NEW YORK (CNN/Money) -

Yahoo! said Tuesday that third-quarter earnings were up 74 percent, to $124 million, or 9 cents a share, on par with estimates. In addition, the company lifted its forecast for revenue in 2004.

The profits do not include a $129 million gain from Yahoo!'s sale of its shares in Google, Inc., which had its initial public offering this past quarter.

Yahoo!'s sales surged 84 percent to $655 million, up from $357 million a year ago. Revenue excludes traffic acquisition costs, or the money that Yahoo!'s Overture Services subsidiary shares with other Web sites in exchange for supplying them with paid search listings.

The revenue consensus was $644 million.

The sales increase was fueled by a 212 percent jump in revenues from the company's core advertising business, which includes the sponsored search market.

Yahoo! has been eager to show investors that, as more companies rush into the Internet ad business, the company continues to tap other growth opportunities.

Its two other major businesses also reported strong growth. Yahoo!'s fee businesses, which include premium e-mail and personal ads, posted a 31 percent rise, to $104 million.

Subscribers who pay for Yahoo!'s premium service grew by 1.2 million, to 7.6 million, up 80 percent from a year ago.

Sales in Yahoo!'s listing business, which consists primarily of its HotJobs employment site, were up 15 percent, to $37 million.

Yahoo! recently invested in a Web travel service and announced plans to buy online music provider Musicmatch for $160 million.

"I think that it was a very good quarter for Yahoo!," said Derek Brown, an analyst with Pacific Growth Equities in San Francisco. The only negatives, continued Brown, was the "somewhat sluggish" growth in Yahoo!'s listing and fee businesses. It just shows, he said, that Yahoo! "is going to be made or broken by the performance of the online advertising market."

Looking to a brighter future

The strong results prompted Yahoo! officials to raise their revenue outlook for the year. Revenue for the full year is expected to be between $2.52 billion and $2.57 billion, up from the $2.45 billion to $2.54 billion range that management set three months ago.

| More on Internet search

|

|

|

|

|

Chief financial officer Susan Decker also said the company should end the year with between 8.2 million and 8.3 million paying subscribers, up from an earlier projected range of 7.5 million to 8 million.

"We believe we are in a position of strength," CEO Terry Semel told analysts shortly after Yahoo! released earnings after trading ended Tuesday. Semel marveled at how Internet advertising, which just two years ago was a medium with a doubtful future, has since become an increasingly important component of corporate marketing.

Yahoo! strong quarter was helped in large part by signs that demand for online advertising has increased as the year has progressed.

Last month the Interactive Advertising Bureau and PricewaterhouseCoopers reported that Web advertising revenues in the third quarter of 2004 jumped nearly 43 percent, to $2.4 billion. Sales from search advertising -- in which marketers pay when user conducts a search and clicks on an ad customized to the search -- during the period shot up 97 percent, to $947 million.

Sponsored search ads now represent 40 percent of the Internet ad market, compared to 29 percent in the same period a year ago.

Semel said Yahoo! saw "good trends" both in the company's ad rates and sales volume.

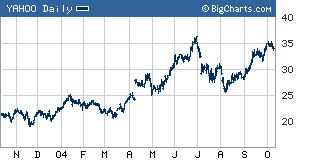

Shares of Yahoo! (Research) seesawed during regular trading on Nasdaq Tuesday, closing up less than one percent at $34.23.

What a difference a quarter makes

The stock was up nearly two percent in after-hours trading, a stark contrast to what happened three months ago when Yahoo! also met industry estimates. Primed for a report that would beat consensus estimates, investors dumped Yahoo! stock upon hearing the news.

That sent shares of other tech companies into a slump. Yahoo! did not recover until a month later, when Google's initial public offering helped to renew investor enthusiasm for Internet stocks.

Yahoo! shares are up about 20 percent since Google's Aug. 19 stock debut. The company continues to outperform by far the S&P 500 this year.

Brian Bolan, an analyst with Marquis Investment Research, said the tepid response to Tuesday's earnings announcement meant that investors no longer expect Yahoo! to exceed forecasts on a regular basis.

"I think everyone kind of understood that this time Yahoo! was definitely coming right in on their number," said Bolan. Yahoo! officials "stated back in May that they were trying to take a lot of volatility out of the stock. I expect that, going forward, this is what investors should be looking for -- for them to make the number and to beat will be a very big thing."

|