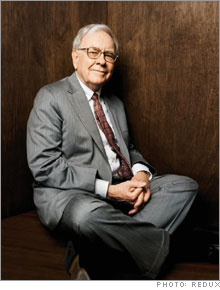

A conversation with Warren BuffettFORTUNE EXCLUSIVE: Editor-at-large Carol Loomis speaks with Buffett on why he sped up his plan to give away his money and why he chose the Bill & Melinda Gates Foundation.

NEW YORK (FORTUNE Magazine) -- Coming from you, this plan is pretty startling. Up to now you haven't been famous for giving away money. In fact, you've been roundly criticized now and then for not giving it away. So let's cut to the obvious question: Are you ill? No, absolutely not. I feel terrific, and when I had my last physical, in October, my doctor gave me a clean bill of health.

Then what's going on here? Does your change in plans have something to do with Susie's death? Yes, it does. Susie was two years younger than I, and women usually live longer than men. She and I always assumed that she would inherit my Berkshire stock and be the one who oversaw the distribution of our wealth to society, where both of us had always said it would go. And Susie would have enjoyed overseeing the process. She was a little afraid of it, in terms of scaling up. But she would have liked doing it, and would have been very good at it. And she would really have stepped on the gas. By that you mean that she always wanted to give away more money, faster, than you did? Yes, she said that many times. As for me, I always had the idea that philanthropy was important today, but would be equally important in one year, ten years, 20 years, and the future generally. And someone who was compounding money at a high rate, I thought, was the better party to be taking care of the philanthropy that was to be done 20 years out, while the people compounding at a lower rate should logically take care of the current philanthropy. But that theory also happened to fit what you wanted to do, right? (He laughs, hard.) And how! No question about that. I was having fun - and still am having fun - doing what I do. And for a while I also thought in terms of control of Berkshire. I had bought effective control of Berkshire in the early 1970s, using $15 million I got when I disbanded Buffett Partnership. And I had very little money - considerably less than $1 million - outside of Berkshire. My salary was $50,000 a year. So if I had engaged in significant philanthropy back then, I would have had to give away shares of Berkshire. I hadn't bought those to immediately give them away. Even so, you and Susie set up the Buffett Foundation way back in the 1960s, which means you obviously expected to be giving away money sometime. What was your thinking back then? Well, when we got married in 1952, I told Susie I was going to be rich. That wasn't going to be because of any special virtues of mine or even because of hard work, but simply because I was born with the right skills in the right place at the right time. I was wired at birth to allocate capital and was lucky enough to have people around me early on - my parents and teachers and Susie - who helped me to make the most of that. In any case, Susie didn't get very excited when I told her we were going to get rich. She either didn't care or didn't believe me - probably both, in fact. But to the extent we did amass wealth, we were totally in sync about what to do with it - and that was to give it back to society. In that, we agreed with Andrew Carnegie, who said that huge fortunes that flow in large part from society should in large part be returned to society. In my case, the ability to allocate capital would have had little utility unless I lived in a rich, populous country in which enormous quantities of marketable securities were traded and were sometimes ridiculously mispriced. And fortunately for me, that describes the U.S. in the second half of the last century. Certainly neither Susie nor I ever thought we should pass huge amounts of money along to our children. Our kids are great. But I would argue that when your kids have all the advantages anyway, in terms of how they grow up and the opportunities they have for education, including what they learn at home - I would say it's neither right nor rational to be flooding them with money. In effect, they've had a gigantic headstart in a society that aspires to be a meritocracy. Dynastic mega-wealth would further tilt the playing field that we ought to be trying instead to level. From the fact that you've given your kids money before to set up foundations and are planning to give them more now, I gather you don't think that kind of flooding them with money is wrong. No, I don't. What they're doing with their foundations is giving money back to society - just where Susie and I thought it should go. And they aren't just writing checks: They've put enormous thought and effort into the process. I'm very proud of them for the way they've handled it all, and I have no doubt they're going to keep on the right track. So what about the Susan Thompson Buffett Foundation and what all this means for it? As you know, because as a director you've seen it close up, Allen Greenberg, the foundation's president, has done an excellent and thoughtful job of running it. His results-to-cost ratio is as good as I've ever seen. And he'll keep on that same path now, not just with Susie's money, but with mine too. Actually, if I had died before Susie and she had begun to distribute our wealth, this is the foundation that would have scaled up to a much bigger size - right now it has only five employees - and become her main vehicle for giving. And the foundation anchored my plans too. Until I changed my thoughts about when to give, this was to be where my fortune would go also. And what changed your mind? The short answer is that I came to realize that there was a terrific foundation that was already scaled-up - that wouldn't have to go through the real grind of getting to a megasize like the Buffett Foundation would - and that could productively use my money now. The longer answer is that over the years I had gotten to know Bill and Melinda Gates well, spent a lot of time with them having fun and, way beyond that, had grown to admire what they were doing with their foundation. I've seen them give presentations about its programs, and I'm always amazed at the enthusiasm and passion and energy they're pouring into their work. They've gone at it, you might say, with both head and heart. Bill reads many thousands of pages annually keeping up with medical advances and means of delivering help. Melinda, often with Bill along, travels the world looking at how well good intentions are being converted into good results. Life has dealt a terrible hand to literally billions of people around the world, and Bill and Melinda are bent on reducing that inequity to the extent they possibly can. If you think about it - if your goal is to return the money to society by attacking truly major problems that don't have a commensurate funding base - what could you find that's better than turning to a couple of people who are young, who are ungodly bright, whose ideas have been proven, who already have shown an ability to scale it up and do it right? You don't get an opportunity like that ordinarily. I'm getting two people enormously successful at something, where I've had a chance to see what they've done, where I know they will keep doing it - where they've done it with their own money, so they're not living in some fantasy world - and where in general I agree with their reasoning. If I've found the right vehicle for my goal, there's no reason to wait. Compare what I'm doing with them to my situation at Berkshire, where I have talented and proven people in charge of our businesses. They do a much better job than I could in running their operations. What can be more logical, in whatever you want done, than finding someone better equipped than you are to do it? Who wouldn't select Tiger Woods to take his place in a high-stakes golf game? That's how I feel about this decision about my money. People will be very curious, I think, as to how much your decision - and its announcement at this particular time - is connected to Bill Gates' announcement in mid-June that he would phase out of his operating responsibilities at Microsoft and begin to devote most of his time to the foundation. What's the story here? I realize that the close timing of the two announcements will suggest they're related. But they aren't in the least. The timing is just happenstance. I would be disclosing my plans right now whether or not he had announced his move - and even, in fact, if he were indefinitely keeping on with all of his work at Microsoft. On the other hand, I'm pleased that he's going to be devoting more time to the foundation. And I think he and Melinda are pleased to know they're going to be working with more resources. Does it occur to you that it's somewhat ironic for the second-richest man in the world to be giving untold billions to the first-richest man? When you put it that way, it sounds pretty funny. But in truth, I'm giving it through him - and, importantly, Melinda as well - not to him. Some people say the Gates foundation is bureaucratic, and bureaucracy is just about your No. 1 dislike. So how do you react to that charge? I would say that most large organizations - though Berkshire is a shining exception - are bureaucratic to some degree. Anyway, what some people really mean when they claim that the Gates foundation is bureaucratic is that big decisions don't get made by anybody except Bill and Melinda. That suits me fine. I want the two of them to make the big calls. What is the significance of your going on the board of the Gates foundation? Not much. The biggest reason for my doing that is if they were ever to go down on an airplane together. Beyond that, I hope to have a constructive thought now and then. But I don't think I'm as well cut out to be a philanthropist as Bill and Melinda are. The feedback on philanthropy is very slow, and that would bother me. I'd have to be too involved with a lot of people I wouldn't want to be involved with and have to listen to more opinions than I would enjoy. In philanthropy also, you have to make some big mistakes. I know that. But it would bother me more to make the mistakes myself, rather than having someone else make them whom I trust overall to do a good job. In general, Bill and Melinda will have a better batting average than I would. Did you talk this huge decision over with other people before deciding to go ahead with the plan? Yes, I talked to my children and Allen Greenberg, and to four Berkshire directors, including my son Howard and Charlie Munger. I got lots of questions, and some people had qualms about the plan initially because it was such an abrupt change from what they had been anticipating. But I'd say everybody, and that certainly includes Allen - who knows what a bear it would have been to scale up the Buffett Foundation - came around to seeing the logic of what I was proposing to do. Now all concerned can't wait to get started - particularly me. And frankly, I have some small hopes that what I'm doing might encourage other very rich people thinking about philanthropy to decide they didn't necessarily have to set up their own foundations but could look around for the best of those that were up and running and available to handle their money. People do that all the time with their investments. They put their money with people they think are going to do a better job than they could. There's some real merit to extending that thought to your wealth, rather than setting up something to be run after your death by a bunch of old business cronies or a staff that eventually comes to dictate the agenda. Some version of this plan I've got is not a crazy thing for some of the next 20 people who are going to die with $1 billion or more to adopt themselves. One problem most rich people have is that they're old, with contemporaries who are not at their peak years and who don't have much time ahead of them. I'm lucky in that respect in that I can turn to younger people. Okay, now what does that mean for Berkshire? I'd say virtually nothing. Anybody who knows me also knows how I feel about making Berkshire as good as it can be, and that goal is still going to be there. I won't do anything differently, because I'm not capable of doing things differently. The name on the stock certificates will change, but nothing else will. I've always made it clear to Berkshire's shareholders that my wealth from the company would go to philanthropy, so the fact that I'm starting the process is basically a nonevent for them. And, you know, though this may surprise some people, it's a nonevent for me too in some ways. Ted Turner, whose philanthropic activities I admire enormously, once told me that his hands shook when he signed a $1 billion pledge. Well, I have zero of that. To me, there's just no emotional downside to this at all. Won't the foundations that are getting your stock need to sell it? Yes, in some cases. The Buffett Foundation and the kids' foundations will have to sell their stock relatively soon after they get it, because it will be their only asset - and they'll need to raise cash to give away. The Gates foundation will have more options because it has lots of other assets, so it will have some flexibility to choose which it should turn into cash. Bill and Melinda will make the decisions about that. I'm going to totally insulate myself from any investment decisions their foundation makes, which leaves them free to do whatever they think makes sense. Perhaps they will decide to sell bigger portions of other assets and hang on to some Berkshire. It's a great mix of businesses and wouldn't be an inappropriate asset for a foundation to own. But I won't tie the foundation up in any shape or form. So it could be that all the shares you give annually will be sold in the market? Yes, that may well happen. And naturally people are going to be interested in whether that selling could weigh down Berkshire's price. I don't think so in the least - and that's true even though the annual turnover ratio for Berkshire has been running only about 15% a year, which is extremely low for large-cap stocks. Let's say the five foundations sell all the stock they get this year. If trading volume continues as it has, their selling will raise turnover to less than 17%. It would be ridiculous to think that much new selling could affect the price of the stock. In fact, the added supply could even be beneficial in increasing the stock's liquidity and should make it more likely that Berkshire would eventually be included in the S&P 500. I'd say this: I would not be making the gifts if they would in any way harm Berkshire's shareholders. And they won't. This plan seems to settle the fate, over the long term, of all your Berkshire shares. Does that mean you're giving nothing to your family in straight-out gifts? No, what I've always said is that my family won't receive huge amounts of my net worth. That doesn't mean they'll get nothing. My children have already received some money from me and Susie and will receive more. I still believe in the philosophy - FORTUNE quoted me saying this 20 years ago - that a very rich person should leave his kids enough to do anything but not enough to do nothing. [The FORTUNE article was "Should You Leave It All to the Children?" Sept. 29, 1986.] Remember I said that way back when I was buying Berkshire, I had less than $1 million in outside cash? Well, I've made a few decent investments with that money in the years since - taking positions that were too small for Berkshire, doing some fixed-income arbitrage, and selling my interest in a bank that was split off from Berkshire. So I'm glad to say I've got quite a bit of cash now. Overall I can - and will - use all my Berkshire shares for philanthropic purposes and will have plenty left over to provide well for all those close to me. |

|