NEW YORK (CNN/Money) -

Corporate owners of sports teams are putting their teams on the market at the same time that a flood of teams for sale is depressing the prices.

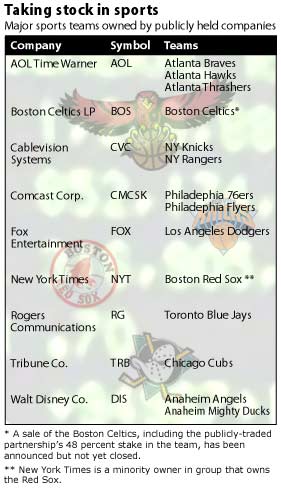

Media conglomerates AOL Time Warner Inc. (AOL: Research, Estimates), Walt Disney Co. (DIS: Research, Estimates) and News Corp. (DIS: Research, Estimates) are exploring selling the six major North American sports teams they hold between them. But there are probably at least a dozen other franchises also on the market, including one in bankruptcy court, the Ottawa Senators National Hockey League team.

The number of franchises on the market, as well as financial losses among many of the teams listed for sale, is depressing prices, by giving potential buyers the ability to shop around.

"This is the toughest market I've ever seen," said one of the leading investment bankers in the sale of sports teams, who spoke on condition his name not be used. "Part of problem is a third of the [NHL] is for sale. There's no scarcity value to the franchises right now. In the past, when a team went for sale, it was like buying a Picasso -- you knew one would only be on the market once in a while. Now if you don't like the price, you can go down the road to another team."

AOL looking to sell

That happened Monday, when New York sports executive Dave Checketts was in Atlanta meeting with AOL Time Warner about the company's three teams based there -- the Braves baseball team, the National Basketball Association Hawks and the NHL Thrashers, even as he was waiting to hear from News Corp. about his bid for the Los Angeles Dodgers baseball team.

A source familiar with those talks said the Atlanta meeting was only preliminary, and that despite reports from a business news wire service and two New York tabloids, there were no prices being discussed.

"I would say these are exploratory talks, nothing more," said the source. "Anything with numbers on it is much too premature."

| Related stories

|

|

|

|

|

But the source said that estimates by Forbes that the three AOL teams could be worth about $760 million are much too inflated.

"I think at the end of the day if people want to sell, they'll have to come off the very high prices we see published as estimates," he said. "Disney been trying to sell the Angels forever. They can't get buyers."

News Corp.'s ownership of the Los Angeles Dodgers baseball team through its Fox Entertainment Group unit is the most attractive property available right now.

Besides Checketts, Emmis Communications confirms it is exploring being part of the purchase of the Dodgers as well as various television properties from Fox. And Milton Glazer, owner of the Tampa Bay Buccaneers football team, is also interested, though NFL rules would require him to sell the defending champ Bucs to buy a team outside the Tampa Bay market.

The Dodgers sale will include 300 acres of land surrounding the ballpark, which could give it space to bring an NFL team to the Los Angeles market.

Checketts is likely only interested in AOL's teams if his bid for the Dodgers falls short. But because he wants to buy the Fox regional sports network that carries the Dodgers as part of the bid, and News Corp. would prefer not to sell that network, he is seen as not being the leading bidder at this time. A decision on a leading bidder for the Dodgers is expected within days.

AOL faces the same question of whether it can hang onto its regional sports network, Turner South, while selling the teams whose games are broadcast on the network.

"Their great desire is to sell the two indoor teams, but anything beyond that -- including Turner South -- they're willing to discuss," said the source familiar with the AOL talks.

Networks can drive up revenue, sales price

Checketts, who formerly ran the New York Knicks and Rangers for Cablevision Systems (CVC: Research, Estimates) along with the regional sports network that carried their games along with other teams, is looking to buy a sports and broadcast combination.

Several teams are in the process of starting their own regional sports networks as a way of increasing their revenue stream. And the inclusion of the Northeast Sports Network as part of the sale of the Boston Red Sox last year is one of the things that drove the sales price to a record $700 million.

There have been reports that Dallas car dealer David McDavid bid $200 million for AOL's Hawks and Thrashers, as well as for the long-term lease to the arena in which they play and Turner South.

One major investment banker specializing in sports team sales said he would be surprised if AOL would accept such low offers, even though he believes all three Atlanta franchises are losing money.

"That [$200 million bid] for all the other properties, that's much too low," said the investment banker. "I don't think you can buy an NBA franchise for less than $140 million, even the Hawks. The building is worth $25 million to $30 million. Turner South is making money. What's that putting for the value of the Thrashers?"

The investment banker says that AOL Time Warner has yet to hire an investment banker to shop any of the teams, or even put together a so-called book, which is a document detailing the value of the asset for sale for potential buyers.

"For AOL to take a pre-emptive bid of $200 million for all those assets without shopping them would be moronic," he said.

Forbes put the value of the Hawks at $206 million and the Thrashers at $134 million, but the investment banker said those estimates are well above the current market values, given how many teams are for sale currently, including the Ottawa Senators, which is in bankruptcy court despite finishing the regular season with the league's best record and much stronger ticket sales than the Thrashers.

"I can't tell you what Ottawa's going to trade at, but it's going to be less than the [$80 million] expansion fee of a few years ago," he said.

AOL Time Warner might not sell the teams at all due to the depressed price for professional sports teams in the current market, Terry McGuirk, the AOL executive in charge of the teams, told the Atlanta Journal Constitution in Wednesday's edition.

"The value of these teams [in a sale] is what someone wants to pay for them," McGuirk was quoted as saying. "This is not the high point [in franchise values], by any means. Whether that is a deterrent from selling or is overridden by some other requirement, that's why it's all so fluid."

McGuirk wasn't available for further comment Wednesday. The teams are part of AOL Time Warner's Turner Broadcasting unit, as is CNN/Money. McGuirk issued an e-mail to Turner Broadcasting employees Tuesday, stating, "While AOL Time Warner management has stated that legitimate offers for the teams would be considered, we do not have an agreement with any outside party or group for the sale of any part of our business."

Click here for a look at media and entertainment stocks

Shares of AOL Time Warner (AOL: up $0.06 to $12.51, Research, Estimates) and Disney (DIS: up $0.07 to $17.20, Research, Estimates) were higher in midday Wednesday trading, while News Corp. (NWS: down $0.23 to $27.65, Research, Estimates) and its Fox (FOX: down $0.53 to $27.32, Research, Estimates) unit were slightly lower.

|