|

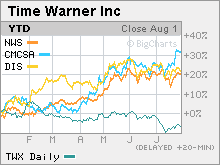

Time Warner revamps AOL No. 1 media company reports mixed results, confirms plans to give away many AOL services for free. NEW YORK (CNNMoney.com) -- Time Warner reported second-quarter earnings Wednesday that slightly exceeded expectations, and also confirmed plans to revamp the strategy for its struggling AOL Internet division. Shares of Time Warner (up $0.50 to $16.75, Charts), the world's biggest media company, rose about 3 percent in early trading on the New York Stock Exchange. Time Warner, which owns CNNMoney.com, posted net income of $1 billion, or 20 cents a share, after excluding the effects of discontinued operations and an accounting change. Wall Street expected Time Warner to report earnings per share of 19 cents, excluding one-time items. The company reported a loss of 9 cents a share a year earlier. Sales were a bit lighter than expected though. The company reported revenue of $10.7 billion, up 1 percent from the same period last year. Analysts were predicting that Time Warner would report sales of nearly $11 billion for the quarter. AOL still losing subscribers and revenue And as widely expected, Time Warner announced that it would allow AOL subscribers with a broadband connection to access their AOL accounts for free. Previously, AOL charged a discounted rate to these subscribers. The company said AOL will continue to offer dial-up access but will not market it as aggressively. AOL has been struggling for the past few years as subscribers abandoned its dial-up Internet access service in favor of broadband plans offered by big cable and phone companies, as well as cheaper dial-up services from rivals such as EarthLink and United Online's NetZero. Although AOL has made steps to boost its exposure to the white-hot online advertising market - an area currently dominated by the likes of search leaders Google (Charts) and Yahoo! (Charts) - by offering more services for free on its AOL.com site, this has not been enough to offset the eroding subscriber base and resulting decline in sales and operating profits. In the second quarter, AOL's subscriber base declined by 3.1 million from the same period last year. As such, sales fell 2 percent from a year earlier, despite a 40 percent increase in advertising revenue. Operating profit at AOL dipped 5 percent. But in a written statement, Time Warner president and chief operating officer Jeff Bewkes, said the company hoped that the changes at AOL will help the division get back on track. "This is the next logical step for AOL to capitalize further on the explosive rise in broadband usage and online advertising. With its robust and rapidly expanding advertising operation, we expect to put AOL back on a growth path," Bewkes said. Susan Kalla, an analyst with Caris & Co., wrote in a research report Wednesday morning that if the new AOL plan is a success, Time Warner might eventually want to consider spinning off the division. However, she said investors would need to remain patient. "A turnaround at AOL could be a catalyst for the stock, though not near term," she wrote, adding that subscription revenue for AOL should decline substantially during the next few years. But if the plan works, AOL's revenue could be back at the same level as they are today by mid-2008, she wrote, thanks to increased online advertising sales. Mixed results for other businesses Overall, Time Warner also reported a better than expected increase in adjusted operating income before depreciation and amortization (OIBDA), a key measure of profitability closely watched by Wall Street. Adjusted OIBDA rose 7 percent to $2.66 billion, ahead of consensus forecasts of $2.59 billion. This profit increase was led by solid growth in two of Time Warner's other big businesses. Revenue at the company's cable division surged 15 percent and operating profit rose 22 percent, thanks to increased subscribers for high-speed data and digital phone services. "Time Warner Cable delivered another great quarter," said Time Warner chief executive officer Dick Parsons during a conference call with analysts Wednesday morning. Time Warner and rival Comcast completed their acquisition of the assets of bankrupt cable provider Adelphia Communications on Monday. That paves the way for Time Warner to possibly sell a stake in its cable business to the public. "As long as things are going well with the bread and butter cable unit, that's a tell-tale sign that the future may be bright for this company," said Greg Gorbatenko, an analyst with Jackson Securities. Sales in the networks business, which includes CNN, TBS and HBO, gained 9 percent and operating profits rose 8 percent, thanks to higher subscription and advertising revenue. Time Warner also raised its full-year adjusted OIBDA outlook, partly due to expected contributions from Adelphia as well as the recent purchase of the 50 percent stake in cable channel Court TV that Time Warner did not previously own. The company said it now expects adjusted OIBDA to increase in the low double-digits in percentage for the year, as opposed to an earlier forecast of high-single digit growth. "We're pleased with this quarter's results, which put us firmly on track to achieve our full-year financial objectives," Parsons said in a statement. Time Warner's filmed entertainment division reported a mixed quarter though. Sales fell 10 percent from a year earlier due to tough comparisons to last year's strong second-quarter DVD sales. But operating profits rose 11 percent thanks to lower costs. Time Warner's magazine publishing business continued to struggle as well due to lower subscriptions. Sales fell 2 percent and operating profit declined by 8 percent. But the company did say that the publishing unit's advertising sales increased, driven by online advertising revenue gains at SI.com and CNNMoney. Still, AOL is where Wall Street is focusing most of its attention. Investors have been waiting for Time Warner to come up with a new plan for AOL. Many blame AOL's struggles for Time Warner's underperfomance when compared to other media stocks. Shares of Time Warner are down 6 percent this year while shares of media rivals Walt Disney (Charts) and News Corp. (Charts) have both gained more than 20 percent. Shares of Comcast (Charts) have surged more than 30 percent this year. But one analyst pointed out that Time Warner's strong results from the cable business, combined with the changes at AOL, are a good sign. "With Time Warner, it comes down to cable and AOL and we heard good things on both sides," said James Goss, an analyst with Barrington Research. "Generally speaking, this was a quarter to be pleased with." Time Warner has continued to lag other media stocks despite the fact that the company has been buying back a large amount of its own stock. Share repurchases typically are viewed favorably by Wall Street because they help boost earnings per share. Parsons said that Time Warner has so far repurchased $11.7 billion's worth in shares since launching a buyback program last year. Under pressure from activist shareholder Carl Icahn, who had urged a break-up of Time Warner earlier this year, Time Warner agreed in February to boost the value of the buyback to $20 billion. Time Warner said Wednesday that it expects to have repurchased a total of $15 billion in Time Warner shares by the end of this year and that the remainder of the buyback will be completed in 2007. -------------------------------------------------------------- Barrington's Goss owns shares of Time Warner but his firm does not have an investment banking relationship with the company. Other analysts quoted in this story do not own shares of Time Warner and their firms do not have an investment banking relationship with the company. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|