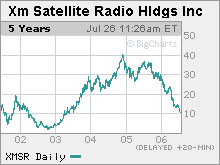

XM faces the music With shares of XM Satellite Radio sinking near a three-year low, is the company now a tempting takeover target? NEW YORK (CNNMoney.com) -- XM Satellite Radio has crashed and burned and now some are starting to wonder if the company could be a takeover target. Shares have plummeted more than 60 percent this year. Tough competition from rival Sirius Satellite Radio, which now employs shock jock Howard Stern, appears to be taking a toll. XM lowered its year-end subscriber and revenue forecasts in May and cut its subscriber target again Thursday when it reported its second quarter financial results. Analysts are also worried about increased advertising and promotional expenses as XM tries to stay ahead of Sirius. The company is also facing regulatory headaches. The Federal Trade Commission is investigating marketing practices. And in May, the company halted the sales of two models of radios that emit signals over standard FM frequencies because the Federal Communications Commission said they did not meet transmission standards. The hiring of a new president and chief operating officer on Monday hasn't eased Wall Street's concerns just yet either. Shares have fallen 7.5 percent so far this week as investors nervously prepared for the release of XM's second-quarter financial results. And those numbers were not good. In addition to lowering its subscriber forecast, XM reported a wider than anticipated net loss of 87 cents a share. Wall Street was expecting a loss of 66 cents a share. Shares of XM fell more than 6 percent in pre-market trading Thursday on the news. So could XM (Charts) soon find itself acquired? After all, the stock is now trading at its lowest point since August 2003 and with a market value of about $2.7 billion, the company could conceivably be absorbed by Sirius, which is valued at $5.5 billion, or one of the two largest terrestrial radio firms, Clear Channel Communications or CBS. Some Sirius merger rumors There have been sporadic rumors during the past year about XM being a target of each of these companies. In fact, Sirius (Charts) chief executive officer Mel Karmazin said at a media conference in June that he would love to buy XM at the right price. However, he said he wasn't sure a deal would be approved by government agencies. Analysts agree, saying that Karmazin's comments about a Sirius-XM merger are probably just a pipe dream for now. Chad Bartley, an analyst with Pacific Crest Securities, points out that the Justice Department and FCC blocked a proposed merger between satellite TV firms DirecTV (Charts) and EchoStar (Charts) in 2002. Based on that precedent, Bartley said it's highly doubtful that the government would look favorably on a deal between the only two satellite radio companies. XM currently has 6.9 million subscribers while Sirius has 4.7 million. But David Bank, an analyst with RBC Capital Markets, said that an eventual merger between the two can't be ruled out. As more and more technologies emerge, such as digital radio and streams of music over cell phones, it may be easier for the two companies to argue that a Sirius-XM combination would not crush competition. "I don't think a merger is viable at this point given the business concentration issues," Bank said. "But in three or four years you maybe could see a deal happening." Takeover in the Clear? So what about the traditional radio firms? Big radio is struggling to hold onto listeners and is faced with sluggish ad sales growth. A steady stream of subscriber fees could help reignite growth. "As people become more comfortable with the longer-term trajectory of satellite radio then XM could ultimately be attractive to outside investors," said Stuart Kagel, an analyst with Janco Partners. "A lot of larger media companies are bereft of high return on investment opportunities and satellite radio could be one." Clear Channel (Charts), the nation's largest radio firm does own 8.3 million shares of XM, about a 3 percent stake, and also programs some of XM's music channels. But relations between the two companies have taken a sour turn lately. Clear Channel and XM feuded over whether XM should air ads on the stations' Clear Channel programs. Commercial-free music has been a main selling point for XM, so the company resisted ads. But in March an arbitration panel ruled in favor of Clear Channel, forcing XM to air commercials. The business arrangement between Clear Channel and XM is set to expire in 2008 and Clear Channel already has an agreement to sell its XM stake to Bear Stearns in that year as well. So it seems unlikely that Clear Channel and XM would kiss and make up and forge a larger deal. An Eye on XM That leaves CBS (Charts). The company has recently inked a program-sharing deal with XM and that has led to increased chatter about a deeper partnership between the two firms. In April, some CBS stations began airing shortened versions of XM's "Opie & Anthony" show. That's a significant move for CBS since the two radio hosts were fired by CBS's radio business (then known as Infinity) in 2002 after they broadcast a couple having sex in New York's St. Patrick's Cathedral. A CBS-XM deal would be juicy since Karmazin and Stern both used to work for CBS. And Stern has not hidden his dislike of CBS CEO Les Moonves. So having Moonves and CBS suddenly become Sirius' top competitor does make for a great battle of egos. However, analysts don't believe the CBS-XM hype that much either. Although XM is getting along better with CBS than Clear Channel right now, Bank said that it would be difficult for CBS, even with its market value of $20.7 billion, to justify a deal since it would hurt CBS's profits for the foreseeable future. Analysts don't expect XM to report positive cash flow on an annual basis until 2008. "I don't really see XM as a viable target for one of the larger radio companies," Bank said. "The dilution would be substantial and I don't think they could withstand it." Bartley adds that buying a satellite radio firm would put Clear Channel or CBS in the uncomfortable position of having to explain why listeners should now have to pay for radio broadcasts. "Strategically, I don't think it fits. It would be a marketing 180 and counter to their view that radio should be free," he said. So XM investors are in a difficult situation. Few deny the long-term growth prospects for satellite radio as more and more automakers begin to install units in their cars. But for the short-term, increased competition, rising costs and regulatory concerns all paint a gloomy picture for XM. Legitimate takeover chatter might be the only thing to spark any interest, and so far all the talk is merely idle speculation. "XM is a momentum stock without a whole lot of momentum right now," Bank said. Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies. -------------------------------------------------------------- |

| |||||||||