|

Retirement: Are you ready for 100?

Increased longevity is changing the rules of retirement -- make sure you don't get caught unaware.

NEW YORK (CNNMoney.com) - You've worked hard and steadily stashed away savings. But your retirement dream can turn into a nightmare if you end up outliving your nest egg. As life expectancy rates climb, people are living in retirement much longer than previous generations. And it's happening at a time when Social Security and pensions are becoming less secure.

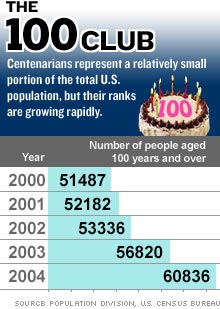

"More than any other single factor, increased life expectancy is changing the rules of retirement," said Brian Wayt, a certified financial planner based in Austin, Texas. Centenarians represent a relatively small portion of the total U.S. population, but they are a rapidly growing group. Membership in the 100 and up club has spiked 63 percent since 1990, according to Census figures. There are now 60,800 in the United States. According to Census estimates, the number of centenarians could exceed 1 million by 2030 and top 4 million by 2050. Factoring in longer life expectancy into retirement planning can be tricky though since no one knows their own particular life expectancy. "People have to make decisions with a lot of uncertainty, which can make it extremely difficult," said Alicia Munnell, director of the Center for Retirement Research at Boston College. Life expectancy has increased 30 years in the past century. Someone born in 1900 only would be expected to live 47 years, while someone born in 2002 is expected to reach the age of 77, according to the CDC's National Center for Health Statistics. (To calculate your life expectancy, click here.) Living longer in retirement can have a significant impact on your nest egg, according to estimates from Darlene Simard, a certified financial planner based in New Hampshire. If a couple wants an annual retirement income of $85,000 and intends to stop working at age 65, they'll need about $838,000 in savings in order to supplement their Social Security income for 20 years, assuming a 7 percent rate of return and 4 percent inflation rate. But if they end up living to 100, they'll need more than one-and-a-half times that amount -- a portfolio worth about $1.3 million -- in order to maintain the same lifestyle in retirement, she said. If Congress ends up reforming Social Security and reducing benefits, the couple would need to boost their portfolio even more. Working longer

Working longer is one of the most effective ways to secure your retirement, according to Munnell. Staying in the workforce increases your earnings as well as financial assets, increases your Social Security benefit and reduces the period over which you have to support yourself. "The financial gains from an additional year of work are really impressive," she said. There are already signs that more people are retiring later in life. According to surveys from the Association for the Advancement of Retired Persons, more than two-thirds of 50 to 70 year old workers say they plan to work into their retirement years or never retire at all. Spending less

If you aren't going to work longer, your rate of spending may need to slow down, said Jerry Cannizzaro, a retirement consultant. "You can't take out too much if you want the money to last. Don't cut your life short -- you will need this money, and you will need it long term," he said. Whereas just a few years ago it was typical for retirees to withdraw as much as 6 percent from their nest egg annually, experts agree 4 percent is now the norm. If you withdraw from your savings at a rate of 6 percent each year, or $60,000 from a $1 million portfolio, you'll run flat out of money in 12 years, Cannizzaro estimates, after taking taxes and inflation into account. Reducing your withdrawal rate to just 4 percent will help those savings stretch 30 years. Planning your dream retirement

If working longer and spending less during your retirement years don't appeal to you, you should craft a solid plan ahead of time, experts said. (For tips on planning the perfect retirement roadmap, click here.) As the first Baby Boomers turn 60 this year, more innovative products, such as reverse mortgages and income annuities, are showing up on the market. But these aren't for everyone, experts cautioned. (For more on income annuities, click here. To learn about reverse mortgages, click here.) "No product or service is going to replace good solid planning ahead of time," said Wayt. ---------------------

Click here for the best places to retire. |

| |||||||||||||||||||||||||||||||||||