NEW YORK (CNN/Money) -

Let's bust out the old crystal ball and take a look into the future, shall we? It's late summer...2008.

There is much mudslinging and little discussion of important issues during the presidential campaign. Michael Phelps has just broken Mark Spitz' gold medal record in Beijing. Moviegoers are eagerly awaiting the release of "Harry Potter and the Half Blood Prince."

And Oracle is still trying to take over PeopleSoft.

Is that last one a little farfetched? Maybe. But Oracle CEO Larry Ellison, it seems, just doesn't know when to quit.

Here's a quick review of the seemingly never-ending Oracle-PeopleSoft takeover melodrama.

Oracle launched a hostile takeover attempt for PeopleSoft in June of 2003. PeopleSoft rejected that bid and three subsequent offers. The Department of Justice sued to block the takeover on antitrust grounds.

A trial took place earlier this summer in San Francisco and closing arguments were heard at the end of July.

A decision is expected before the end of September. But some on Wall Street have started to speculate that U.S. district judge Vaughn Walker may rule in favor of Oracle.

Even if Walker does, however, that still doesn't make Oracle's chances of winning PeopleSoft's hand in corporate marriage any more likely.

Fifteen months of value destruction

Oracle probably would need to get approval from the European Union, which is no slam-dunk since the EU has shown that it won't necessarily approve a merger just because the United States has done so.

Ellison and company would also have to either convince PeopleSoft to agree to a friendly deal or succeed in getting the company's so-called poison pill takeover defenses revoked to make it easier for Oracle to gain control of PeopleSoft's board. That could drag out this saga even longer.

That's not good news for shareholders. It has been nearly 15 months since Oracle announced its initial bid for PeopleSoft, and shareholders are the clear losers.

|

|

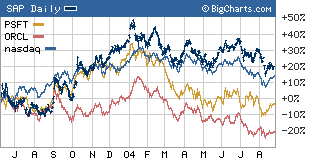

| Oracle and PeopleSoft have lagged top rival SAP -- and the Nasdaq -- during their nearly 15-month long takeover battle. |

Shares of Oracle (ORCL: Research, Estimates) have plunged nearly 25 percent since launching the takeover and are hovering just 6 percent above their 52-week low.

PeopleSoft's (PSFT: Research, Estimates) stock is now trading lower than where it closed the day Oracle announced the deal.

Meanwhile, German enterprise software industry leader SAP (SAP: Research, Estimates) and its shareholders are the major beneficiaries of the chaos. The company has been able to pitch itself to customers as a model of stability and SAP's stock has shot up about 27 percent.

Trip Chowdhry, an analyst with FTN Midwest Research, said that the takeover battle has left Oracle customers are "disenchanted and confused". He adds that even if Oracle pulls off a miracle and eventually acquires PeopleSoft, he doubts that the company would be able to pull off a successful integration of the merger because of all the damage done.

So what should Oracle do to get back in the good graces of investors? I've said it before and I'll say it again. Walk away from PeopleSoft.

Other fish in the software sea

Oracle has disclosed during the trial that it has compiled a list of other takeover candidates, including Siebel Systems, BEA Systems and Lawson Software. So how about going after one of them? But how about a friendly offer this time...just a thought Larry.

| �* data as of 8/25/04 | | �Sources: Oracle, Thomson/Baseline�� |

|

After all, it does make sense for Ellison to do his best Monty Hall impersonation and make a deal. The company's database software business, while thriving, is starting to mature.

In order to sex up its growth prospects, Oracle has tried to compete with SAP and PeopleSoft in the lucrative application business -- selling software that helps automate routine corporate functions like supply chain, human resources and customer relations management.

But this business has not been growing rapidly enough to satisfy Wall Street. Hence, Oracle's attempt to acquire PeopleSoft in order to remove a competitor.

| Recently in Tech Biz

|

|

|

|

|

"Oracle's application business continues to be its Achilles heel, rather than the "silver bullet" growth driver some investors had hoped for. In our opinion, this is just another telling sign that Oracle must look at acquisitions to find its next growth driver," wrote David Hilal, an analyst with Friedman Billings Ramsey in a recent report.

Oracle will be announcing its latest quarterly results sometime in mid-September. (Its fiscal first quarter ends in August.) Earlier this month, chairman Jeff Henley reaffirmed analysts' consensus estimates of 9 cents a share and sales of about $2.2 billion.

But these targets are not much to get excited about since it would represent a year-over-year sales increase of just 8 percent and profit increase of 12.5 percent. SAP, by way of comparison, is expected to post a sales jump of 13 percent and earnings gain of 21 percent in its third quarter, which ends in September.

So if Oracle really wants to wow Wall Street next month, it should tell investors that in order to become a tougher competitor to SAP, it's finally decided to stop wasting time on PeopleSoft and is starting to look elsewhere for acquisition opportunities.

Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties to the companies.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|