|

Google's terrible twos It could do no wrong in its first full year as a public company. That's no longer the case. But analysts think the search engine is due for a comeback. NEW YORK (CNNMoney.com) -- As Google approaches its second anniversary of its initial public offering, much of the euphoria surrounding the search engine's stock is gone. Sure, nearly every press release from the company or rumor of an upcoming product launch is met with breathless hype from the financial and techie media. But even though many reporters treat every new Google feature as the online equivalent of sliced bread, this has not translated to success on Wall Street in 2006.

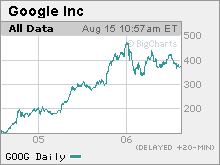

Shares of Google (Charts) have fallen 7 percent this year and are trading nearly 20 percent below the all-time high they hit in mid-January. Of course, the stock is still a huge success story; shares have more than quadrupled since Google went public on August 19, 2004. But now that the stock has pulled back a bit, many Wall Street analysts think this is a good time for investors to once again embrace Google. Here's why. It's diversifying The biggest knock on Google since it went public is that it's a one-trick pony which relies almost exclusively on ads tied to keyword searches. Granted, that's a booming business right now. But many analysts wondered if Google was setting itself up for a gloomy future if it did not branch out. "I had been critical of the company for not substantially diversifying. They have poured a heck of a lot of resources into developing a lot of new offerings and a lot of them have had mixed results at best," said Scott Kessler, an equity analyst with Standard & Poor's. But Google, to its credit, has made several key announcements this month that should allow it to broaden from its core business of search. First, Google announced a partnership with satellite radio firm XM that will allow advertisers to use Google's technology to buy commercial time on XM stations. And last week, Google made two big deals with media giants. The first, with Viacom (Charts), will let Google place ads in online videos for some of Viacom's cable channels, which includes MTV and Nickelodeon. The second, with News Corp.'s (Charts) Fox Interactive Media (FIM) unit, makes Google the exclusive provider of search and keyword ads on FIM's popular MySpace social networking site. The deal also gives Google the first right of refusal on selling so-called display advertising, non-text based ads such as banner ads, on FIM sites. "They will diversify somewhat and that's good news for Google. To have all your eggs in the one basket of paid search is not something I'm comfortable with," said Martin Pyykkonen, an analyst with Global Crown Capital. In particular, Google's move into video and other forms of display advertising is notable since that's an area where Google's top rival, Yahoo! (Charts), has had more success. But Kessler said there's no reason why Google shouldn't be able to get its network of advertisers to buy more than just search ads. "Google's extensive experience with advertisers and affiliate partners will validate what they are trying to do. Cross-selling opportunities would be enormous," he said. Yet, Wall Street doesn't seem to care. The stock is down slightly in August despite all this news. It's still dominant in search Analysts say that investors should clearly keep an eye on Google's long-term prospects. But they shouldn't ignore the present either. Search will continue to be the straw that stirs the drink, if you will, for Google for the foreseeable future. And Google is dominating this business. According to data from Internet traffic research firm comScore Networks, Google's share of the U.S. search market grew from 36.9 percent in June of 2005 to 44.7 percent in June of this year. Meanwhile, search market share for Yahoo, Microsoft's (Charts) MSN and IAC/InterActive's (Charts) Ask.com all declined on a year-over-year basis. "Google continues to take share in the core search business," said Stewart Barry, an analyst with ThinkEquity Partners. "It's still very early in the search game and Google is benefiting from a very favorable macro trend of ad dollars going online." What's more, Google could benefit from Yahoo's struggles to get its new online search system for advertisers, code-named Panama, up and running. Yahoo announced last month it was delaying the launch of Panama by a quarter, news that sent Yahoo's shares tumbling 22 percent in one day. It's not that expensive and the timing is right Finally, it's getting tougher to argue that Google is an overvalued stock. Sure, there's sticker shock when you notice that the share price is in the triple digits. But that's not really the most appropriate way to value Google or any stock for that matter, analysts say. Google is currently trading at just 29 times 2007 earnings estimates, which seems reasonable considering that analysts expect earnings to increase by 32 percent next year. Global Crown's Pyykkonen said Google could easily trade at a multiple of 40 times next year's earnings estimates, which implies a price of $525 (His official price target is $500.) That hardly seems absurd considering that Yahoo is trading at 43 times 2007 estimates, despite its high profile problems. "Google's valuation is not all that rich. It's still cheaper than Yahoo," Pyykkonen said. What's more, Google's stock, in its short history, has done well toward the end of the year as investors get excited about third-quarter and fourth-quarter results. To that end, Google's stock surged nearly 50 percent in the fourth quarter of 2004 and gained more than 30 percent during last year's final three months. "The fourth quarter has tended to be very meaningful for Google. I would suggest that the ship will be righted by the fourth quarter of this year," said Brian Bolan, an analyst with Jackson Securities. Bolan thinks more investors will gravitate back towards Google once they realize that the company's strength in search should lead Google to report blockbuster third-quarter results in October. Analysts expect earnings to increase by 60 percent and that sales will be up more than 70 percent from the same period last year. "Google's definitely one of the preeminent holdings in a core tech portfolio. There's plenty of room to grow," he said. -------------------------------------------------------------------------------- Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies. |

Sponsors

|