NEW YORK (CNN/Money) -

The more Wall Street is learning about Google's quirky IPO, the less attractive the shares are starting to look.

For example, should Google really be worth $36.2 billion? Well, if the search engine giant, which unveiled pricing details and its ticker symbol (GOOG) Monday morning, begins trading at the upper end of its range, then that would be its market value.

That's comparable to Yahoo!, which currently has a market capitalization of about $37.8 billion.

But there are growing doubts about just how strong the company's eagerly anticipated debut will be.

For one, Google is only offering a small number of shares to the public, about 24.6 million of its expected 268.5 million shares outstanding. Yahoo! (YHOO: Research, Estimates), by way of comparison, has a float of nearly 1.2 billion shares.

And because Google will be relatively thinly traded, the expected price for its stock is abnormally high for any stock, let alone an IPO, with an anticipated range of $108 to $135 a share.

The company is selling shares in a Dutch auction. So that process will ultimately determine the stock's offering price. Google has maintained that the Dutch auction process will be a fairer way for the average investor to partake in the IPO.

Yet, a triple digit stock price may lead to some sticker shock for investors considering a purchase.

| †All data as of 7/23/04 * For Berkshire Hathaway Class A shares. Class B shares also trade above $100, at $2940.95 | | †Source:††Thomson/Baseline |

|

"Here's the reality for John or Jane Q. Public. If the stock prices at $125 and I want to buy 100 shares, I've got to write a check for $12,500," said David Menlow, president of IPOfinancial.com, a research firm. "There's going to be a psychological disconnect for the average investor."

But Kevin Calabrese, an analyst with Argus Research, said he thinks Google is intentionally trying to price out smaller investors who might have only been interested in the company because of the lure of a huge one-day gain, similar to the dot-com IPOs of the mid-to-late 1990's.

"They don't want speculators hoping for a pop and because of this range, there probably won't be a pop. If there is one, it would be small and fleeting," said Calabrese.

In addition, there aren't too many stocks trading for more than $100. Often, companies will split their stock when the price approaches this level in order to make it more attractive to the retail investor. But Google might not be so quick to do so.

| Related stories

|

|

|

|

|

The company's co-founders Larry Page and Sergei Brin quoted legendary investor Warren Buffett at length in Google's prospectus. And Buffett is not a proponent of stock splits. His investment company Berkshire Hathaway (BRK.A: Research, Estimates) has never split. Class A shares trade for about $87,600 a share.

"I wouldn't expect a split anytime soon. The founders have said they are not managing this company for Wall Street or on a short-term, quarter to quarter basis," said Calabrese.

Now if that's enough to make the average investor a little wary, consider this. Google, based on the middle of the projected price range and a conservative earnings target for 2004, would be trading at a sizable premium to Yahoo!

Timing isn't great

Google earned $143 million, or 54 cents a diluted share, in the first half of 2004. Double that and you wind up with an earnings projection of $1.08 a share. Using the $121.50 midpoint of Google's price range, you wind up with a P/E of 112.5.

Yahoo!, with a stock price of about $28 and consensus earnings estimates of 33 cents a share, trades at a P/E of 84.

Sure, Google is a juggernaut. According to Monday's filing, Google reported revenues of $700.2 million, up 125 percent from a year ago and 7.5 percent sequentially. And profits were $79.1 million, up 145 percent from last year and 23.6 percent sequentially.

Google's year-over-year increases are slightly higher than Yahoo!'s second quarter revenue increase of 90 percent and profit increase of 122 percent from a year ago. Sequentially, Yahoo!'s sales and earnings rose 11 percent and 12 percent.

But is a nearly 35 percent premium to Yahoo! warranted, especially since Yahoo! is a more diversified company?

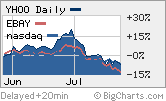

Plus, there's the fact that investors have seemed to have lost their appetite for expensive technology stocks lately, despite strong earnings. Yahoo!, after all, may be cheaper than Google, but it's not exactly a bargain.

Add all that up and it's another reason why Google might not get that receptive of a welcome on Wall Street.

"There's not as much unbridled excitement about the offering now. A lot of technology and Internet stocks don't look nearly as appealing as they did in April, May or June," said Scott Kessler, an equity analyst with Standard & Poor's.

Google said in Monday's filing that it hopes to begin trading in August. That would be a tad odd as well since August is typically one of the slowest months for the market. Few IPOs tend to debut that month as bankers usually prefer to wait until after Labor Day to price deals.

Nonetheless, Google prides itself on being different.

"The timing is probably not optimal but I really don't know if the company cares. Interest is such that they're going to get it done, no matter when they do it," said Calabrese.

But the question now is will the market care? Despite strong results, the convoluted manner in which Google is going public appears to be alienating investors.

"If you have something this high priced and institutions walk away from it, then who's there supporting this?" asks Menlow. "This is the stock we hate to love. We really like what's going on with Google. The only problem is the process it's using to go public."

Analysts quoted in this story do not own shares of Yahoo! and their firms have no banking relationships with either Yahoo! or Google.

CNN/Money has a business relationship with Overture Services, a subsidiary of Yahoo!

|