|

The Mouse is mighty and the Fox trots Shares of Walt Disney and News Corp. are sizzling. But are the stock's best days behind them? NEW YORK (CNNMoney.com) -- Walt Disney and News Corp. are the Midases of media this year: Just about everything they've touched has turned to gold. Solid ratings at ABC and ESPN, healthy attendance at theme parks and a box office treasure chest at its movie division have Disney investors excited. Disney's "Pirates of the Caribbean" sequel is the top-grossing film by far this year, and "Cars," the latest animated film from Pixar, which Disney acquired this year, is the second biggest.

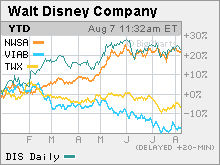

Disney's stock has soared 25 percent in 2006, making it the fifth-best-performing stock in the Dow. Analysts expect the company to report fiscal third-quarter earnings of 44 cents a share, up 5 percent a year ago, and sales of about $8.6 billion, an 11 percent increase. Disney (Charts) is due to report on Wednesday. "Bob Iger is riding pretty high," said Dennis McAlpine, an independent media analyst, about Disney's chief executive officer. Iger took over from Michael Eisner last October. It's a similar story at News Corp (Charts)., which will report its fiscal third-quarter results Tuesday. Investors have bid up News Corp.'s stock 23 percent this year thanks to strong results from its Fox TV networks as well as its movie studios. The Fox broadcast channel finished in first place with 18-49-year-olds for the second consecutive year, while Fox's "X-Men: The Last Stand" is the third-biggest-grossing film of the year and the animated hit "Ice Age: The Meltdown" ranks fifth. Wall Street is also excited about the online advertising revenue potential at News Corp.'s social networking juggernaut MySpace, which recently overtook Yahoo's email site as the most popular on the Web. Analysts expect News Corp. to report a profit of 23 cents a share, up 6 percent from a year ago, and sales of nearly $6.6 billion, a 10 percent gain from last year. Can the Mouse and Fox beat the Street? But it seems safe to say that Wall Street wants to see both Disney and News Corp. exceed estimates. Disney reported earnings of 37 cents a share in its second quarter, 6 cents above forecasts. In fact, Disney has beaten Wall Street targets by an average of 19 percent for the past 4 quarters. McAlpine said he thinks Disney does have a good chance of topping forecasts again thanks to the success of "Cars" and that it could lift guidance for the remainder of the year since "Pirates" has now taken in $380 million at the box office in the United States and $682 million worldwide. News Corp. has exceeded the Street's earnings expectations by a penny a share for the past two quarters and has topped profit forecasts by an average of 13 percent for the past four quarters. Investors might also be looking for both companies to raise their forecasts for the year following last week's earnings report from Time Warner (Charts), one of their top media rivals. Time Warner boosted its adjusted operating income before depreciation and amortization (OIBDA), a key measure of profitability, for all of 2006. (Time Warner is the parent company of CNNMoney.com.) Andy Baker, an analyst with Cathay Financial, said News Corp. should be able to give a rosy forecast for the remainder of the year and beyond. For one, he said, the company probably will benefit from strong DVD sales of "Ice Age" when that's released later this year. Likewise, McAlpine said Disney investors should be able to look forward to healthy sales of "Cars" and "Pirates" DVDs, which are expected to hit stores before the holidays. In the case of News Corp., Baker said the company may also be in strong position to negotiate for big increases in carriage fees it charges cable companies to include its popular Fox News Channel on their systems. Baker said that several multiyear contracts expire this year and that News Corp. currently gets a fee of about 25 cents per subscriber a month, less than half what Time Warner gets from cable companies to carry CNN. Since Fox News's ratings are now higher than CNN's, he thinks News Corp. might ask for as much as $1 per subscriber. Stocks may be ahead of themselves But both Disney and News Corp. now trade at a premium to their main competitors. Disney trades at 20 times earnings estimates for the current fiscal year, while News Corp. is valued at nearly 23 times projections. CBS (Charts), Viacom (Charts) and Time Warner, by way of comparison, trade at 15 to 19 times 2006 earnings estimates. With that in mind, analysts said investors need to be a bit wary. McAlpine said that if the economy continues to soften and gas prices rise further, that could hurt Disney's theme park business, which accounts for more than a quarter of its sales and 20 percent of its operating profits. Baker said that even though he thinks News Corp.'s premium is justified, sooner or later, CEO Rupert Murdoch will need to prove to Wall Street that there is a plan to generate profits off of MySpace and other Web sites the company has acquired in the past year. "Hopefully we'll get some color on how well News Corp. is monetizing its Internet properties," Baker said. "So far, people have been giving Murdoch the benefit of the doubt." News Corp. took a big step in that direction when it announced Monday that its Fox Interactive Media unit, which includes MySpace, inked an advertising deal with Google. As part of the deal, MySpace and other Fox Internet properties will use Google's search technology and Google will pay News Corp. at least $900 million in revenue sharing agreements. Still, one fund manager who thinks both stocks may be too pricey prefers another media firm that will also report earnings this week, John Malone's Liberty Media, which now trades as two stocks, Liberty Capital (Charts) and Liberty Interactive (Charts). "I think the best value in media is in Liberty," said Don Yacktman, who owns both Liberty stocks in the Yacktman and Yacktman Focus funds. Yacktman adds that owning Liberty is a good way to invest in the media sector at large since Liberty has stakes in Time Warner and News Corp. -------------------------------------------------------------------------------- Analysts quoted in this piece do not own shares of the companies mentioned and their firms have not done investment banking for the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

|