NEW YORK (CNN/Money) -

Can tech stocks take off on one of those magical year-end rallies like the ones enjoyed in 1998, 1999 and for the past three years?

The answer may depend on Friday's crucial August employment report.

The biggest concern facing tech companies is the health of the overall economy. The less than inspiring job growth figures for June and July has created fears that the economy is running out of steam.

A stronger than expected overall employment number on Friday -- the consensus forecast among economists is for an addition of 150,000 jobs -- could go a long way toward reassuring investors that both corporate and consumer spending on tech is not going to take a precipitous dive.

Simply put, unless corporations begin to hire more workers they will probably not see an urgent need to spend a lot more on new laptops, servers, networking equipment and software upgrades.

And with the holiday shopping season rapidly approaching, it's hard to imagine that consumers would be willing to plunk down big bucks for flat-screen televisions, digital cameras and MP3 players if the job picture doesn't brighten.

Job concerns taking toll on profit forecasts

As such, analysts' earnings estimates for the tech sector, which had been rising for most of the year, have started to come down.

| Recently in Tech Biz

|

|

|

|

|

The consensus estimated growth rate for the third quarter is 34 percent from a year ago. That's strong, but analysts were expecting earnings growth of 35 percent at the beginning of August and 38 percent at the beginning of July, according to Thomson/First Call.

Fourth quarter earnings growth projections have been lowered as well. Analysts now expect growth of 19 percent for techs, compared to a forecast of 23 percent in July.

Fortunately, there have been some encouraging signs. Monster Worldwide reported Thursday that its employment index, which measures online job demand, rose in August after dipping in July.

|

|

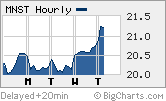

| Monster Worldwide investors seem to be banking on a strong August employment report. |

And investors in companies that depend on a healthy job market appear to be betting on a favorable employment number. Shares of Monster (MNST: Research, Estimates) were up more than 3 percent Thursday, adding to gains from earlier in the week.

Staffing firm stocks Manpower (MAN: Research, Estimates), Administaff (ASF: Research, Estimates) and Spherion (SFN: Research, Estimates) have also gained ground this week, as have shares of payroll processing companies Automatic Data Processing (ADP: Research, Estimates) and Paychex (PAYX: Research, Estimates).

Still, prominent tech executives Cisco Systems CEO John Chambers and Hewlett-Packard chairman and CEO Carly Fiorina both indicated last month that the recent economic softness has their corporate customers wary. Microsoft CFO John Connors said in July that he expected consumer spending on tech to probably slow down a bit.

And this cautiousness is reflected in the job growth numbers for the tech sector itself.

According to the Bureau of Labor Statistics, only 6,600 new jobs were added in the computer and electronic products sector, which includes the PC, semiconductor and communications equipment industries, in July. That came on the heels of flat job growth in June.

What's more, the following high tech industries all reported declines in new jobs in July: telecommunications, Internet publishing and the Internet search and data processing industries.

So in addition to the overall employment growth number, investors should also take a close look at how many jobs are being added in the tech and telecom sector. A pickup in hiring here would be a promising development since it could indicate that tech companies are bracing for higher demand and are staffing up accordingly.

But without firm evidence of a stronger job recovery, tech stocks will likely remain under pressure.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|