|

Boeing: Still gaining altitude Aircraft maker on a winning streak, helped by stumbles at Airbus. $100 a share coming soon? NEW YORK (CNNMoney.com) -- It wasn't that long ago that Boeing appeared to be what General Motors is today: A lumbering giant struggling to fight off a more nimble competitor from overseas. In the wake of the Sept. 11 attacks and the sharp drop in demand for new aircraft from U.S. airlines, Boeing (Charts) had lost its long-held title of the world's largest commercial aircraft manufacturer to European rival Airbus in 2003.

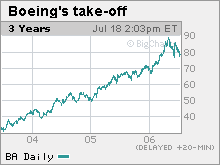

Meanwhile, scandals in its defense business and its executive suite had cost Boeing two CEO's in just over a year. And it had to drop plans to build its next-generation commercial jet, the high-speed "Sonic Cruiser," due to lack of interest from its troubled airline customers. Airbus was moving ahead with plans for a new super-jumbo double-decker jet, the A380, which was unlike anything that Boeing could offer. When then-CEO Phil Condit resigned under pressure in December 2003, shares of the Dow component were down 25 percent from the eve of the Sept. 11 attacks. But as Boeing and Airbus face off at the Farnborough Air Show this week, it is the American aircraft maker that's soaring over its troubled European rival. Strong plane orders and earnings have lifted Boeing shares 11 percent so far this year and more than 20 percent the last 12 months. And a number of analysts say the rally's not over, with some saying the stock could hit $100 over the next year or two, up from about $78. Meanwhile, Airbus has seen a 20 percent-plus drop in the stock of its parent, EADS, and a shake-up of top management since it announced another delay in A380 deliveries. Boeing, meanwhile, is racking up sales of its new 787 Dreamliner, the plane being built with lighter-weight materials to be 20 percent more fuel efficient. The company's also doing well with existing aircraft. Despite its own internal problems coupled with the sharpest downturn in economics in airline industry history, Boeing reported no quarterly operating losses at any time from 2001 through 2005. U.S. airlines reported$42 billion in losses during that period. Boeing announced two more big wins at the air show Tuesday: a $3.3 billion order from the airline of the United Arab Emirates for 10 747 freighters, and an order for 787s from Pegasus Aviation Finance Co., a San Francisco leasing company. That gives Boeing 362 firm orders from 28 customers worldwide for the new plane, due to start being delivered in 2008. The success has come even though most of Boeing's U.S. customers have yet to place an order as they struggle to end years of losses. Boeing is expected to top Airbus in orders this year for the first time since 2000, leaving the European manufacturer playing catch-up. Monday Airbus announced a new version of its A350 widebody that the company says will be more fuel efficient that the Boeing 777. But the new A350 won't be available until four years after the first scheduled delivery of the 787. Boeing shares to keep climbing? "We have a $100 12-month target, and we don't see anything that causes us to change that," Howard Rubel, aerospace analyst for Jefferies & Co., said Monday after Airbus unveiled its new A350 plans. "The first delivery of the A350 isn't until the middle of 2012," said Rubel. "If you want a new advance technology aircraft, Boeing is still the place to go." Cowen aerospace analyst Cai von Rumohr thinks one year might be a bit quick for Boeing stock to reach $100, but he's expecting it to get there within two years, based on his 2008 earnings estimate for the company. "I think it's things going well for Boeing, plus luck plus Airbus missteps," said von Rumohr regarding the stock. He said even without the latest A380 delays, he had doubts about Airbus being able to meet its sales projections for the large jet, particularly with no significant decrease in jet fuel prices in sight. "Boeing launched the 787 and the long-range 777 at just the right time, when oil prices were going up," said von Rumohr. "Last year the 777 outsold the competing products by a two-to-one margin. In the two previous years it was outsold by a two-to-one margin." Some skeptics remain But while both Rubel and von Rumohr have buys recommendation on Boeing, other analysts have their doubts. David Strauss of UBS Securities has a neutral rating on the shares. "It is likely that Airbus's problems with the A380 are a near-term boon for Boeing," Strauss wrote in June after the Airbus problems were revealed. "However, the A380 issue should also serve as reminder that new aircraft programs typically run into problems and rarely deliver to schedule and we believe the 787 is unlikely the exception. We view 787 schedule risk as much greater than for the A380." Alan Mulally, CEO of Boeing Commercial Airplanes, admitted Monday that some 787 subcontractors are behind schedule and the plane's design as it stands is over the weight commitments given to customers. But he said Boeing is confident it will be able to meet both its delivery schedule and weight commitments. But Strauss said he not only anticipates problems in the next two years for Boeing, but thinks its production schedule is too optimistic. "Boeing is exploring producing 10-plus 787's per month fairly early on in production, yet it has never produced more than 80-85 of any one widebody type in one year in its history," he wrote. Related: Boeing finally has a flight plan |

|