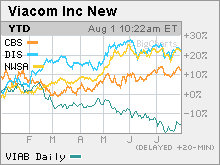

Viacom: I want my LBO? Shares of MTV parent have stumbled this year, sparking talk that Redstone should take the company private. NEW YORK (CNNMoney.com) -- MTV turned 25 on Aug. 1. But investors in MTV's parent company are probably in no mood to celebrate. Shares of Viacom (Charts), which also owns Nickelodeon, Comedy Central and the Paramount movie studio, have fallen more than 15 percent since the company spun off its CBS unit as a separate company in January.

CBS, meanwhile, has gained 8 percent. Kind of ironic since CBS (Charts), with its broadcast TV, radio and book publishing units, was viewed at the time of the split as the more boring of the two companies. Viacom was billed as the sexy growth play. A 'private' affair Now, some are calling for Viacom Chairman Sumner Redstone to take the New York-based company private. According to a report last week by Pali Research analyst Richard Greenfield, Viacom could be an attractive buyout target at $38.50 a share, nearly 11 percent higher than its current price of about $34.75. That would value Viacom at about $28 billion, excluding debt. Greenfield estimates that Redstone could fund a purchase of the shares he doesn't already own by taking on debt, a practice known as a leveraged buyout, or LBO. The 83-year-old Redstone already owns 12 percent of Viacom stock and has majority voting control over the media company. In another report from last week, Morgan Stanley's Richard Bilotti argued that Viacom could be worth $47.25 a share, or about $34 billion, in a leveraged buyout. The idea is not that far-fetched. In fact, Redstone has taken Viacom private once before, when he first bought it in 1987. And there's no shortage of capital, or interest, for media buyout deals. For example, a group of private equity investors agreed recently to buy Univision, the nation's biggest Spanish language broadcaster. One fund manager who owns both Viacom and CBS said he doubts Redstone is seriously interested in taking Viacom private, but that nothing could be ruled out. "Stranger things have been known to happen. Viacom does have some tremendous assets with MTV that are probably being undervalued," said Tom McIntyre, manager of the McIntyre Global Equity fund. Weak ad sales hurting cable So why has Viacom struggled? The biggest issue worrying shareholders is that ad growth for the cable networks is likely to be lower than originally thought this year. Viacom should give an update about ad sales when it reports second-quarter results on Aug. 9. Advertisers have become more reluctant to commit big dollars in the so-called "upfront" ad buying period due to questions about the effectiveness of television commercials as more and more viewers skip ads with digital video recorders. David Joyce, an analyst with Miller Tabak + Co., said he thinks Viacom's cable networks may wind up generating only a 1 percent increase in upfront ad pricing, at best. Earlier this year, some analysts were predicting as much as a 7 percent increase. Another problem for Viacom is that, like my parent company Time Warner (Charts), Wall Street has doubts about its growth strategy. Walt Disney (Charts) gets praise for its purchase of Pixar and online deals with Apple's iTunes. Investors are fawning over News Corp.'s (Charts) acquisition of MySpace. And while Viacom has made "new media" moves, they are not nearly as splashy. It has bought smaller Internet media firms like video game site Xfire, online video site IFILM and virtual pets site Neopets. Joyce said a Viacom LBO could make sense since it would be a welcome relief for Redstone and CEO Tom Freston to not have to worry about the whims of Wall Street and pressures to make more deals. A buyout too soon? Still, Joyce thinks that speculation is premature since it's been less than six months since Viacom and CBS separated, hardly enough time to deem the split a failure. "An LBO is not an outlandish idea. But I don't think there has to be a quick knee-jerk reaction," he said. The company also maintains that the split of Viacom and CBS was in the best interest of shareholders. "We said from the beginning that it would take at least a year before we can evaluate the separation and the performance of the two companies," a Viacom spokeswoman said in a statement. "We remain confident that Viacom is on the right track and that we have the assets and opportunities for growth and the absolute best leadership to get the job done." Keep in mind, back in January many analysts were raving about Viacom's chances as a public company without CBS holding back growth. So it's interesting that some analysts may be trying to save face by now suggesting that Viacom is not a viable standalone public company. "It is somewhat amusing. This is coming out of basic frustration with the stock price," said David Miller, an analyst with Sanders Morris Harris. "If the stock went from $40 to $48 after the split, then nobody would be talking about an LBO." Miller said Viacom's recent struggles should not come as a big surprise, noting the "new" Viacom has a lot more exposure to the ups and downs of the movie business. He said he's had a "hold" on Viacom since the split for this very reason. And so far this year, Paramount has been a bit of a disappointment. The studio released this summer's "Mission: Impossible III," which has grossed just $133.5 million in the U.S. The first movie in this series made $181 million in the U.S. while the second generated $215 million at the domestic box office. Both Bilotti and Greenfield suggested Viacom could sell Paramount following an LBO to focus Viacom squarely on cable networks and reduce some of the debt that would be taken on through a buyout. That, of course, assumes that an LBO takes place. Analysts said Redstone likes the spotlight that comes with running a public company, which makes an LBO less likely. But the longer that Viacom's stock founders, the more it could be that Redstone warms up to the idea of taking Viacom private again. After all, management teams at several other big corporations, most notably oil and gas pipeline company Kinder Morgan and hospital operator HCA (Charts), have teamed up with private equity firms on leveraged buyouts this year. "There are companies in other industries that are basically saying if the public doesn't realize there's value here, I'll take matters into my own hands," fund manager McIntyre said. So if investors keep telling Redstone they don't like what they see in Viacom, maybe he'll relent and latch on to the LBO trend. -------------------------------------------------------------- |

| ||||||||||||||||||