Dude had become a fledgling guru, and Jim Cramer gave him a column on TheStreet.com called "Nails on the Numbers." The Dude claims 95 percent of his options tips made money - notably predicting Cisco's (Charts) bounce last summer - but before folding the column last August he picked his share of pooches. When I mentioned to one of his former teammates that Nails was a stock guru, he laughed and said, "Would you give Lenny your money to invest?" But the Dude may have the last laugh. He claims his total net worth is close to $50 million from his businesses and investments combined. The next morning, the Dude is in his hotel room trading on his three computers while watching Bloomberg TV, talking to his broker and explaining his other holdings. He owns several Castrol Quick Lube centers, a landscaping business and a property development company. Real estate has always been very, very good to Dykstra even when the market wasn't. Since his playing days, he has understood the importance of a good location. He bought his first car wash for $1 million in 1995, and it is currently in escrow for $11 million. "That's why they call it real estate, dude, because it's real. I'd go down to the city and ask about the future of an area - what's coming here, when? I looked up this one parcel owned by a little old lady in Corona. She paid $43,000 for it forever ago. I had this big sweepstakes check made up, put $1 million on it, and knocked on her door. I thought she'd have a heart attack. I paid her the million for 2� acres, subdivided it, built a car wash, a Conoco fueling center, and then sold it," he says. All righty, then. The Player's Club When the Dude stops trading, I ask him about my meager investment in an annuity. I know what he thinks about mutual funds already, so I wait for his comments with trepidation. "A Hartford annuity, dude, that's a great annuity," says the Dude. "It's a monster. I woulda picked it for you." He brings it up on his computer. "See! AAA. The Hartford's the bomb, dude. The Hartford is the model for what I'm selling my players." The Dude's next move is putting together an annuity of his own, which he calls the Player's Club. "Guys are done playing at 35," he says, "and there's nothing worse than to make a man change his lifestyle. When that money's flying in, they don't think about paying the bills when they get older, 'cause they never been 35 and outta work. If you don't have cash coming in, you either gotta change your lifestyle drastically or go broke. You can't pay for the big house with the big lawn and the big driveway. The wife says, 'What happened, honey?' What're you gonna tell her? Get a job? She's gotta take care of the kids." The Dude grabs a piece of paper and a pen and begins scribbling. On one side of the paper he writes "Paycheck" and "$3,000,000." On the other side he writes "Monthly Expense $100,000." Figure in taxes, and "in 12 months it's gone," he says. He slashes at the paper as if drawing an explosion. Then he writes next to the explosion in huge letters: "Divorce." "I spoke to players last spring training," the Dude says. "Trying to educate them in stocks. I want them to lock up a guaranteed cash flow so they can meet their nut, and one day they won't wake up to realize they're not getting paid anymore." The Player's Club hasn't signed up its first player yet, but it will require each one to invest at least $250,000. Professional money managers of Dykstra's choosing will manage the assets. Day trading is fine for his money, but he wants these players to be in the hands of the experts. "That's how I do things, dude. You know, people who are smart don't want to ask questions 'cause they don't want to feel dumb. To me, that's stupid, not to ask for help. If I don't know something, I go to the best three people for help." And with that life lesson, the Dude escorts me to the door of his room at the St. Regis and steps out into the hallway, assuming a crouch, as if he's taking a lead off first base. Then he says, "I used to practice stealin' bases in this hallway." Telis Demos contributed to this article. ________________________ |

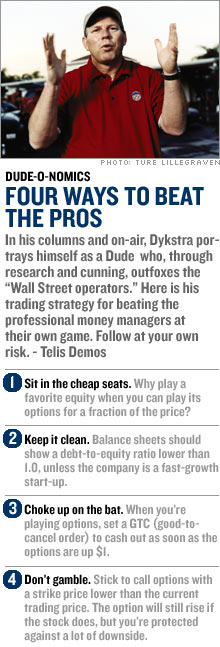

|