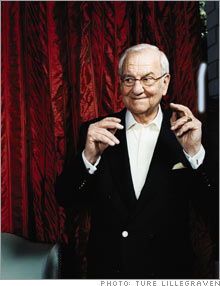

'They're throwing us to the curb'In a new book, Lee Iacocca asks, Where Have All the Leaders Gone? Speaking with Alex Taylor III, Iacocca, 82, talks about Kerkorian, Chrysler and the future of Detroit.(Fortune Magazine) -- Your third book, due out this month, is about the state of American leadership. How is Detroit doing on that score? I give [GM CEO] Rick Wagoner a lot of credit. He had a lot of pressure on him, but he kept his cool and he stayed with his plan. Their styling is getting better, and they're doing better. Ford (Charts) has more difficult problems than GM (Charts). It has so much invested in the truck business; it has got to get some good cars. I think this new guy from Boeing (Charts) [CEO Alan Mulally] knows the business pretty well. Not the auto business, but he knows what it takes to run a big organization and deal with the labor unions. As for Chrysler, [president] Tom LaSorda is doing a great job in manufacturing, but I don't know what's going to happen. I'm reading about it every day. I would hate to see Chrysler go under. It would be tough to live with.

There are four apparent bidders for Chrysler, including Kirk Kerkorian's Tracinda, which has offered $4.5 billion. What is your take? I read about Kerkorian's bid with interest, especially the part where the New York Times said I supported it, but I had nothing to do with it. I've decided to stay neutral on this one. What do you think Kerkorian would do with Chrysler? He's a gambler, and I don't know what his endgame would be. He'll be 90 years old in June, but he's a healthy guy and he exercises a lot. Twelve years ago we [Kerkorian and I] tried to take over Chrysler, and we couldn't raise the money. How important are the unions to this deal? Very. The deal is contingent on Daimler (Charts) sharing the legacy costs and the union negotiating concessions. Those are two big conditions. Who do you think is going to wind up with Chrysler? Who knows? Private equity funds scare me. Do they really understand the car business? I would like to see somebody with a leadership group that has the experience to handle the dealers and the employees. If I had the money, I'd buy it. I'd come out of retirement to buy it. Chrysler builds great cars. Maybe you could sell off Jeep, but I would hate to see it busted up. I've done my time in Detroit. I live in L.A. now. [Former DaimlerChrysler chairman] Jürgen Schrempp asked me to come work for him, and I said, "Where do I have to live?" When he said, "Stuttgart," I said, "Forget it." If you were back as chairman and CEO of Chrysler, what would you be doing? To succeed today you have to set priorities, decide what you stand for. You can't do all things for all people. I think the model lines are too complicated at all the Big Three - too many kinds of cars for customers to assimilate what they're being sold. In your book you say the news of the Daimler-Benz merger made you "sick." Why do you think it failed? There were no synergies. None. And culturally the Germans operated differently than the Americans. It was emotional when Chrysler sold out to the Germans. It's extra-emotional now that the Germans are selling - they're throwing us to the curb, in effect. What's the matter with Detroit? Let's start with health-care costs - the legacy costs. There are lots of retirees out there. They've earned what they're getting, but we can't afford it anymore. The world has changed. To use a GM number that I quote often, Toyota (Charts) pays $200 per car in retiree health care; GM pays a little over $1,500 a car. That's a tough albatross to carry. People are living longer, and the government and the union and the Big Three have got to get together and see what they can do to collaborate. The union contract is coming up in September. That's a watershed contract. The current contract is too rich. I hope cooler heads will prevail, and we'll come to some settlement. But the union is already threatening a strike. They should wait until they get to the negotiating table to start their talking, but they're doing it in the press. We've got to work this out together because it's a matter of survival. Will Detroit's market share keep slipping? I think it will stabilize. It's pretty bad right now. The imports have over half of the passenger-car market. I think GM will start coming back a little bit. But as you know, in this business more share doesn't come easy. Do you blame the Japanese for Detroit's decline over the past couple of decades? I've taken on the Japanese forever. Toyota's a great competitor. Nissan's (Charts) coming on strong. Honda's (Charts) always been great on engineering. They're good companies, but they had advantages. It's unfair competition. Their market is closed to us. They still manipulate currency. When they come to this country they don't have unions, and that's tough to compete against. Sometimes I think their trade practices are predatory. In the '80s you suggested raising the gas tax. Yes. I went to see Reagan and said, "Let's put a 50-cent-a-gallon tax on gasoline. That's $50 billion. We can cut the deficit in half." He said, "You've got to be out of your mind. You don't tax gasoline." And he laughed. So we never did it. Our state and federal taxes add up to about 46 cents a gallon, compared with $5 in Europe. What do you think of global warming? I campaigned for George W. Bush in 2000 and against Gore because I thought Gore was a little nutty when he was talking global warming. Now I think it's a serious problem. As I said in my book, I never thought I'd pay $8 to go see Al give a PowerPoint presentation. There has to be a solution that everybody's got to join - the whole planet, not one country - and so I've become a believer. I didn't get too enlightened until years after I left the auto business. What can the auto industry do? Plug-in hybrids. I think they're virtually here now. We've still got to get better batteries, of course, but hybrids are good. Expensive and complex, but they do the job and get good gas mileage. That's the wave of the future. Some people are betting on hydrogen-powered fuel cells. I think that's way off. Where are you going to get all that hydrogen? How are you going to store it in the car? How are you going to distribute it? That's a long-term problem. Are you sorry you never ran for president? I have no regrets, but I am a little despondent, because I love this country and I want to do something. I'm running out of time. But I've got to cure diabetes [through research funded by the Iacocca Foundation]. What do you tell young people who are considering going into the auto industry? Do it. It's an exciting life. I loved going to work in the morning. I just loved cars. And if you love what you're doing, it shows. From the April 30, 2007 issue

|

Sponsors

|