NEW YORK (CNN/Money) -

U.S. stock markets closed mostly higher Wednesday, recovering from a choppy morning as investors focused on the positives in Fed Chairman Alan Greenspan's testimony before Congress, not to mention some upbeat earnings.

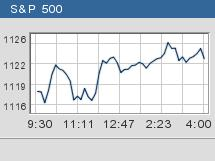

The Nasdaq composite (up 17.00 to 1995.63, Charts) added nearly 0.9 percent, the Standard & Poor's 500 (up 5.94 to 1124.09, Charts) index gained more than 0.5 percent and the Dow Jones industrial average (up 2.77 to 10317.27, Charts) closed just above unchanged. All three indexes had traded on both sides of unchanged throughout the morning.

Stocks were choppy in the morning as positive quarterly earnings, including reports from Ford and Motorola, were overshadowed by worries about the economy and short-term interest rates.

This tug-of-war has been in play for several weeks but was exacerbated Tuesday and Wednesday, as the Federal Reserve Chairman spoke before Congress.

By the early afternoon, selling dwindled and the market managed to recover, thanks largely to gains in technology and telecom.

"Greenspan had something for everybody, as he usually does," said Robert Philips, president ant chief investment officer at Walnut Asset Management. "It depends on your frame of reference in terms of how you interpret it. I think his comments were pretty benign."

The Nasdaq's gains on the session are likely related to a bounce after a few days of selling, and to the impact of Motorola on technology and telecom, Philips added.

Motorola (MOT: up $3.08 to $19.30, Research, Estimates) posted a higher-than-expected quarterly profit late Tuesday and forecast higher second-quarter results, as it boosted its share of the global handset market. Shares of Motorola surged 19 percent during the session, topping the New York Stock Exchange's most-actives list.

After the close, online auctioneer eBay (EBAY: Research, Estimates) reported earnings and sales that rose from a year earlier and topped expectations.

Reports are due before the start of trade Thursday from AT&T (T: Research, Estimates), BellSouth (BLS: Research, Estimates), Caterpillar (CAT: Research, Estimates), Merck (MRK: Research, Estimates), Nextel (NXTL: Research, Estimates), UPS (UPS: Research, Estimates) and Viacom (VIA.B: Research, Estimates). (For a look at the week's biggest earnings and why they matter, click here.)

Thursday also brings economic news that speaks to the inflation/interest rate debate. The much-delayed March producer price index (PPI) is due before the start of trade. The PPI is expected to have risen 0.3 percent in March after climbing 0.1 percent in February. The core PPI, which excludes volatile food and energy prices, is thought to have risen 0.1 percent, as it did in February.

The weekly jobless claims report is also due Thursday. It's expected to show that 340,000 Americans filed new claims for unemployment last week, down from 360,000 the previous week.

Interest rate debate

Among his comments Tuesday morning before the Senate Banking Committee, Greenspan said that deflation was dead and that corporate pricing power is returning. Investors took this as a sign that rates are set to rise soon, and stocks tanked.

In Wednesday's comments before the Joint Economic Committee, Greenspan reaffirmed that rates will have to rise at some point as the economy picks up but didn't offer a specific timeline. The Fed chief also said the protracted period of low interest rates hasn't created an environment in which broad-based inflation pressure is building.

Wednesday's testimony seemed to soothe the skittish market.

The Fed's Beige Book, released at 2 p.m. ET, offered a similar message.

"You can interpret it a bunch of ways, but all I know, and all that the market seems to know, is that short-term rates are going to rise, and they're going to rise really soon," said Tim Heekin, head of stock trading at Thomas Weisel Partners.

Market participants are worried that if the Fed raises rates too soon, it will choke off the still-developing economic recovery, which will hurt corporate profits and stock prices. However, economists say the Federal Reserve won't raise rates until there are several months of strong labor and other economic data.

"The stock market initially got pretty spooked by the strong March payrolls number," Philips added. "At that time, the futures market was signaling no rate hike until November. Now, it's signaling August."

Corporate earnings continued to provide a solid foundation for the stock market ahead.

Stocks on the move

On the Nasdaq, a variety of big cap tech stocks edged up, providing support, including Cisco Systems (CSCO: up $0.26 to $22.37, Research, Estimates) and Intel (INTC: up $0.20 to $26.27, Research, Estimates). The stock moved in part because of the strong response to telecom Motorola.

Ford Motor (F: up $1.38 to $14.94, Research, Estimates) reported earnings per share in the quarter that more than doubled from a year earlier and topped estimates. The company also boosted its outlook for full-year earnings and as a result the stock jumped 10.2 percent. Rival General Motors (GM: up $0.50 to $48.27, Research, Estimates) posted strong results Tuesday.

However, Motorola and Ford were exceptions. Earnings in the first-quarter have been very strong, but so far, that hasn't really translated to stock gains.

A number of Dow companies that released earnings in the morning saw little reaction.

United Technologies (UTX: down $2.46 to $85.02, Research, Estimates) fell 2.8 percent after the company reported higher-than-expected earnings that rose from a year earlier.

JP Morgan (JPM: down $0.86 to $37.68, Research, Estimates) lost 2.2 percent after it reported earnings that rose from a year earlier and topped estimates.

Coca-Cola (KO: down $0.15 to $52.13, Research, Estimates) edged lower after the Dow component reported results that rose from a year earlier and topped estimates. However, the company is still searching for a new CEO, and its annual shareholders meeting later Wednesday is likely to be contentious, analysts said.

Alcoa (AA: down $1.34 to $31.74, Research, Estimates) and other metals declined as the U.S. dollar rose, with a stronger greenback making the dollar-traded commodity more expensive. The Dow stock lost 4 percent.

Market breadth was mixed. On the New York Stock Exchange, gainers beat losers by eleven to four as 1.72 billion shares traded. On the Nasdaq, advancers edged decliners by a narrow margin, as 2.09 billion shares changed hands.

Treasury prices gained, with the 10-year note adding 1/4 of a point in price, pushing its yield down to 4.42 percent from 4.45 percent late Tuesday. The dollar fell versus the yen and gained versus the euro.

Among commodities markets, NYMEX light sweet crude oil futures fell 77 cents to settle at $35.73 a barrel. COMEX gold fell $6.90 to settle at $391.40 an ounce.

|