NEW YORK (CNN/Money) -

Google's stock has done extremely well since its hotly anticipated initial public offering last month. But where Google goes from here is a source of intense debate.

Shares are up more than 40 percent from their offering price and nearly 20 percent from their first day closing price.

And momentum could continue, with Tuesday marking the 40th day since the IPO. That means that big underwriters, including Morgan Stanley, Credit Suisse First Boston and Goldman Sachs, will be free to launch coverage on Google.

To that end, CSFB, JP Morgan, WR Hambrecht and Thomas Weisel all put out reports on Google Tuesday morning with the equivalent of a "buy" rating. CSFB slapped a $145 target price on the stock, more than 23 percent higher than its current price.

Several banks that were not underwriters had already initiated coverage.

Typically, brokerages bestow favorable ratings on companies they helped bring public. "People are trading Google stock on the expectation of bullish reports coming out Tuesday -- it's not an illogical trade to make," said Mark Mahaney, an analyst with American Technology Research.

But Google's veil of secrecy is irritating some investors. Last week, for example, Google would not comment on reports that it was thinking of launching a Web browser to rival Microsoft's Internet Explorer. On Monday, however, a Google spokesman did weigh in, saying that Google was not planning to "reinvent the wheel" when it comes to browsing technology.

The spokesman also said Monday afternoon that the company will report its third-quarter earnings on Oct. 21 -- the quarter ends on Thursday. But none of the analysts CNN/Money spoke to Monday morning were aware of this date. Google also has yet to set up an investor relations section on its Web site. The spokesman said it is currently being developed.

"They're not telling anybody anything," said David Garrity, an analyst with Caris & Co. "They are certainly playing their cards close to the vest."

Strong earnings already priced in?

Now Google has a lot going for it. Hopes are high that the third and fourth quarters will be incredibly strong ones for Google since the search-based advertising market remains robust.

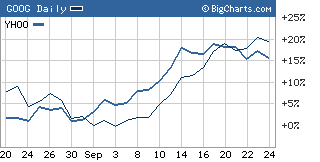

As such, shares of Yahoo! have also surged since Google's IPO after hitting a rough patch in the summer.

|

|

| Google's stock has soared since going public in August...and so have shares of its top rival Yahoo! |

"We do get a sense that search advertising has picked up since mid-August and that this recovery will continue in the fall and the fourth quarter," said Marianne Wolk, an analyst with Susquehanna Financial Group.

But how much of that is already priced into Google's stock? Shares trade at 52 times earnings estimates for 2005. While that is a discount to Yahoo!'s P/E of 68.5 times next year's profit projections, that still doesn't make Google cheap.

The valuation is even tougher to swallow, said Steve Weinstein, an analyst with Pacific Crest Securities, because of the lack of visibility.

| More about Google

|

|

|

|

|

"We shouldn't have to be speculating about what they are going to do with their IPO money," said Weinstein. "I would wait for more visibility before buying at these levels."

However, Garrity said he is not concerned about the persistent air of mystery shrouding Google -- and investors shouldn't be either.

"Management has a track record of taking this company from zero to a billion in revenues in a few years. So people at first blush should be inclined to give them the benefit of the doubt," said Garrity.

Short sellers are skeptical

Nonetheless, it's also worth noting that short sellers, who bet that a stock is going to fall in the near-term, have shown an intense interest in Google.

According to figures released by the Nasdaq on Monday, 4.1 million of Google's shares were being held short as of mid-September. That amounts to more than 21 percent of the stock's available float.

"That's a fairly sizable number," said Mahaney. "It's conceivable that some of the movement in the stock in September may have been some near-term short covering."

If that were the case, then some of Google's recent run would not really have been a reflection of optimism but simply a concession by shorts looking to close out their positions.

So investors will need to keep an eye on short interest figures for the next few months to see if bears keep betting against Google.

And Garrity, who says he likes the stock as a long-term investment, admits that investors will need to be wary in the short-run because nearly 40 million shares of Google stock will be eligible for sale in mid-November once the next phase of the company's lock-up period for insiders expires.

"Investors need to be mindful of the fact that while Google's a dynamic company, it may offer a very bumpy ride," he said.

Analysts mentioned in this story do not own shares of Google and their firms have no investment banking relationship with the company.

CNN and CNN/Money have business relationships with Overture Services, a subsidiary of Yahoo!

Time Warner, the parent company of CNN/Money, owns a stake in Google.

|