NEW YORK (CNN/Money) -

Intel's sales warning last week put another dent in the already fragile psyche of tech investors.

Now Wall Street is waiting on word from another chip leader, Texas Instruments, which is giving its mid-quarter update for the third quarter after the bell Wednesday.

Considering the relentless wave of negative news about tech stocks, the challenge for investors is to find stocks that have been unduly punished instead of lumping all techs together.

Texas Instruments might fill the bill.

TI, the largest manufacturer of digital signal processors (DSPs) used in cell phones, said in July that it expected sales for the third quarter to come in at a range of $3.2 billion to $3.44 billion and that earnings would be between 26 cents and 29 cents a share. Wall Street's consensus estimates call for sales of $3.32 billion and earnings of 27 cents a share.

Sure, the likelihood of TI boosting this guidance now seems small in the wake of Intel's warning Thursday. As such, TI's stock fell 4.8 percent Friday and was down another 1.8 percent Tuesday.

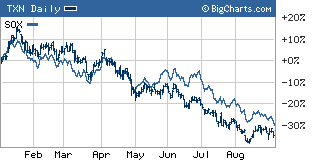

For the year, shares of TI have plunged 36 percent on fears that the company's growth will begin to dramatically slow heading into 2005.

Wall Street preparing for the worst

But there is a good chance that TI's outlook won't be nearly as dismal as everyone fears. TI, unlike Intel, did not appear to set the bar too high in July. The midpoint of its revenue guidance implies just a 2.4 percent sequential increase in sales.

Intel had predicted a more than 10 percent gain.

So if TI either reiterates its targets or just reduces them slightly, that could be a positive for a market that is bracing for extremely bad news.

|

|

| Shares of Texas Instruments have done even worse than the rest of the chip sector this year. |

"There's so much doom and gloom in semiconductors, any little prayer of hope will be well-received," said Greg Gorbatenko, an analyst with Marquis Investment Research.

Gorbatenko said that expectations for the third quarter have come down so drastically that investors are now probably less interested in the actual third quarter forecast and will instead be looking for more clues about how sales could be in the fourth quarter, particularly for wireless.

Along those lines, he is confident that Nokia, TI's biggest customer, is slowly turning things around. Nokia appears to have stemmed market share losses and there are hopes that its new cell phone models will sell briskly in the fourth quarter.

That would be good for TI. Even though cell phone sales have been robust this year, TI has suffered because industry leader Nokia has lost ground to rivals such as Motorola and Samsung.

Not all chips due for a bigger dip

William Conroy, an analyst with Sanders Morris Harris, said that TI has a better chance of escaping some of the inventory problems plaguing Intel since it has a broader customer mix.

| Recently in Tech Biz

|

|

|

|

|

Intel aggressively built-up inventories during the first two quarters of this year with the expectation of strong personal computer sales and it appears that Intel overestimated the demand for PCs. TI is not nearly as dependent on the PC market as Intel.

In addition to wireless, it has exposure to several industrial markets and the consumer electronics business. Specifically, Conroy said sales of TI's digital light processors (DLPs) used in high-definition television sets appear to be holding up well.

And in another encouraging sign for TI, Motorola chip spin-off Freescale Semiconductor said Tuesday that its third quarter sales should roughly meet analysts' expectations.

Freescale is probably a better comparison for TI than Intel because Freescale also has more exposure to the industrial, wireless and consumer markets, as opposed to PCs.

With all this in mind, Conroy said he sees little downside for the stock as long as earnings estimates don't get significantly reduced further. Analysts expect TI to report a profit of $1.26 a share in 2005, down from estimates of $1.39 a share two months ago.

The stock is trading at about 15 times 2005 earnings estimates but analysts still expect earnings to increase 26 percent next year.

So is TI going to save tech with its mid-quarter update? Probably not. Intel's warning does paint a bleak near-term picture for PC demand and that clearly won't help a large number of chip, hardware and software companies. (For more, see "Techs go down with the chip".)

But as long as TI doesn't give Wall Street a reason to slash 2005 estimates, then its stock, as well as those of other wireless chip companies like RF Micro Devices, Skyworks Solutions and Triquint Semiconductor, could all be due for a bounce.

Sanders Morris Harris' Conroy owns shares of TI but his firm has no banking ties with the company. Gorbatenko does not own the stock and Marquis Investment Research has no investment banking relationships with the company.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|