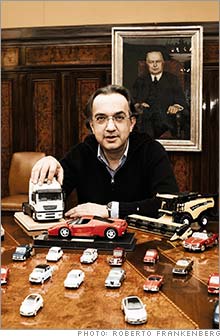

The turn around at FiatHow Fiat, once a wreck of a car company, got hot again.(Fortune Magazine) -- Luca De Meo, head of the Fiat car brand, was given his job after just one interview. It was a hot Turin summer day in 2004, and Sergio Marchionne, the new CEO of the Fiat Group, was prowling the company's holiday-drained halls. "In Italy the CEO of the Fiat Group is a kind of mythical personage, somewhere between Pope and Prime Minister," says De Meo, 39. "He knocked on the door and said, 'What do you do?'" Fiat was a wreck - it would lose more than $1 billion that year - and Marchionne, just arrived from Switzerland's SGS, the world's largest goods-inspection company, was looking for a team to strip it clean and hammer it into shape. De Meo was in charge of the group's Lancia brand at the time, and during the two hours they talked, he felt as if he were being X-rayed. "Marchionne has a real ability to read people's psychology," says De Meo. "Three months later he said, 'You have to run Fiat.'"

De Meo's promotion - the snap gamble, the pluck from the ranks - was typical for Marchionne, who this year announced that Fiat Group Automobiles, which includes the Fiat, Lancia, and Alfa Romeo brands, had returned to profitability for the first time since 2000. Last year revenues reached $31.3 billion, up 35% from 2005. Trading profits, which do not include restructuring costs or one-time items, flipped from red to black, from $332 million in losses in 2005 to a $384 million profit. The Fiat Group (Charts) - which also owns the luxury brands Ferrari and Maserati, as well as makers of trucks, agricultural and construction equipment, and automobile components - announced it will pay its first dividends in five years. At a time when many of the industry's major players are struggling, Marchionne had accomplished the impossible, salvaging a company headed for the scrapheap. "When you're fighting in an industry like this, you need to take very unorthodox approaches to the business," says Marchionne, a 54-year-old jazz-loving Italian who has spent his entire adult life living outside his native country. It was this outsider quality that may have helped him most: He has flushed out the management, lubricated the design process, revved up production, fine-tuned union relations, and begun to bang out the dents in a badly damaged brand. "It's like what Michelangelo said about his 'David,'" says Giorgio Elefante, head of the European auto retail practice at PricewaterhouseCoopers. "He took a block of marble and cut off what was superfluous." In March the company's market capitalization reached $32.5 billion, more than that of GM (which once owned a 20% stake in Fiat) and Ford combined. But Marchionne says the job is not finished. To cement his success, Fiat Automobiles will roll out 23 new vehicles and as many model face-lifts by the end of 2010. He hopes to boost sales from two million cars last year to 2.8 million and increase Fiat Automobiles' current 9% share of the European market - it is the fifth-largest seller on the continent, behind GM (Charts, Fortune 500), Ford (Charts, Fortune 500), Peugeot (Charts), and market leader Volkswagen (Charts) - to 11%. And he predicts that net profits for the Fiat Group will nearly triple by 2010. "We need to be one of the top three producers in Europe," Marchionne says, sitting in his office in Turin under a large black painting with the single word "competition" in white. "Once we get to that stage, I'll feel a lot more comfortable." It is a tall order, but in 2004 the challenge seemed all but insurmountable. Fiat Automobiles' share of the Italian market had slipped from 52% at the beginning of the 1990s to below 28% in 2003. The group had expanded into insurance, banking, and energy, and had neglected its auto division. Investments were low, and the management culture was stagnant. "It wasn't the fault of one, two, or three people," says Elefante. "It was a problem of culture - big offices, big waste, and nobody responsible for anything." Mass discounts that were intended to boost volume cost the company on each car it sold. Unions were striking over job cuts. Fiat's most recent launch, an effort to break into the compact-car market, had sputtered. Judged by consumers to be ugly and costly, the Stilo sold fewer than half of what Fiat had hoped. "It was priced too high for what a typical Fiat customer would pay for the car," says Monica Bosio, an analyst at Intesa Sanpaolo, Italy's largest bank. Meanwhile Alfa Romeo hadn't updated its top-selling models in years, and sales were slipping. The death in 2003 of Gianni Agnelli, the industrialist credited with building Fiat from car company to conglomerate, was followed a year later by that of his brother Umberto. Leadership of the family, which owns 30% of the Fiat Group, fell to Gianni's 28-year-old grandson, John Elkann, now vice chairman. The company had chewed through four CEOs in three years. Management shakedown Marchionne had been appointed to Fiat's board in 2003 and became CEO under Elkann. He began by stripping away layers of management, starting at the top. Ten percent of the roughly 20,000 white-collar employees in and around Turin were fired. "This was a very hierarchical, status-driven, relationship-driven organization," says Marchionne. "All that got blown up in July 2004." In the offices where career Fiat managers once lorded for life, Marchionne placed outsiders or promoted talent from the middle ranks. Antonio Baravalle, then marketing manager at Alfa Romeo, recalls being summoned for a meeting with Marchionne shortly after he arrived. "It was the time when he was shaking the trees, looking to see how many [managers] were still hanging," says Baravalle, 42. "His first question was, 'Tell me what was wrong with what you did in the past.'" Baravalle passed the test. After a second interview, Marchionne put him in charge of Lancia. A year later he asked him to head Alfa Romeo. "Of the first level there, I am the only one that survived," says Baravalle. Marchionne drives his new executives to take risks. "They have a huge amount of freedom," he says. "But the freedom has a very expensive pricetag: the delivery of results." Recalls Baravalle: "He would say, 'The reason I chose you is that you don't have in your background the sedimentation of the past.' He was looking for fresh air." Baravalle cites Alfa Romeo's push in Britain as an example of the new approach. "It's a place where we have in theory an incredible potential," he says. "We could do 50,000 cars. Today we sell 6,000." Under the old management, the brand would have targeted its nearest competitors, fine-tuning quality, marketing, and customer care. "If this year we were in 27th place, next year we would try for 22nd," says Baravalle. After commissioning a study comparing Alfa Romeo to its highest-ranked competitor, Lexus, Baravalle scrapped 60% of his dealer network overnight. He restructured the spare-parts division and set up a predelivery center to give cars a last going-over before they reached the dealer. When Marchionne learned that 2,000 Alfa Romeo customers had called the company the year before and received no reply, he ordered them all called back with apologies. "Marchionne's challenge was, 'Tell me how to be No. 1,'" says Baravalle. "We can no longer have an incremental philosophy. It has to be a policy of breakthroughs." Alfa Romeo's plans in Britain, only a few months old, have yet to produce results. But worldwide sales of the brand rose 17% last year. Emergency-room overhaul At the Mirafiori plant in Turin, welders work in safety glasses with a designer curve to the lens. Automobile bodies swing overhead like skeletal cable cars. Behind Plexiglas, robots jerk and whir. It isn't easy to spot what has changed here since Marchionne took over. But before he arrived, engineering for each brand was run independently. Fiat would commission its own research. Alfa Romeo would design its own components. Lancia would engineer its own cars. None built on what the others had accomplished. Fiat's Stilo and Alfa Romeo's 149, similarly sized cars offering similar performance, shared no components, says Harold Wester, the head of engineering Marchionne hired from Magna Steyr, an Austrian automobile manufacturer, in 2004. Only two of the company's 19 independently developed platforms shared the same heating, ventilation, and air-conditioning systems. "The customer is interested in a fuel-efficient and well-functioning HVAC unit," says Wester, 48. "Whether it's the same between four cars, he doesn't care." Wester launched a plan to produce 85% of Fiat Automobiles' cars on just four platforms by 2010. "I will no longer reinvent the wheel each time," he says. "I will work instead on improving the same solution." Two cars of the same size will share two-thirds of their components, most of them not visible to the customer. "You cannot survive with small steps," he says. "You need to leapfrog to put yourself in a state-of-the-art position as soon as possible." To be sure, Marchionne's successes have included more conventional moves. He shepherded the Fiat Grand Punto through a successful launch, and under his supervision the Fiat Panda has seen increasing sales for four years running, a rarity in an industry where new models usually peak after the first year. The car's long life has been achieved by the careful rollout of new features and upgrades, the most popular being the Panda Cross, a 4X4 version of the tiny car with the trimming of an SUV. Marchionne has aggressively forged partnerships abroad, in China, India, Russia, and Turkey, manufacturing Fiat-branded cars and selling them through local dealers. In early 2005, when Fiat was still spewing red ink, he negotiated a $2 billion payment from General Motors in exchange for annulling a deal in which the Italian car company could force GM to buy it outright. Yet if Fiat Automobiles had not been stalled, it's unlikely that Marchionne would have had the freedom to carry out his emergency-room overhaul. "In a well-established, settled company in the automotive industry, nobody could do something like this," says Wester. The car company had the talent, knowledge, and skills, but it lacked leadership. "This company was like a cage full of horses," says Baravalle. "Marchionne's incredible capability is to destroy the cage and to drive the horses in the right direction. Then, when he has you in the right direction, he says, 'Run as fast you can. Nobody will stop you.'" Since taking charge, Marchionne has become increasingly casual in dress. His wavy, graying hair now reaches his shoulders. His voice is deep and a touch lazy, like a jazz singer's drawl. He rarely wears a suit, preferring to come to work in a black sweater. Add his rimless glasses and the hunch in his shoulders, and he resembles less a car executive than an orchestra conductor. In his office is a turntable and vacuum-tube speakers (he favors the American pianist Keith Jarrett and Bobby McFerrin's orchestral works). From the broad deck of his desk, his Mac laptop calls out the time at 15-minute intervals. Born in Italy but raised in Toronto, where his family moved when he was 14, Marchionne straddles a line between Italian and outsider. After earning a bachelor's degree from the University of Toronto, he studied accounting and law. Before joining Fiat he presided over a turnaround at SGS. On the rare weekend he takes off, he commutes to Lake Geneva in Switzerland, where his Canadian wife lives with their two sons. Marchionne has as much as possible divorced his position as head of Italy's largest private industrial company from its traditional political role. He has eschewed conflict with the unions by promising not to close plants, boosted domestic production, and signed the company's first contract with the metalworkers' union in ten years. "What's gone from here is the typical confrontational style of unions against the company," he says. Marchionne may delegate, but he leaves his executives little free time. Weekend meetings are routine. So are predawn phone calls. Travel can occur on a whim. "He can be very tough," says De Meo. "But he can be very warm from a human point of view. That's the magic, but it's also the trap. You get emotionally attached to the guy." Adds Baravalle, who is the divorced father of a young girl: "He is incredibly tough and demanding, but he will never leave you in the mud. I told him that between Alfa and my daughter, I always choose my daughter. And he always respected that. He never said, 'But this time is important.' Never." 'Fiat cars must remain affordable' When it comes to the competition, Marchionne is happy to imitate, though the word he usually chooses is "benchmarking." Alfa Romeo's push in Britain was called "the Lexus-like project." On the production side, he makes no pretense of breaking ground, maintaining that "any attempt at reinventing outside of the Toyota pattern is idiotic." His marketing inspirations, however, come from outside the industry. "If you were to ask me today what the Toyota (Charts) brand stands for, I couldn't tell you," he says. "I grew up in North America, and I remember when Apple started. How much care [CEO Steve] Jobs takes in nurturing their place in the market is just phenomenal. We need to learn that." De Meo calls Apple a "smiling" brand. "When you walk into a computer store, the first thing you want to touch and look at is the Mac," he says. Last summer De Meo forged an agreement with IKEA to redesign Fiat's showrooms in the Scandinavian company's crisp, modern style. In March, Fiat announced it would sponsor the Yamaha racing team in the MotoGP. The main reason: the team's star racer, Valentino Rossi. "This guy is the image of the smiling, winning, simpatico, simple, young Italy," says De Meo. "He's a kind of human representation of what Fiat would like to be." Fiat also signed a three-year $44 million deal with Juventus, a football club also owned by the Agnelli family. Fiat cars must remain affordable, says De Meo, but the rise of carmakers in low-cost countries means Italian-made cars can no longer compete just on price. "We are trying to transform Fiat from a popular brand to a pop brand," he says. "We should be totally consistent with the values normally associated with MADE IN ITALY. When you enter a shop to buy a suit or jeans, you never expect the Italian product to be the cheapest one. Yes, you have Prada, but you also have Diesel. You have Miss Sixty." In January, Fiat launched the Bravo, the first car Marchionne has overseen from its conception. It is a culmination of his reforms, sharing two-thirds of its components with its predecessor, the Stilo, which continues to be offered as a station wagon. Development from first sketch to production line took just 18 months, an industry record, according to Marchionne, achieved through virtual computer design and modeling. Stylistically, the compact car is a radical departure. Fiat's slump in sales had been matched by a slide in style. The last several generations of cars were boxy and uninspired. But the Bravo boasts sporty, organic curves like the muscled head of a bull. "We got quite inspired by the Italian ladies," says Christopher Reitz, head designer for the Fiat brand. "We started talking about Sophia Loren with the cat's-eye taillights." On July 4, Fiat plans to relaunch the Cinquecento, 50 years to the day after the original was introduced. The company hopes it can do with its iconic centerpiece what BMW did with the Mini Cooper: turn a car into a fashion icon, one that young people will want to own, customize, and accessorize. "It will create the basis on which the Fiat brand can grow," says Marchionne. "Everything else we've done in the past three years, they've been successful cars, but the brand will find its roots in the Cinquecento." Designed by Frank Stephenson, the American designer responsible for the Mini and the Ferrari F430, the new car is larger than the original, sharing its platform (and two-thirds of its components) with the Panda. Fiat says it has not settled on a starting price, but the Cinquecento will cost a bit more than the Panda, which begins at about $11,000. "We want to have a basic car with a very accessible entry price," says De Meo. "But if you want to spend $25,000, because you want racing stripes, chrome on the wheels, a leather interior, and an iPod jack, you can have them all." The long lag times in the car industry mean that many of Marchionne's reforms are just now showing results, and he's racing to stay ahead. After all, market share is a zero-sum game, and the other players aren't idling. Volkswagen is growing, Toyota is coming on strong, and both Ford and GM are restructuring. "I was talking to the kids last night, to our brand guys," says Marchionne. "The problem with this level of success is that we're going to get copied." Says De Meo: "So far we've only done what people were expecting Fiat to do. The challenge of surprising and innovating is the challenge for the next lap." From the May 14, 2007 issue

|

Sponsors

|