NEW YORK (CNN/Money) -

Cue the cheesy Hank Williams Jr. "Monday Night Football" theme music:

Dah dah dah-dahhhhhhhhh! Are you ready for some earnings?

Intel and Yahoo! will get the tech profit party started Tuesday when they report third quarter results. And what these two bellwethers say about the quarter and, more importantly, their outlook for the fourth quarter will have an enormous impact on the entire sector.

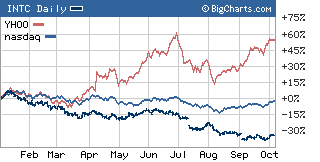

But expectations for the two companies couldn't be any different. And that's reflected in their stock performances this year.

Intel has plunged nearly 35 percent while Yahoo! has surged more than 55 percent.

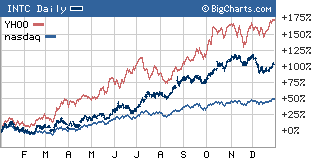

This is a stark contrast to last year when you didn't need to be a genius to pick winning tech stocks. Just about all the major ones went up thanks to optimism about the earnings outlook for 2004.

Now, however, investors are realizing that there is a need to be more discerning.

So here's what you should be keeping an eye on when Intel and Yahoo! report.

The chips are down

Semiconductor kingpin Intel (INTC: Research, Estimates) has stumbled this year on concerns that growth for chip companies may be starting to slow after a stellar first half of the year.

|

|

| 2003 was a banner year for Intel, Yahoo! and the tech sector at large... |

Intel didn't do itself (or other semiconductor firms) any favors by reducing its sales and gross margin targets for the third quarter last month. As a result, analysts are now predicting that Intel will post earnings of 27 cents per share for the quarter, compared to estimates of 31 cents a share just 3 months ago.

What's more, the consensus earnings estimate for 2005 is $1.18 a share, 18 percent lower than three months ago.

So what will Intel need to do to get people more excited about the chip sector again? For one, the company is going to have to prove that its inventory buildup during the past few quarters is not going to hurt its results going forward.

Wall Street has been worried that Intel may have to discount the price of some of its chips to clear inventory, or worse, take a write-down.

|

|

| ...but what a difference a year makes. Only Yahoo! has continued to head higher so far in 2004. |

But if Intel can show that it has its inventory issues under control, namely that demand for PCs, servers, cell phones and other devices that use its processors is picking up, then investors may breathe a sigh of relief.

So the key thing to look out for is the range that Intel gives for its fourth-quarter sales. Analysts are predicting revenues of $9.1 billion. If the mid-point of Intel's guidance is worse than that, look out below.

And since Intel is the top supplier of chips used in PCs, a weak outlook could have a ripple effect on many of Intel's top hardware customers like Dell (DELL: Research, Estimates), Hewlett-Packard (HPQ: Research, Estimates) and IBM (IBM: Research, Estimates) as well as many leading software companies since it could indicate that demand for tech gadgets is cooling.

Searching for a surprise

For Yahoo! (YHOO: Research, Estimates), the issue isn't whether business trends are heading south. It's whether the company can satisfy investors that are constantly craving better than expected results. The whisper number has returneth.

| Recently in Tech Biz

|

|

|

|

|

Back in July, Yahoo! reported earnings of 8 cents a share for the second quarter. And while that was 122 percent higher than the same period a year ago, it merely matched Wall Street's consensus estimate.

Investors proceeded to dump the stock for the next few weeks. Other big Internet companies like eBay (EBAY: Research, Estimates) and Amazon.com (AMZN: Research, Estimates) tumbled as well.

This bearishness didn't last for long though. Google went public in mid-August and that rejuvenated interest in Net stocks, particularly other search companies like Yahoo! So once again, the pressure will be on Yahoo! to beat estimates for the quarter.

Clearly, the business of selling search-based advertising is booming. But investors have to be wondering if increasing competition from Google (GOOG: Research, Estimates), now flush with IPO proceeds to spend, and Microsoft (MSFT: Research, Estimates), which recently unveiled a new and improved MSN search tool. could have a slightly negative impact on the entire sector.

That's not to say that Yahoo! is in danger of reporting "bad" results. The consensus estimates call for a 80 percent year-over-year jump in sales and earnings. But given the stock's surge and lofty multiple of 74.5 times 2005 earnings estimates, investors certainly want to see more than in-line numbers.

Wall Street is forecasting earnings per share of 9 cents a share on sales of $644.3 million. If Yahoo! simply meets these numbers, a repeat of July's sell-off is likely. And that could put a dent in the shares of many other richly valued tech stocks as well.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|