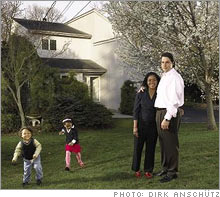

Crazy mortgage, exhibit A

John and Mona Ramonetti's rate on their option ARM adjusts monthly with a max of more than 12%.

NEW YORK (MONEY Magazine) - Patent litigator John Ramonetti isn't averse to taking risks. Two years ago, John, 38, and wife Mona, 36, sold their home in Montclair, N.J. and moved to Northport, Long Island, where they felt the schools were better (for kids Adrian, 3, and Emily Jasmine, 6) and they'd be closer to John's extended family.

The couple closed on a $700,000, four bedroom home in December 2004, financing it with 20 percent down and a loan that could best be described as Exhibit A in the gallery of crazy mortgages: a $560,000 monthly adjustable-rate option-payment loan. Not only does the rate move up or down 12 times a year, but the payment is flexible. The Ramonettis can choose a minimum that doesn't even cover the interest (currently $2,000), an interest-only payment or a sum that covers interest and principal based on a 15- or 30-year loan. Fortunately, John is averse to debt -- he picked this loan because of the low initial rate. "I hate paying interest and fees," he notes. So since taking out the loan, the couple have consistently paid $3,000 to $5,000 a month, enough to cover the 30- or 15-year interest and principal payment, and often more. "I'd really like to pay the loan off even sooner than 15 years," John says. But lately, chipping away at principal has become tougher. When the Ramonettis got the loan, the interest rate was 4.3 percent; now it's 6.2 percent, so a higher portion of each payment goes toward interest. The amount needed to cover interest and principal on a 30-year loan has grown from $2,771 to $3,452. If their rate ever hits its 12.3 percent max, it could cost them $5,785 a month to cover interest and principal. Recently, John took a look at the history of the index that determines their rate and noticed that in the late '80s and early '90s they would have paid double-digit rates. "I was a little frightened by what I saw," he says. "What is the risk and likelihood of those rates continuing to jump at the current pace? I'm still ahead with this loan. Should I wait and see if rates ease over the coming year or two, and get a better fixed rate at that point?" The solution: Refi with a fixed-rate loan; pay down the HELOC

Easy answer: Don't wait. The Ramonettis' mortgage rate is based on the monthly Treasury average index (MTA), which is currently 3.9 percent, plus 2.35 percentage points. Because the MTA tracks changes in short-term interest rates over the previous 12 months, the rate on their loan is guaranteed to rise by about a point in the year ahead. With rates on jumbo fixed-rate loans only half a point higher than their current 6.2 percent variable rate, they can lock in a payment ($3,549) for 30 years that's virtually the same as what they pay now -- security that's worth the few thousand dollars in closing costs. If the Ramonettis are willing to lose some flexibility in their budget, they can pay off their debt sooner with a 15-year loan, which comes with higher monthly payments but a slightly lower interest rate. Because the couple aren't planning to move soon, Los Angeles financial planner Jeffery Harwood suggests that they consider paying a point in fees to drop the rate even closer to 6 percent, giving them a fixed payment of $4,712 a month.

|

| |||||||||||||||