|

Would you like that $11 billion in twenties, Mr. Buffett? The first step in giving away $44 billion is a stop at the bank and a courier.

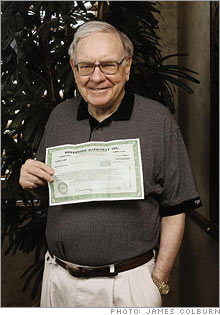

NEW YORK (Fortune) -- On July 3, Warren Buffett drove himself downtown, walked into the cavernous and nearly deserted central branch of U.S. Bank in Omaha, descended a flight of steps, and opened his large safe-deposit box. He took out a 1979-dated certificate for 121,737 shares of Berkshire Hathaway A (Charts) stock, on that day worth about $11 billion - roughly one-quarter of his Berkshire fortune.

Driving back to his office, he pondered the next step: getting that certificate and a few others (worth only tens of millions) to Wells Fargo in Minneapolis for conversion at a 30-to-1 ratio into around 3.75 million shares of Berkshire B stock. He considered FedEx and elected instead to turn one of the 16 people working at Berkshire headquarters into a courier. As FORTUNE first reported last month, Buffett has begun to give his money to charity. Converting the astoundingly valuable 1979 certificate is an initial step in that process. When it is switched over, Buffett will have the B stock he needs for handing out the 602,500 shares he has committed this year - the first of his huge philanthropic program - to the Bill & Melinda Gates Foundation and four smaller foundations. Because of the size of that one certificate, he will also be up to his eyeballs in B shares, having manufactured enough to fill his giving needs for most of the next decade. (He'll keep the excess shares in a brokerage account to be used as needed.) Buffett says the whole exercise on July 3 made him think of the time almost 70 years ago, when he was 6 years old and his father, Howard Buffett, took him to the same bank to open a $20 savings account. The money was a gift, the bank was then called Omaha National, and the small passbook he got was maroon. After that, he says, it took him five years of gifts, chores, and moneyearning schemes to build the account to $120. Having accrued this fortune, he bought, at age 11, his first stock: three shares of Cities Service preferred for $114. Well, if you are going to amass $44 billion, you have to start someplace. ____________________ |

|