|

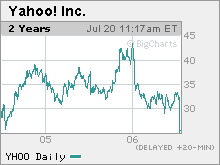

Only Yahoos would buy Yahoo? The Internet giant took a serious beating; now there's a split on whether it's a good bet. NEW YORK (CNNMoney.com) -- When a company that is a leader in its industry loses more than a fifth of its market value in one day, it's reasonable for people to wonder if the stock is now a good long-term buy. That's the question facing investors in Yahoo! Shares of the world's No. 2 search engine plummeted nearly 22 percent Wednesday and closed at their lowest level since April 2004. Yahoo (up $0.58 to $25.78, Charts) reported second-quarter sales Tuesday afternoon that were slightly lower than expectations and issued guidance for the third quarter that was below Wall Street's consensus estimates. But what really spooked the Street was the revelation during the company's conference call that the rollout of Yahoo's long-awaited new search tools, code named Project Panama, would be pushed back from the third quarter to the fourth quarter. Investors worried that this delay would lead to weaker results for Yahoo's search advertising business in the latter half of this year and allow search industry leader Google to widen its already formidable market share lead over Yahoo. Google reports its second quarter results on Thursday. Several Wall Street analysts downgraded Yahoo on Wednesday while only one analyst, Laura Martin from Soleil Securities - Media Metrics, upgraded the stock. And even many analysts who maintained their ratings on Yahoo gave it the most tepid of endorsements (i.e. that Yahoo was now a "2007 story.") But Yahoo is not going out of business. It's not Pets.com or Webvan. So was Wednesday's sell-off a case of panic overshadowing rational behavior? Bulls think it's cheap... Scott Devitt, an analyst with Stifel Nicolaus, thinks so. In a report Thursday, he wrote that investors should be "aggressive buyers" of Yahoo at current levels. He pointed out that the company now trades for just 10 times his 2007 earnings estimate before interest, taxes, depreciation and amortization (EBITDA), just a slight premium to the average for the traditional media sector. That's even though Yahoo's profits are expected to grow at a much higher rate than mainstream media firms. EBITDA is typically viewed by analysts as a good financial yardstick to value media companies. Devitt also wrote that solid results from online auction firm eBay (Charts) on Wednesday afternoon should lift sentiment for all Internet stocks and that the anticipated strong earnings from Google (Charts) will also help. In her upgrade note on the stock Wednesday, Soleil's Martin wrote that she also thought investors overreacted to the Panama delay. "The bad news is in the stock," Martin wrote. "We think there is little downside from these price levels." She added that investors were overlooking strong results from Yahoo's branded advertising business, selling banners, video ads and other non-keyword search types of ads. Martin estimates that Yahoo's branded ad sales should grow 35 percent to 40 percent in the second half of the year thanks to increased spending by big corporations as well as more political ads tied to Congressional campaigns. Even one of Yahoo's competitors thought that Wall Street needed to put things in perspective. "Yahoo's revenues were up 26 percent .Those are pretty large gains for a business of that size and people do seem to be forgetting that," said Jim Lanzone, chief executive officer of Ask.com, the search firm owned by Internet conglomerate IAC/InterActive (Charts). ...but bears say it's dead money But not everyone thinks it makes sense for investors to rush into Yahoo stock now. Even though it may look attractive on an EBITDA basis, it's still trading at 35.5 times 2007 earnings estimates, not exactly a low enough multiple to get traditional bargain hunters excited. "I would still be wary. There is a big gap between when growth investors start selling and value investors start buying," said Brian Bolan, an analyst with Jackson Securities. To that end, several institutional investors said that they are not tempted to buy Yahoo, even after its big plunge Wednesday. "Yahoo is not permanently damaged goods but we are not going to pick up something that's this questionable," said Kent Mergler, chairman of Northstar Capital Management, an investment firm based in Palm Beach Gardens, Fla. Mergler said his firm owned Yahoo for several years but decided to sell its stake in February because of concerns about growth and competition from Google. Another fund manager said that the Panama delay was the last straw for him and that he sold his Yahoo stake Wednesday. "Yahoo will be dead money for a while. I just don't think it will do much of anything," said Jon Burnham, manager of the Burnham fund. He said he does own Google, however, and is expecting a strong earnings report from the company. So even though Yahoo may seem like a tempting long-term buy now, it could become even cheaper during the next few months once there is more clarity about exactly when Panama will launch and what impact it will have on 2007's sales and earnings. "There isn't going to be a catalyst to look forward to for the second half of this year, so the stock could be down even further by that point," Bolan at Jackson Securities said. -------------------------------------------------------------- Related: No joy for Yahoo Related: Tech: The Good, the Bad and the Ugly Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies. |

|