NEW YORK (CNN/Money) -

Intel reported third-quarter sales and earnings that were roughly in line with Wall Street's diminished expectations.

But shares rallied after-hours even though the company provided guidance for the fourth quarter that was slightly below analysts' estimates.

The stock has plunged more than 36 percent this year on concerns about rising inventories and slowing growth. Intel now trades just 3 percent above its 52-week low. So investors might have been breathing a sigh of relief that the company's outlook was not significantly worse.

"A lot of the negative news was baked in to the stock already," said Patrick Ho, an analyst with Moors & Cabot.

The Santa Clara, Calif.-based company reported net income of $1.9 billion, or 30 cents a share, up 15 percent from a profit of $1.7 billion, or 25 cents a share, a year earlier.

Analysts had been expecting Intel to post a profit of 27 cents a share according to Thomson/First Call. However, the company said that a lower than anticipated tax rate and reduced tax provision boosted earnings per share by 3.6 cents. Backing that out, Intel reported earnings of about 26 cents a share.

Intel's sales came in at $8.5 billion, 8 percent higher than a year ago and slightly higher than Wall Street's lowered expectations of $8.44 billion. Intel warned in September that its third-quarter sales would come in much lower than the $8.6 billion to $9.2 billion it had originally forecast in July.

Shares of Intel (Research) fell 33 cents, or 1.6 percent to $20.28 in regular trading on the Nasdaq Tuesday. But the stock rose more than 3 percent in aftermarket trading, according to INET.

Weakened demand

In a written statement, Intel said that weaker than anticipated demand for PCs and inventory adjustments by its customers hurt revenues, which rose just 5 percent from the second quarter. Typically, third-quarter revenues for Intel are about 8 percent to 9 percent higher than the second quarter due to strong PCs sales in the back-to-school shopping season.

|

|

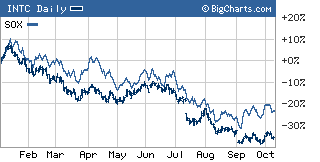

| It has been a rough year for Intel and other chip stocks. |

Intel said that sales for the fourth quarter would be between $8.6 billion and $9.2 billion. The $8.9 billion mid-point is lower than the $9.07 billion in revenues that analysts had been predicting.

It appears that investors were pleased that the news wasn't more gloomy. After all, the outlook for Intel had grown so pessimistic in recent weeks that it in some respects, it would have been very tough to disappoint.

Cody Acree, an analyst with Legg Mason, said that Wall Street was bracing for the fourth quarter sales outlook to be worse.

He said that the fact that analysts won't have to take their numbers down drastically for the fourth quarter is an indication that demand for PCs and servers may be picking up into the crucial holiday shopping season and year-end technology budget flush for large corporations.

"Given the difficulty Intel had just come through, some would have expected more cuts on the guidance. This has to be considered at least an endorsement that things improved in September. People are reading into the fourth quarter outlook and saying if this is conservative, it feels pretty good."

During a conference call with analysts, Intel chief operating officer and president Paul Otellini said that one of the reasons for this conservative guidance was due to sluggishness in U.S. consumer demand for desktop PCs. Otellini added, however, that shipments of chips used in mobile laptops and servers were strong.

| More about 3Q earnings

|

|

|

|

|

In addition, Wall Street was probably thrilled by the fact that Intel's inventories dipped about 1 percent from the end of the second quarter, to $3.18 billion. Tai Nguyen, an analyst with Susquehanna Financial Group, said that there was an expectation that inventories would rise again in the third quarter.

Intel had reported double-digit percentage sequential inventory increases in both the first and second quarters of this year, sparking fears of a possible glut of chips that the company would have to write-down or sell at a steep discount.

During the conference call, Intel chief financial officer Andy Bryant said that the company's inventories were still higher than he would like and that he hoped the company would reduce inventories by a greater amount in the fourth quarter than in the third quarter.

And although Intel's gross margins, which measures how profitable a company is after subtracting the cost of sales, did come in at a lower than projected 55.7 percent in the third quarter, partly due to increased inventory reserves, Nguyen said Wall Street was preparing for a lower gross margin number as well.

Nguyen added that Intel has done a good job though of keeping its expenses relatively low and that as long as it keeps doing that, then Wall Street may have reason to be a bit more excited about the company's prospects for the fourth quarter and 2005.

"I still think that inventory is high and we'll continue to see how they will monitor working that off. But Intel is trying to bring costs down. If end demand continues to hold up and inventory comes down, that will bode well for the company," Nguyen said.

Shares of several other beaten down semiconductor companies also rose after hours on the Intel earnings news, which could set the stage for a chip stock rally on Wednesday. Intel's top rival, Advanced Micro Devices (Research), shot up nearly 3 percent. Two other Intel competitors, Texas Instruments (Research) and Broadcom (Research), were each up nearly 2 percent.

And chip equipment firms Applied Materials (Research), Novellus Systems (Research), and KLA-Tencor (Research), which sell gear and tools to Intel, all gained more than 1 percent.

Analysts quoted in this story do not own shares of Intel and their firms do not have investment banking relationships with Intel.

|