SAN FRANCISCO (CNN/Money) -

Despite his unassailable achievements in the world of technology and business, when Bill Gates is ensconced in his San Simeon 2.0 home late at night, he dreams of being a television star.

More specifically, he dreams of the day when his company will make serious inroads into that most mighty of 21st-century media: digital cable television.

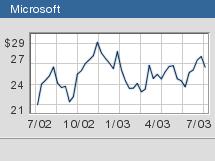

With Monday's announcements from Comcast (CMCSK: Research, Estimates) and AOL Time Warner Cable (AOL: Research, Estimates), Gates's dreams may be coming true, and the cable industry as we know it could be headed for a serious shake-up. Investors in Gemstar-TV Guide and Scientific-Atlanta (SFA: Research, Estimates) should follow these developments very closely, because the two companies are sitting squarely in Microsoft's (MSFT: Research, Estimates) crosshairs.

Here's what's up: Both Comcast and AOL Time Warner (the top two players in the cable industry, based on number of customers) announced plans to test Microsoft's new interactive program guide (IPG) and back-end Foundation Edition software.

The IPG uses Microsoft technology to give consumers a faster-loading guide to the hundreds of digital cable channels now available, and the Foundation Edition software gives cable operators the ability to offer rich-media promotions for upcoming movies and video-on-demand fare.

The announcements come after a turbulent year for Microsoft's TV division -- a year that saw layoffs, realignments, and, most important, a fundamental strategy shift. "These trials are the fruits of the TV division's strategic shift that began a year ago," says Greg Ireland, an analyst with IDC.

A year ago, Microsoft surveyed its paucity of cable contracts and revamped its television strategy, promoting veteran Moshe Lichtman to run the division. Lichtman shifted the focus from pushing technology and porting the Internet experience to designing products around what the cable operators wanted -- and were willing to pay for.

What they wanted was a startlingly simple solution (from a technological standpoint), but one that could give them flexibility with future products. Both Microsoft products fit the bill.

Even though Comcast and AOL Time Warner (corporate parent of CNN/Money) announced trials as opposed to full-fledged rollouts, the Microsoft encroachment is sending shock waves through the industry.

Currently, Gemstar's interactive program guide sits on approximately 95 percent of Motorola's (MOT: Research, Estimates) set-top boxes, which occupy 57 percent of the total digital cable market, according to IDC. Comcast and AOL Time Warner both use Motorola boxes and Gemstar software.

| Recently in Tech Biz

|

|

|

|

|

Scientific-Atlanta also manufactures boxes and offers a program guide. Gemstar and Scientific-Atlanta are down nearly 10 and 5 percent, respectively, since Monday's announcements. Representatives from either company could not be reached by press time.

Are the trial announcements death knells for the Gemstars and Scientific-Atlantas of the world? Hardly. But Microsoft has been trying to enter the cable market for six years, ever since Gates's $1 billion investment in Comcast in 1997. (Nice one, Bill!)

While these test runs are a long way from national rollouts, they do represent a significant first-step victory for Microsoft and a potential problem for entrenched tech players in the cable market.

Sign up to receive the Tech Biz column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|