CBS: Cheap Broadcasting Stock

Shares of CBS have struggled since the company began trading as a separate company. But it might be the best bet in the media sector.

NEW YORK (CNNMoney.com) - CBS gets a bad rap. The company is perceived by investors as being stodgy. But it's actually one of the better values in the rapidly changing media business. And it's also had its fair share of good news to report during the past week.

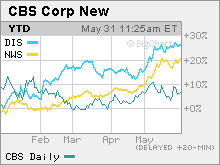

CBS finished in first place in the overall prime-time ratings race during the just-ended 2005-2006 season. That's the network's fourth consecutive ratings victory. Also last week, the company announced that it was selling its slow growth Paramount Parks business to theme park owner Cedar Fair (Research) for $1.24 billion. In addition, CBS (Research) raised its quarterly dividend by 12.5 percent and settled a breach of contract lawsuit it filed against Sirius Satellite Radio (Research) and its shock jock (and former CBS Radio employee) Howard Stern. And to top that all off, the company said it was exploring the sale of radio stations in ten of its smallest markets in order to boost the sluggish performance of its radio division. But none of this has mattered for CBS' stock. Shares have been relatively flat since the company began trading as a separate public company in January following its split from Viacom (Research). By way of comparison, other media companies such as Walt Disney (Research) and News Corp. (Research) are up more than 20 percent during the same time frame. Street ignores ratings success

It's about time that Wall Street gives CBS the respect it deserves. "I don't get it. I think CBS is very well positioned," said Susan Kalla, an analyst with Caris & Co. "The network is ranked number one and has a solid lineup for the fall." Kalla thinks some investors are concerned about a slow start to the so-called upfront buying season for advertising. All the major networks unveiled their programming line-ups earlier this month and now the networks and advertisers are negotiating rates for commercials. But many media experts have speculated the networks may report a decline in ad revenue from a year ago due to increased competition from the Internet as well as the effect of digital video recorders (DVRs). Many viewers use DVRs to fast forward through commercials. Still, Kalla thinks that broadcast television is far from obsolete and that CBS is in a better position than many of the other TV networks since it has a stable lineup of shows for the fall (it is only introducing four new ones.) With returning hits like "CSI," "Without a Trace" and "Survivor" averaging between 18 million and 25 million viewers a week, she said CBS is still an attractive way for companies to reach a large swath of consumers. "There are concerns that the Internet is taking away business. But at the end of the day if you're Toyota and you want to sell a truck you're going to do it on a national network like CBS," she said. CBS also gets knocked for having an older audience. Although the network won the overall ratings battle, it finished in third with viewers in the advertiser-coveted 18 to 49 year-old demographic. However, it's unfair to say that CBS isn't as "hip" as other networks. In fact, CBS has been as aggressive as other media companies in targeting younger viewers, particularly through the Web and other digital offerings. CBS is embracing the Web

The network's March Madness on Demand site, which aired video streams of games during the extremely popular men's NCAA college basketball tournament, was a huge success with viewers and advertisers. According to CBS SportsLine, the network's online sports news site, about 1.3 million people signed up and watched more than 19 million streams during the tournament. The offering, free to viewers, featured ads from well-known companies like Dell and Lowe's. CBS also recently unveiled Innertube, a broadband TV network with clips from current shows as well as original programming. This site is free and will be supported by advertising. "CBS has digital initiatives and they should have significant growth from a small base," said Andy Baker, an analyst with Cathay Financial. "It's important for old media companies to be perceived as being on both sides of the equation. It's important to have an Internet presence." And as long as CBS has shows that people actually care about, viewers will probably find them online. At CBS' upfront presentation two weeks ago, CEO Leslie Moonves stressed that people aren't going online or watching shows on cell phones or iPods just because it's cool to do so; they want the same quality they are used to on network television. "If viewers aren't watching the shows to begin with, people aren't going to download them," he said. "Wireless is useless if you're hitless. Believe me. A bad show won't look better on a two-inch screen." Outdoor strength and asset sales could juice results

Looking beyond the TV business, CBS has another strong asset as well: billboards. The outdoor advertising business has boomed during the past year and many analysts expect that to continue as billboard owners start to roll out digital billboards. In the first quarter, revenue from CBS' outdoor advertising segment increased 5 percent and operating income before depreciation and amortization (OIBDA) surged 43 percent. Cathay's Baker said that since the radio business is struggling - both revenue and OIBDA decreased in the first quarter - a sale of weaker stations is a plus. He added that it would not surprise him if CBS also sought to sell its Simon & Schuster publishing division as well. And this could all benefit shareholders. Baker said that between the sale of the parks business and possible sales of some radio assets and publishing, he thinks CBS could easily afford to double its dividend from current levels and repurchase shares as well. With all that in mind, both Baker and Kalla think the stock, trading at just 15 times 2006 earnings estimates, is a great value, especially since profits are expected to increase at about a 10 percent clip, on average, for the next few years. "The stock is really cheap and doesn't have a lot of downside. CBS is in the sweet spot," Kalla said. _____________________ TV networks ignore their TiVo problem. Click here. Is the worst over for the radio business? Click here. Radio is struggling but outdoor advertising is sizzling. Click here.

Analysts quoted in this story do not own shares of CBS and their firms have no investment banking ties with the company. |

| ||||||||||||||||||||||||