NEW YORK (CNN/Money) -

Are cable stocks finally ready for a comeback?

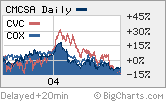

Shares of the three big Cs of cable -- Comcast, Cox Communications and Cablevision (CVC: Research, Estimates) -- have fallen nearly 20 percent this year, on average.

The Baby Bells, which are seen as having become tougher competitors to cable, have fared much better: Verizon Communications (VZ: Research, Estimates) is up 4 percent for the year while BellSouth (BLS: Research, Estimates) and SBC Communications (SBC: Research, Estimates) are down just 5 percent.

And over the past month, which has been brutal for the overall market, the Bells are up an average of nearly 5 percent.

But investors in cable may be overreacting to the threat from telecom, particularly when it comes to high-speed Internet access.

The Bells had been gaining market share in broadband thanks to price cuts in their digital subscriber line (DSL) services.

But according to Richard Greenfield, an analyst with Fulcrum Global Partners, the three big Bells reported a 25 percent decline in net DSL subscriber additions from the first quarter to the second quarter. Industry declines in broadband subscriptions are expected because of seasonal factors. But Greenfield is predicting a smaller percentage decline -- 15 percent -- for Comcast, Cox and Time Warner (TWX: Research, Estimates), which, in addition to being the parent of CNN/Money, is the owner of the nation's second largest cable firm.

Those three companies will report their second quarter results this week.

|

|

| Big cable stocks have slumped this year. |

If Greenfield's forecast is correct, that would be good news for the cable companies' profit margins, since they haven't slashed prices to compete with DSL.

"Clearly if cable is regaining market share without cutting prices, that is a positive," said Greenfield.

David Mantell, an analyst with Loop Capital Markets, said he expects Cox (COX: Research, Estimates) and Comcast (CMCSA: Research, Estimates) to both reaffirm their full year broadband subscriber targets for the year when they report results on Wednesday and Thursday.

And that might be enough to finally convince cable investors that the stocks are worth buying again, he said. "If cable companies have a good quarter on the broadband front, that could be a boost to the stocks," said Mantell.

Too cheap to pass up?

There are some other factors keeping a lid on cable companies lately. In addition to the threat from telecoms, investors seem to be concerned about competition from satellite TV firms EchoStar (DISH: Research, Estimates) and DIRECTV (DTV: Research, Estimates) in the cable companies' core business of video services.

| Recently in Tech Biz

|

|

|

|

|

There is also the likely prospect of a bidding war for bankrupt Adelphia Communications, which could hurt the balance sheets of the cable firms. Among the companies said to be interested in Adelphia are Comcast, Cox and Time Warner.

But the valuations of the major cable stocks appear to more than factor in any significant weakening of cable fundamentals.

Cablevision for example, is trading at just 5 times cash flow estimates for 2004 while Cox and Comcast are valued at about 8 and 10 times 2004 cash flow estimates, respectively.

(Analysts tend to look at cash flow, as opposed to net income, as a key metric for cable companies since it adds back big non-cash charges, such as amortization and depreciation, to earnings.)

These multiples are way too low, said Rob Sanderson, an analyst with American Technology Partners, considering that he expects annual cash flow gains in the high teens for the next few years.

Sanderson said he's not sure if the stocks will rebound immediately, given how weak the overall market is, but thinks that they are compelling long-term values.

"At some point, the growth in cash flows is going to drive these stocks higher," said Sanderson. "I don't think there's another big leg down. These are pretty good stocks."

Analysts quoted in this story do not owns shares of the companies mentioned and their firms have no investment banking relationships with the companies.

The reporter of this column owns shares of Time Warner through his company's 401(k) plan.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|